Debt Ratio Regression: January 2020

Debt Ratio Regression: January 2020

Variables used in the regression

- Debt

Ratio = Debt/ (Market Value of Equity + Debt): If you can get market value

of debt, use it. Else, use book value of debt.

- Payout Ratio= Dividends/ Net Income, if Net Income is positve, not available if net income is negative.

- Expected growth rate in EPS- next 5 years= You can use expected or even historical earnings growth, if you don't have an EPS growth forecast

- Effective Tax Rate = Effective tax rate in most recent year

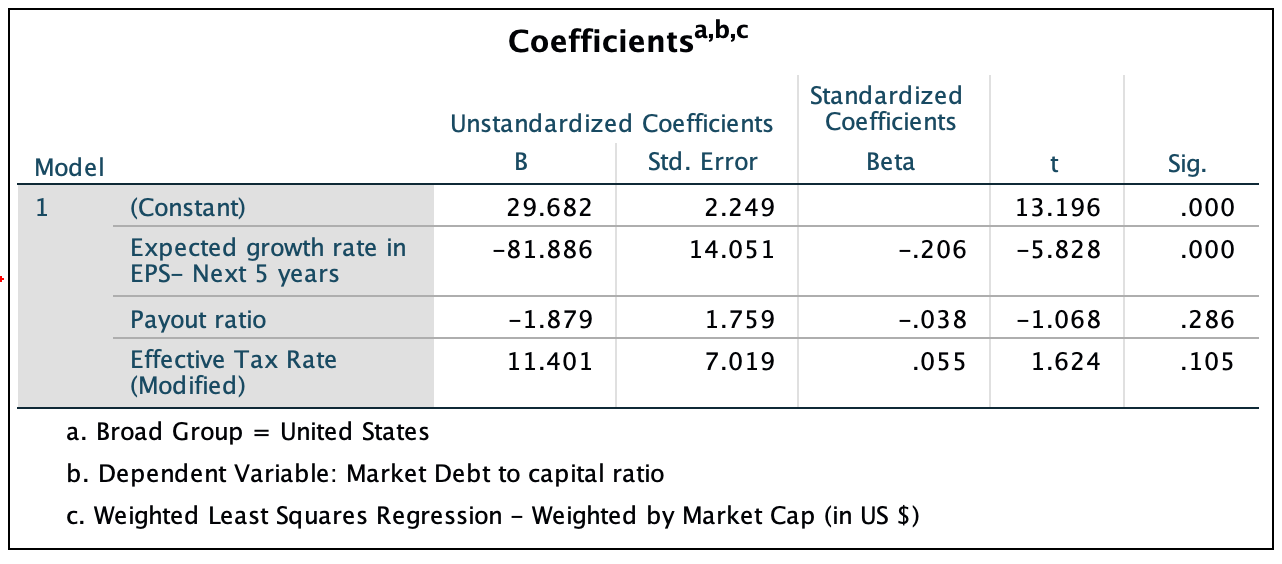

US Regression

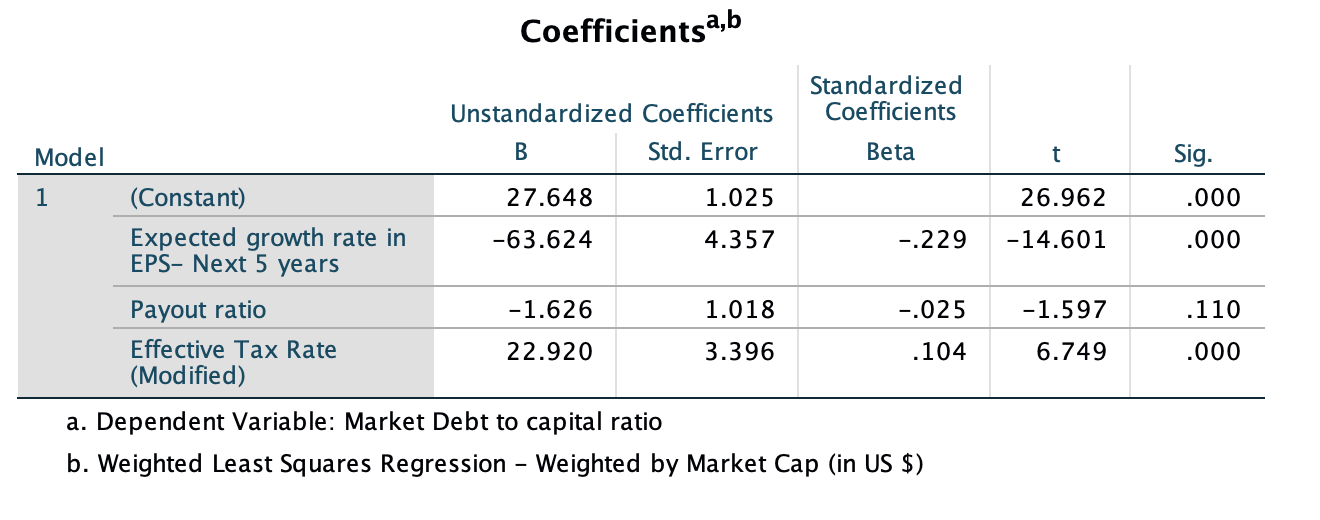

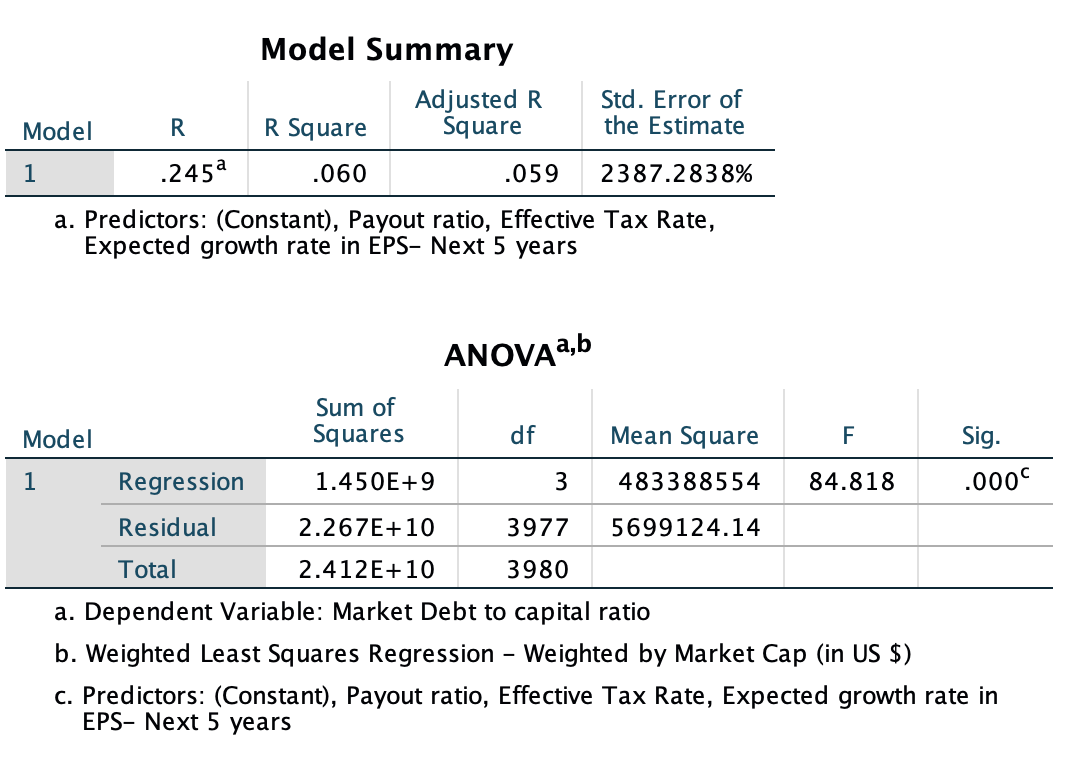

Global Regression

- How do I use this regression?

Assume that you want to estimate the market debt ratio for a firm with the following characteristics, using the Global regression

Payout Ratio = 40%

Effective Tax Rate= 20%

Expected growth rate in EPS = 15%

- Predicted Value

Expected Debt Ratio = 27.65 + 22.92 (.20) - 63.62 (15 ) - 1.63 (40) = 22.04 or 22.04%

If your predicted value is less than zero, your predicted debt ratio is zero.