|

Case

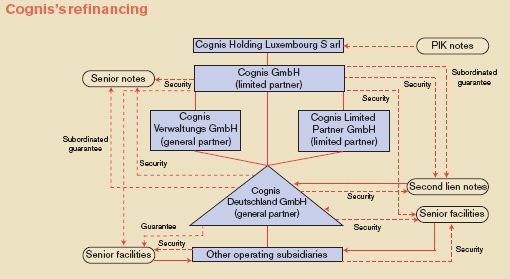

study Prof. Ian Giddy, New York University A Refinancing with Second Lien Debt In May 2004, Cognis, the German chemicals company, completed a €2 billion leveraged recapitalization to fund a €330 million distribution to Permira and funds advised by Goldman Sachs, the owners of Cognis who retained 100% of their equity in the company. The recapitalization was made possible though an innovative three-tiered debt structure consisting of a traditionally syndicated €1.3 billion senior European credit facility on the top, €345 million of subordinated high-yield bonds on the bottom and in the middle €400 million of US-style second lien financing sold primarily to US hedge funds. The second lien financing consisted of €235 million of Luxembourg-listed bonds and a loan consisting of a €62 million Euro tranche and a $125 million US dollar tranche. The terms of the second lien financing were eye-opening: a nine-year maturity; a floating rate coupon of Euribor plus only 475 basis points; optional redemption at 104% after one year, at 102% after two years and at 100% after three years; and high-yield style incurrence covenants rather than financial maintenance covenants found in European mezzanine loans. Priority in Liquidation versus Right of Payment The sponsors found that both the terms and the amount of the second lien financing compared favourably to what was available at the time in the European mezzanine loan market. What makes the US-style second lien product different from traditional European mezzanine loans? For one thing, the US hedge fund buyers of the second lien product require that the paper be contractually senior in right of payment. They are willing to give the banks priority with respect to proceeds from the joint collateral, but they are unwilling to accept general bankruptcy turnover provisions characteristic of contractual subordination. In return for this fairly nuanced improvement in insolvency rights, second lien lenders are willing to forgo warrants or other equity kickers, lend at rates substantially below the benchmarks set by European mezzanine funds and live with incurrence rather than maintenance covenants. Structure of the Cognis Refinancing .  Source: Bryant Edwards, "Innovation fuels Europe’s high-yield market," International Financial Law Review, March 2005. Questions

1. Why would a company choose to finance with second lien debt rather than conventional mezzanine notes with warrants? 2. This deal was a refinancing. Could second lien debt be used for a leveraged buyout? |