View:

March 14, 2025

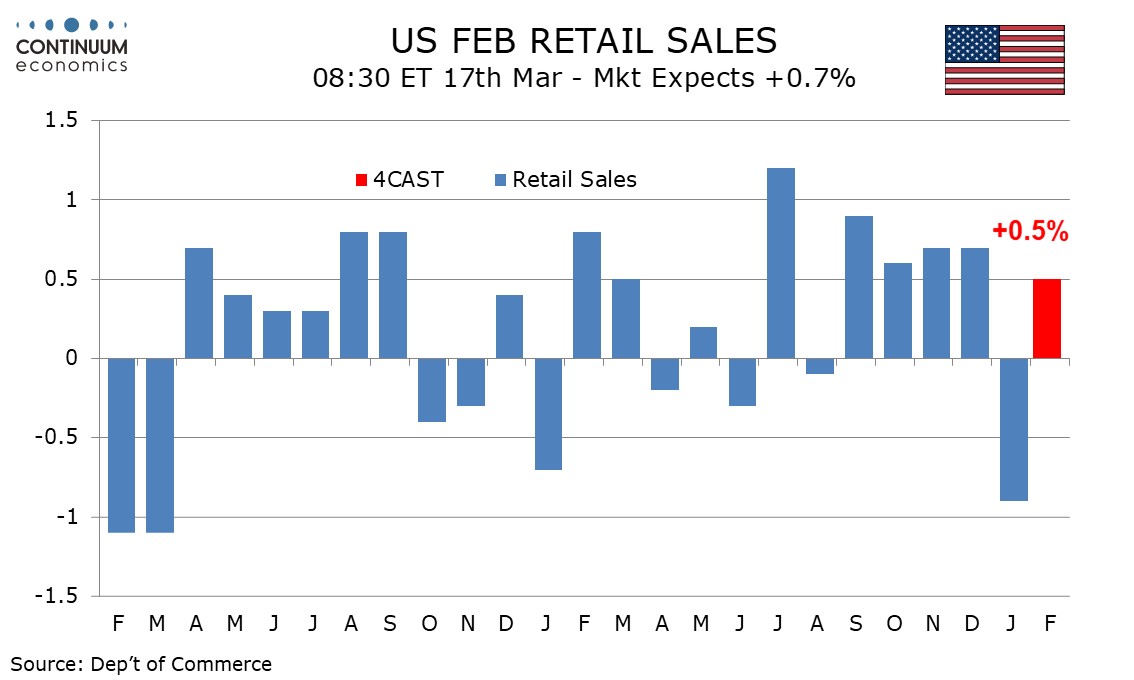

Preview: Due March 17 - U.S. February Retail Sales - Only a partial reversal of January's drop

March 14, 2025 12:58 PM UTC

We expect US retail sales to rise by 0.5% in February in what would be only a partial reversal of a 0.9% decline in January. Ex autos we expect a 0.3% increase after a 0.4% January decline while ex autos and gasoline we expect a 0.4% increase after a 0.5% January decline.

Germany: Breakthrough in Attempt to Unlock Debt Brake?

March 14, 2025 12:08 PM UTC

It does seem as if effective German Chancellor-elect Merz now has enough parliamentary support to amend the so-called debt brake and unlock more spending and borrowing to be directed toward added defense and infrastructure. Thus, it does seem as if Germany and its economy are undergoing a sea-chan

Europe Summary and Highlights 14 March

March 14, 2025 11:08 AM UTC

EUR/USD gained half a figure late in the European morning on news that the German government collation had reached agreement with the Greens on the debt package, allowing the fiscal boost from defence and infrastructure spending to be passed.

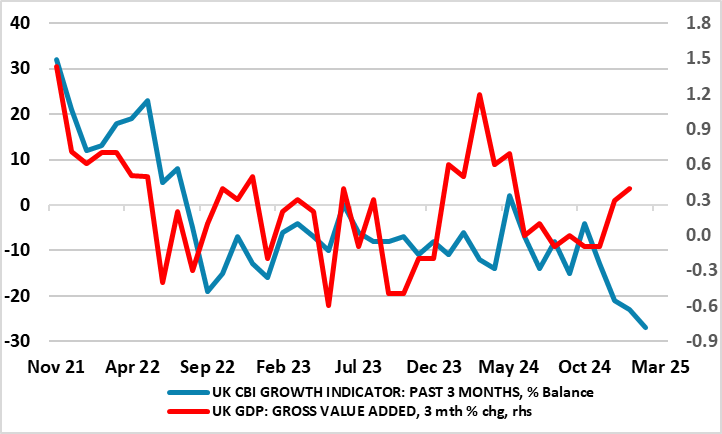

UK GDP Review: Previous Resilience Gives Way to Softer Surveys

March 14, 2025 7:39 AM UTC

Despite a fresh downside surprise for January numbers, the odds are increasing that current quarter GDP will be decidedly positive as opposed to the weak(ish) picture we perceive. The upside surprises in December contrasts with a much softer impression from surveys (Figure 1), the latter now showi

Chartbook: Chart JP Nikkei Update: Room to extend losses within the bull channel from 2020 year low

March 14, 2025 3:03 AM UTC

Choppy trade within the 40400/38000 range area through 2024 Q4 extended into the new year before giving way to selling pressure at the end of February.

Breakdown and extension through the 37500 congestion has seen losses to reach support at the 36000 level and the 100-week EMA. Consolidation here see

Clone - Asia Open - Overnight Highlights

March 14, 2025 12:00 AM UTC

EMERGING ASIA

EM currencies perform individually against the USD as market participants are getting numb towards the drastic changes in tariff daily. The biggest winners are THB by 0.26%, followed by INR 0.24%, IDR 0.12% and PHP 0.02%; while the largest losers are KRW 0.25%, SGD 0.22%, MYR 0.19%, C

March 13, 2025

Due March 20 - U.S. Q4 Current Account - Another record deficit

March 13, 2025 5:01 PM UTC

We expect a Q4 US current account deficit of $325.0bn, or 4.4% of GDP, up from the record $310.9bn in Q3 when the deficit was 4.2% of GDP. This will be a fresh record deficit in nominal terms and the highest as a proportion of GDP since Q1 2022.

U.S. February PPI - Core goods accelerate, but outweighed by weakness in services

March 13, 2025 12:57 PM UTC

February PPI is surprisingly subdued at unchanged overall with an even softer 0.1% decline ex food and energy. Much of the surprise comes from trade prices with ex food, energy and trade up by 0.2%, but even this is moderate. Initial claims at 220k from 222k suggest the labor market remains healthy.