|

Case

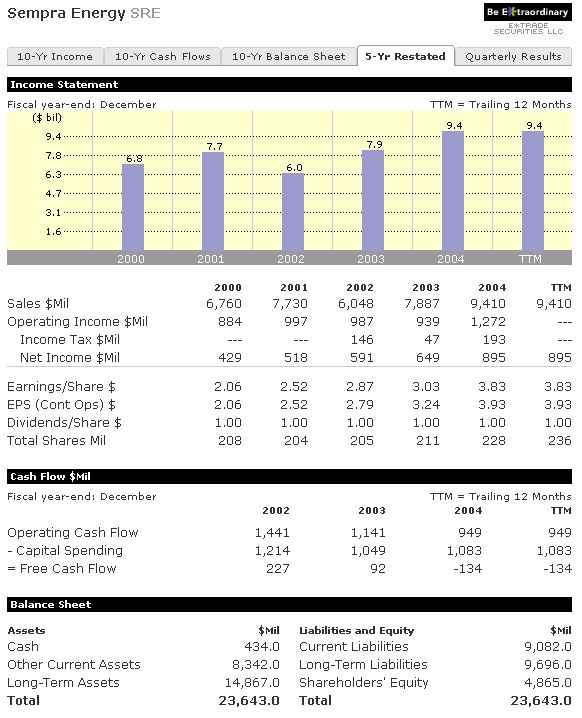

study Prof. Ian Giddy, New York University Sempra's Finance After deregulation of the American energy market, many U.S. power companies found themselves burdened with more debt than their cash flows could sustain. As energy prices rose, they discovered that deregulation applied more to the cost side than to the revenue side. As a result, some succumbed and others sought to move towards a less leveraged financial structure. At the same time, energy CFOs wanted to take advantage of their borrowing capacity and ensure that, as the industry became more consolidated, they would have the capacity to raise funds for future acquisitions. In mid-2005 the company had a market capitalization of $9.6 billion and long term debt of $9.7 billion. With a beta of only 0.37, the company had a relatively stable equity value, but senior management was concerned that their $400 m of cash was only just enough to meet working capital needs, and that a substantial amount of funds might be needed in the near future for capital expenditures and possible acquisitions. EBITDA was $1.89b, more than enough to cover interest costs of $330,000. The Debt-Reduction Plan In a March 2005 presentaiton Sempra's CFO, Neal Schmale, argued that the company was on track to bring its debt down and also that it had the liquidity to handle anticipated capital needs. Based on the summary financials shown below, and Mr Schmale's presentation, do you agree? Download Sempra presentation.   |