Weekly Puzzle #5: The Magic of Beta

The Set up

In most finance text books, you are told that all you need to do to estimate the beta for a stock is to run a regression of returns on the stock against returns on the market index. The slope of the line is, of course, the beta. This avoids many key questions including:

- Over what period should the regression be run, and with what return intervals?

- What market index should you use for the regression?

- What exactly is the regresssion telling you about the beta for the stock?

- What is the beta telling you about the risk in your stock?

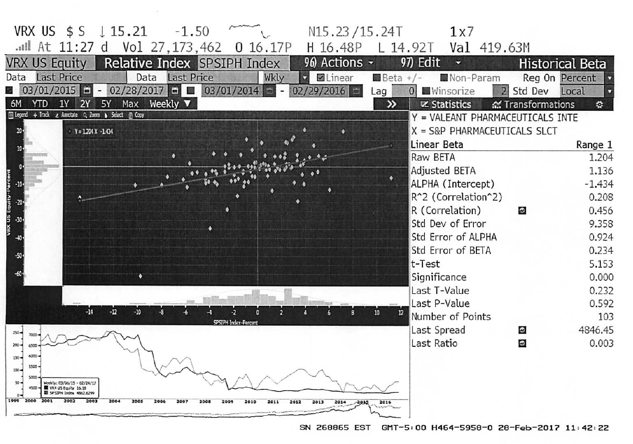

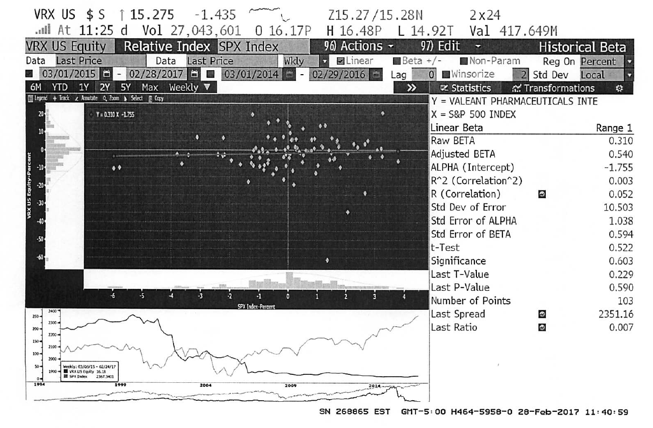

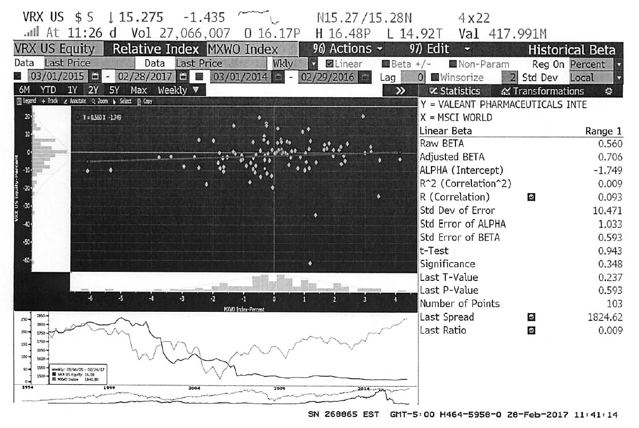

In this weekly puzzle, I have taken one company, Valeant, and estimated its beta against three different indices and you will have to make your judgment, based on these betas. On the other, GoPro, I report one regression beta and again ask you to make your best judgment on its relative risk.

Valeant's Betas

1. Against S&P Pharmaceuticals Index

2. Against the S&P 500

3. Against the MSCI Global Index

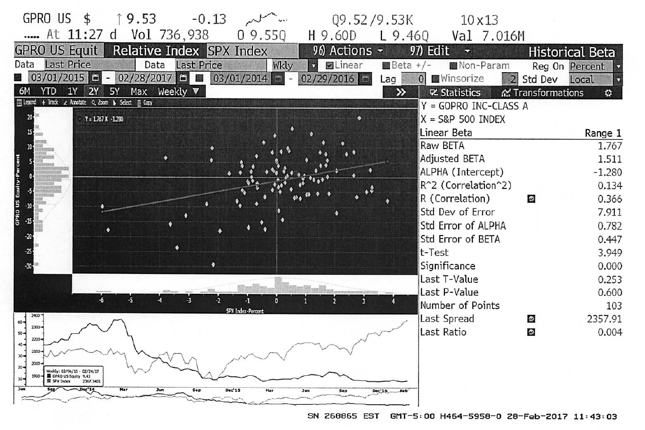

GoPro's Beta

Questions/

discussion issues

- For Valeant, list out the key regression statistics (alpha, beta and R squared) in the four regressions. Do you notice any patterns? Can you explain them?

- If you are analyzing Valent and were required to use one of these regression betas, which one would you use and why?

- With the beta that you decided to us, estimate the range on the beta and what it means for your estimate of cost of equity.

- During the period of the regression, Valeant lost almost 80% of its market value and was involved in multiple scandals and management turnover. What effect, if any, do you think this crisis has had on your estimated regression betas (increased them, decreased them, left them unchanged)? Explain why.

- With GoPro, why is the standard error on the beta so high? What are the consequences for using GoPro's regression beta?