Weekly Puzzle #1: Corporate Governance, Family Group Style

The Set up

In class, this week, we will start our discussion of corporate governance by zeroing in on how much or how little power stockholders have to get managers of publicly traded companies to change their ways, even when those ways are destructive. When, as is the case for many Latin American and Asian companeis, that publicly traded company is part of a family group, shareholders are even more powerless and are often at the mercy of the families that control these groups. The defense that many offer is that this is not a problem if the family is one that has a long history of good stewardship and can be trusted. In this week's puzzle, we examine the perils of this assumption using one of India's oldest and best-regarded family groups, the Tatas.

The History of the Tata Group

The Tata Group is one of India's oldest family groups. It was founded in 1868 by Jamsetji Nusserwanji Tata as a trading company in Bombay. In the decades since, it has grown to be to in too many businesses to list, ranging from steel to technology. Through it's history, it has maintained a reputation for social responsibility and honest dealings, setting itself apart from many less scruplous family groups. You can get the official history of the Tata Group by going to this link.

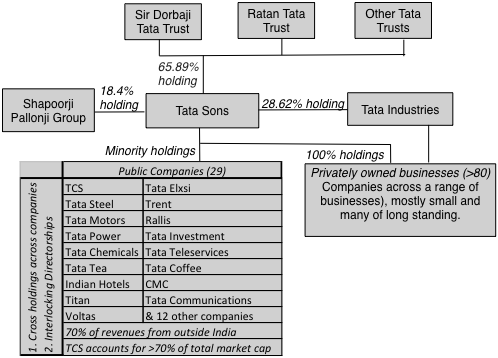

Over this long history, The Tata Group has had grown in both size and business mix and by 2016, the group had more than a hundred companies bound together with a cross holding structure that effectively gives control to Tata Sons, a privately held entity, at the apex of the organization.

Some of the complexity in this holding structure comes from the history of the Tata Group and some is by design.

The Tata Group has had only seven leaders in its history of almost 150 years.

| CEO | Tenure | Highlights |

| Jamsetji Tata | 1868-1904 | Founded the Tata Group as a trading company in 1868. |

| Dorab Tata | 1904-1932 | Instrumental in creating the Tata Trust, the family philathropy |

| Nowroji Saklatvala | 1932-1938 | Related to the Tatas and started profit-sharing scheme. |

| JRD Tata | 1939-1991 | Legendary and longest-serving CEO and a pioneer in civil aviation. |

| Ratan Tata | 1991-2012 | Presided over global expansion of the group, acquiring global companies to do so. |

| Cyrus Mistry | 2012-2016 | Related to Tatas and son of one of the Tata group's largest stockholders. |

When Cyrus Mistry was appointed as the Tata Group leader in 2012, it was viewed as a passing of the guard from the Tata family to someone who was at least nominally an outsider, though he is part of a family that is related by marriage to the Tatas and has a long insider history at the Tata Group. The assumption was that he like his predecessors would enjoy a long stint at the top of the organization.

The Crisis

This history of stability is perhaps why investors and onlookers were shocked by the events of the last few weeks. On October 24, 2016, Cyrus Mistry was removed as CEO of Tata Sons, the controlling entity for the group, by directors on the board for non-performance, a failure to deliver on promises and Ratan Tata returned to the helm. Mr. Mistry did not go quietly into the night and fought back, arguing that not only was the removal not in keeping with Tata traditions, but that his removal was effectively a coup by old-time Tata hands who were threatened by his attempt to clean up mistakes made by prior regime (headed by Ratan Tata). In particular, he argued that many of the high-profile acquisitions/investments that Mr. Tata had made, including those of Corus Steel (by Tata Steel) and forays into the airline business were weighing the company down and that it was his attempts to extract Tata companies from these messes that had provoked the backlash. Defenders of the removal argued that Mr. Mistry had been removed for just cause and that his numbers-driven (and presumably short-term) decisions were not in keeping with the Tata culture of building businesses for the long term and taking into account social obligations while doing so.

In the weeks following, the fight boiled over not only into the public arena but into legal settings, as the Tata Group tried to remove Mr. Mistry from board positions and leadership roles that he continued to have at individual Tata companies and Mr. Mistry sued to keep his place. As that fight continued, the market capitalization of Tata companies dropped by billions of dollars. If you are interested in what I thought in November about how this crisis was playing out, you can read my blog post on the Tata Group, in particular, and family group companies, in general.

The Resolution?

In the months after the Mistry firing, the Tata Group was on the lookout for a new head but found it to be a hard sell. On January 13, 2017, the group announced that it had found its new leader in Mr. Chandrasekaran, the CEO of Tata Consulting Services (TCS), and that Ratan Tata would be stepping down. By choosing Mr. Chandrasekaran, the group seems to have found a way out of the crisis. Not only is he someone who is intimately familiar with the group, its culture and management, but he also happens to be the head of the crown jewel of the Tata Group; TCS accounts for almost 60% of the overall market capitalization of the group and is the least conflicted of the companies in the group in terms of cross holdings.

Questions/

discussion issues

- What do you see as the pluses and minuses of family group control of publicly traded companies?

- Can you use that trade off to explain why family group companies grew to dominate Asian and Latin American markets? Can you use it to look at the challenges that family groups will face in the future?

- Given the Tata Group's current standing and the evolution of the Indian economy/market, do you think that the pluses still outweigh the minuses?

- Do you believe the governance problem has been resolved with the appointment of Mr. Chandrasekaran as the new CEO of Tata Sons? Why or why not? If no, what would you like to see done at the company to make you feel more comfortable with your investment in a Tata company?