Corporate Finance: Newsletter – April 14, 2012

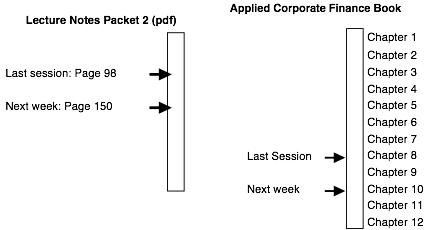

Where we

are in class…

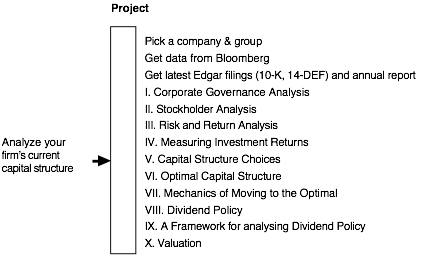

Where you

should be in the project…

Data Notes…

As you work at coming up with the optimal debt ratio for your company, keep your focus on the big picture. You want your company to borrow money to get the tax advantages but you don’t want them to borrow too much. Keeping this in mind, you want to look at not only what your company earned last year but what it will make in a normal year. This will be difficult. You can look at the average operating income over several years for a cyclical firm, but there can be still be shifts that have occurred in the market that you may miss. You can also look at typical numbers for the industry. You can get industry average operating margins and returns on capital on my web site.

After you have come up with the optimal debt ratio, ask the follow up questions. Do you want your company to move to this optimal immediately? If it does, what will happen to the stock price? Play devil’s advocate and think of everything that can go wrong if the company takes your advice.

Miscellaneous FAQs

Can

I compute the optimal debt ratio for my company without your spreadsheet?

Absolutely. It is actually a great way to build up your knowledge of corporate finance and excel at the same time. If you want to try and your run into trouble, I will be glad to help.

Can

my optimal debt ratio be 0%?

Yes. If your company has negative operating income or very low operating income, your optimal debt ratio will be 0%.