The

Little Book of Valuation

The

Little Book of Valuation

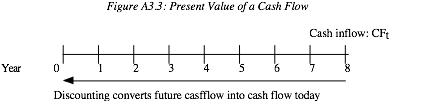

The Mechanics of Time Value

The

process of discounting future cash flows converts them into cash flows in

present value terms. Conversely, the process of compounding converts present

cash flows into future cash flows. There are five types of cash

flows—simple cash flows, annuities, growing annuities, perpetuities, and

growing perpetuities—which we discuss next.

Simple Cash Flows

A

simple cash flow is a single cash flow in a specified future time period; it

can be depicted on a time line as in Figure A3.3.

where CFt = the cash flow at time t.

This

cash flow can be discounted back to the present using a discount rate that

reflects the uncertainty of the cash flow. Concurrently, cash flows in the

present can be compounded to arrive at an expected future cash flow.

Discounting

a cash flow converts it into present value dollars and enables the user to do

several things. First, once cash flows are converted into present value

dollars, they can be aggregated and compared. Second, if present values are

estimated correctly, the user should be indifferent between the future cash

flow and the present value of that cash flow. The present value of a cash flow

can be written as follows

Present

Value of Simple Cash Flow = ![]()

where r = discount rate.

Other

things remaining equal, the present value of a cash flow will decrease as the

discount rate increases and continue to decrease the further into the future

the cash flow occurs.

Current

cash flows can be moved to the future by compounding the cash flow at the

appropriate discount rate.

Future

Value of Simple Cash Flow = CF0 (1 + r)t

where CF0

= cash flow now, r = discount rate.

Again, the compounding effect increases with both the discount rate and the

compounding period.

The

frequency of compounding affects both the future and present values of cash

flows. In the examples just discussed, the cash flows were

assumed to be discounted and compounded annually—that is, interest

payments and income were computed at the end of each year, based on the balance

at the beginning of the year. In some cases, however, the interest may be

computed more frequently, such as on a monthly or semi-annual basis. In these

cases, the present and future values may be very different from those computed

on an annual basis; the stated interest rate on an annual basis can deviate

significantly from the effective or true interest rate. The effective interest

rate can be computed as follows:

Effective

Interest Rate = ![]()

where n = number of compounding periods during

the year (2 = semi-annual; 12 = monthly). For instance, a 10 percent annual

interest rate, if there is semi-annual compounding, works out to an effective

interest rate of

Effective

Interest Rate = 1.052

– 1 = 0.10125 or 10.125%

As compounding becomes continuous,

the effective interest rate can be computed as follows

Effective

Interest Rate = expr – 1

where exp

= exponential function and r = stated

annual interest rate. Table A3.2 provides the effective rates as a function of

the compounding frequency.

Table A3.2 Effect of Compounding Frequency

on Effective Interest Rates

|

Frequency

|

Rate |

t (Days) |

Formula |

Effective

Annual Rate |

|

Annual |

10% |

1 |

0.10 |

10% |

|

Semi-annual |

10% |

2 |

(1 + 0.10/2)2

– 1 |

10.25% |

|

Monthly |

10% |

12 |

(1 + 0.10/12)12

– 1 |

10.47% |

|

Daily |

10% |

365 |

(1 + 0.10/365)365

– 1 |

10.5156% |

|

Continuous |

10% |

|

exp0.10 – 1 |

10.5171% |

As you can see, compounding becomes

more frequent, the effective rate increases, and the present value of future

cash flows decreases.

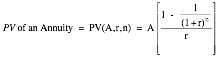

Annuities

An

annuity is a constant cash flow that

occurs at regular intervals for a fixed period of time. Defining A to be the

annuity, the time line for an annuity may be drawn as follows:

A A A A

| | | |

0 1 2 3 4

An

annuity can occur at the end of each period, as in this time line, or at the

beginning of each period.

where A = annuity, r

= discount rate, and n = number of

years. Accordingly, the notation we will use in the rest of this book for the

present value of an annuity will be PV(A,r,n).

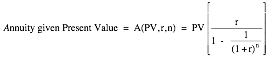

Individuals or businesses who

have a fixed obligation to meet or a target to meet (in terms of savings) some

time in the future need to know how much they should set aside each period to

reach this target. If you are given the future value and are looking for an

annuity—A(FV,r,n) in terms of notation:

![]()

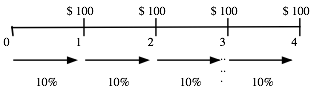

The

annuities considered thus far i are end-of-the-period cash

flows. Both the present and future values will be affected if the cash flows

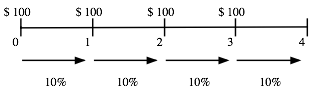

occur at the beginning of each period instead of the end. To illustrate this

effect, consider an annuity of $100 at the end of each year for the next four

years, with a discount rate of 10 percent.

Contrast this with an annuity of

$100 at the beginning of each year for the next four years, with the same

discount rate.

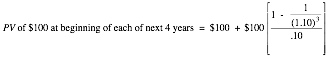

Because the first of these

annuities occurs right now and the remaining cash flows take the form of an

end-of-the-period annuity over three years, the present value of this annuity

can be written as follows:

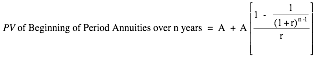

In general, the present value of a

beginning-of-the-period annuity over n

years can be written as follows:

This

present value will be higher than the present value of an equivalent annuity at

the end of each period.

Growing Annuities

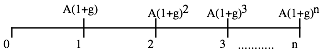

A

growing annuity is a cash flow that

grows at a constant rate for a specified period of time. If A is the current

cash flow, and g is the expected growth

rate, the time line for a growing annuity appears as follows:

Note that to qualify as a growing

annuity, the growth rate in each period has to be the same as the growth rate

in the prior period.

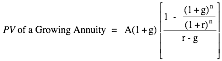

In

most cases, the present value of a growing annuity can be estimated by using

the following formula:

The present value of a growing

annuity can be estimated in all cases, but one—where the growth rate is

equal to the discount rate. In that case, the present value is equal to the

nominal sums of the annuities over the period, without the growth effect.

PV

of a Growing Annuity for n Years

(when r = g) = nA

Note also that this formulation

works even when the growth rate is greater than the discount rate.[2]

Perpetuities

A perpetuity is a

constant cash flow at regular intervals forever. The present value of a perpetuity can be written as

![]()

where A is the perpetuity.

A

growing perpetuity is a cash flow

that is expected to grow at a constant rate forever. The present value of a

growing perpetuity can be written as:

![]()

where CF1 is

the expected cash flow next year, g

is the constant growth rate, and r is

the discount rate. Although a growing perpetuity and a growing annuity share

several features, the fact that a growing perpetuity lasts forever puts

constraints on the growth rate. It has to be less than the discount rate for

this formula to work.