Weekly Puzzle #4:

Firm-specific and Market Risk

Making it Real

In every risk and return model in finance, the central concept is that risk is measured through the eyes of the marginal investor in the company and that marginal investor is assumed to be diversified. As a consequence, the only risk that this investor sees in a company is the risk that cannot be diversified away (market risk) and it is this risk that gets captured in a beta (in the CAPM) or betas (in multi factor models). While every student who goes through a finance class is given this lecture, the notion of firm specific and market risk remains an abstraction for most. In this weekly puzzle, I will make it real.

Firm specific versus

Market Risk: Let me take a shot

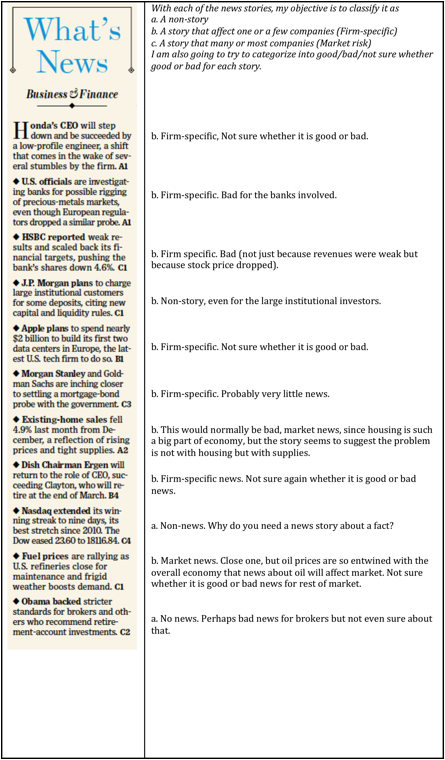

So, here is what I did. I opened up the print version of the Wall Street Journal today and focused on just the "What's news" section right on the front page. I went through each news story, with two classification objectives.

1. Firm Specific or Market Risk: With each news story, I first classified it into news that affected only one or a few companies (firm specific risk), many or most companies (market risk) or no companies (no risk).

2. Good news, Bad news or Tough to tell: I also classified each news story into good, bad or tough to tell.

The page is attached, but to illustrate what I did, take the very first story, which talks about Honda's CEO stepping down. The story is clearly firm-specific, since the only company really affected is Honda, though you could loosely argue that other auto companies may be slightly affected as well. I am not sure whether it is good or bad news, since that would depend on how the CEO was perceived. If he was perceived as an incompetent wastrel, this is really good news. If he was a star, this would be bad news. (I think it is more likely to be the former with Honda, but did not make the leap on that one).

Take a look at the page. Most of the stories are firm specific and there are relatively few market stories. There are quite a few non-stories, which tells you more about financial journalism than it does about markets.

Firm specific versus

Market Risk: Your challenge

For the next week, pick up the Wall Street Journal (in print form or digitally). Focus on the Whats News page every day and try what I did. At the end of the week, see if you can do a count of both the type of story it was (Firm specific, Market, Non-story) and whether it contained good or bad news. You will have a clearer sense of what we are talking about when we talk about firm specific and market risk.