Comcast Shareholders Have Little Difficulty Containing Enthusiasm

By GERALDINE FABRIKANT

Published: February 13, 2004

Even as Disney's directors weigh Brian L. Roberts's takeover offer, Comcast's

own shareholders so far do not seem to be buying it.

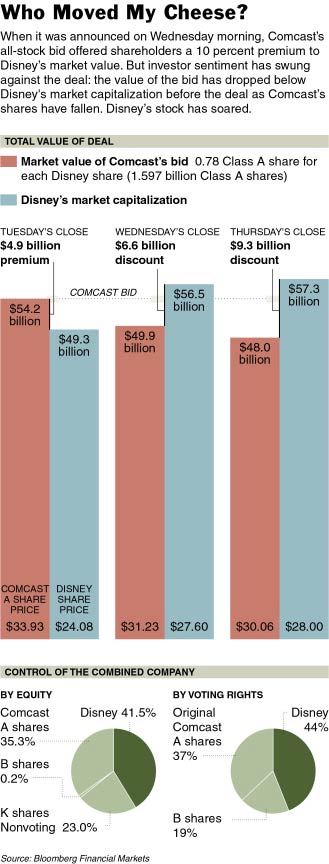

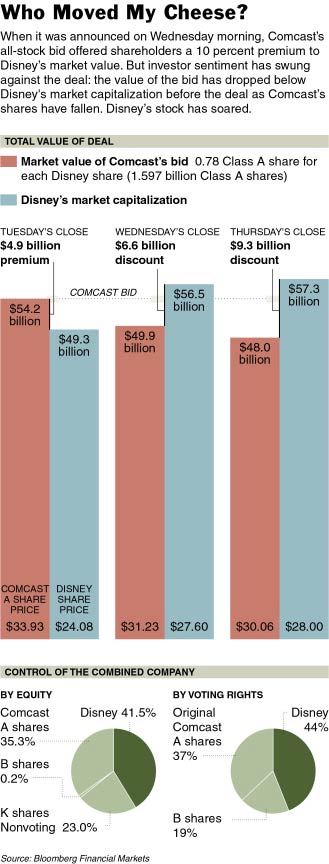

Comcast's shares tumbled for a second day yesterday and are down nearly 12

percent since Mr. Roberts, the company's chief executive, announced his all-stock

offer for the Walt Disney Company early Wednesday. That means the takeover

offer, which placed a 9 percent premium on Disney's shares and was valued at

$54 billion at 7 a.m. Wednesday, is now worth $48 billion - or below Disney's

current value in the open stock market.

Disney's stock has risen 16 percent in the last two trading days, as investors

evidently expect a higher offer - whether from Comcast or another bidder. Disney

closed yesterday at $28, up 40 cents, while the diminished worth of Comcast's

own shares made the takeover offer worth $23.53 a Disney share. Comcast closed

at $30.06, down $1.17.

But Comcast executives insist that Wednesday's bid, which would give 0.78

of a share for each Disney share, was its best offer. And they predict the

two stocks will return to normal trading ranges again, once it becomes clear,

as they expect, that there will be no bidding war for Disney.

"Our calculus was that at the end of the day there was unlikely to be

another bidder," Comcast's president, Stephen B. Burke, said yesterday.

He cited General Electric, Time Warner and Viacom as the likeliest candidates,

but said Comcast executives had concluded that each would have its own reasons

not to make a run at Disney. "At the right price, this is a great deal

and we are going to be disciplined about the price," he said.

"Our calculus was that at the end of the day there was unlikely to be

another bidder," Comcast's president, Stephen B. Burke, said yesterday.

He cited General Electric, Time Warner and Viacom as the likeliest candidates,

but said Comcast executives had concluded that each would have its own reasons

not to make a run at Disney. "At the right price, this is a great deal

and we are going to be disciplined about the price," he said.

Comcast's big institutional investors, several dozen of whom were courted

by Mr. Roberts at a cocktail party on Wednesday at the St. Regis hotel in Manhattan,

are loath to comment, for fear of further battering their Comcast portfolios.

But analysts say the big sell-off speaks volumes about their wariness of recent,

unhappy big media mergers like AOL Time Warner and Vivendi Universal.

"They are worried about Comcast being able to run Disney and get the

synergies out of it that they are promising," said Richard Greenfield,

who follows Comcast and Disney for Fulcrum Global Partners, an independent

research firm. "Investors have been burned on so many other big media

deals already," he said, noting that Comcast had completed its $50 billion

purchase of AT&T's cable business only 15 months ago.

It is relatively unusual for the entire premium in a takeover offer to disappear

within two days of its announcement, Wall Street analysts said yesterday. The

market's response indicates not only that Comcast's bid was something of a

low-ball offer but that investors are worried that Comcast - like many companies

before it - may lose its financial head and start bidding up its offer. Some

investors privately fret that Mr. Roberts has long wanted to own a programming

business that would provide movies, television shows and other entertainment

for his 21.5 million cable subscribers, and may get seduced into overspending

for those assets.

"At the price they first offered, the bid was only mildly dilutive," noted

Matthew Harrigan, a media analyst at Janco Partners, referring to the impact

on the earnings value of Comcast's shares. "That price is very safe and

sane. But some people are talking about Disney at $30 a share or $35 a share.

That would be very dilutive."

At the current valuation, there is little reason to think Disney shareholders

would find Comcast's bid appealing. But should Comcast attempt to raise the

offer's share ratio, "it has a circular problem," one analyst said. "If

they issue more stock in the deal - say 0.85 shares for each Disney share -

it means more dilution and investors would be very unhappy.''

Analysts also generally agree that Comcast could never offer more than one

share of its stock for each Disney share. Even at that ratio, the Comcast shareholders

would own just half the combined company. "I don't think Comcast shareholders

would want to give up more than 50 percent of their company," said Dennis

Leibowitz, who heads Act 11, a hedge fund that specializes in media companies.

Giving up half or more of the equity of Comcast could be particularly hard

for its shareholders to accept, because they have already ceded to Mr. Roberts

33 percent voting control through supervoting shares - a power he would continue

to wield under the terms of the Disney takeover offer, even as other Comcast

shareholders' own voting power would be further diminished.

There is always the possibility, of course, that rather than offering more

shares of Comcast, Mr. Roberts and his team could add cash to the bid. One

way to muster perhaps several billion dollars would be for the company to sell

its 21 percent stake in Time Warner Cable, or its $1.5 billion of preferred

stock in Time Warner itself. And the company also has a cash-laden investor

in Microsoft, which owns 7.4 percent of Comcast - although Microsoft is saying

nothing about the matter.

But for now it makes sense for Comcast to simply sit tight. It cannot raise

its offer because "it would look like it was bidding against itself and

people would go crazy," said one hedge fund manager, who owns Comcast

shares and spoke on condition of anonymity.

Comcast's president, Mr. Burke, said yesterday that the company had ruled

out most of the likely rivals that might conceivably start a bidding war.

"We never thought G.E. would get into this," Mr. Burke said. "We

can't believe AOL Time Warner would bid; you can't shut down a movie studio

and there would be studio overlap there. Viacom already has a network. There

was a possibility that five guys might try to get together and split up the

pieces. But there would be serious tax leakage with that and we can't believe

that would be the kind of thing the Disney board would go for."

If Disney resists its overture, Comcast could attempt to solicit Disney shareholders

to replace the board. Because of the way Disney's bylaws are written, it is

possible to "write to the shareholders and send out ballots with a new

slate of directors," one person close to the company said. "As soon

as you have 50 percent, plus one vote, you can replace all the directors."

But, Mr. Burke said yesterday, "We are genuinely hoping that it goes

friendly." He recalled that although AT&T initially spurned Comcast's

unsolicited takeover offer in July 2001, by the end of that year the companies

had agreed to a deal. "If the Disney board came out and said we want to

consider this and reached out to us," Mr. Burke said, "I think there's

a chance this could work out the way it worked out with AT&T."

Bill Carter contributed reporting for this article.

"Our calculus was that at the end of the day there was unlikely to be

another bidder," Comcast's president, Stephen B. Burke, said yesterday.

He cited General Electric, Time Warner and Viacom as the likeliest candidates,

but said Comcast executives had concluded that each would have its own reasons

not to make a run at Disney. "At the right price, this is a great deal

and we are going to be disciplined about the price," he said.

"Our calculus was that at the end of the day there was unlikely to be

another bidder," Comcast's president, Stephen B. Burke, said yesterday.

He cited General Electric, Time Warner and Viacom as the likeliest candidates,

but said Comcast executives had concluded that each would have its own reasons

not to make a run at Disney. "At the right price, this is a great deal

and we are going to be disciplined about the price," he said.