Corporate Finance: Newsletter – April 21, 2012

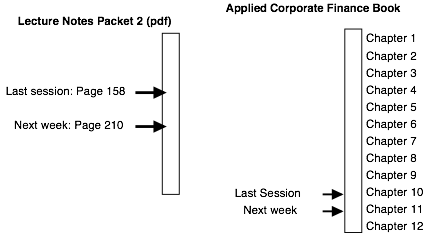

Where we

are in class…

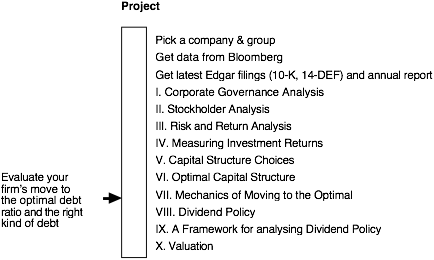

Where you

should be in the project…

Data Notes…

If you have computed your optimal debt ratio using the cost of capital approach, you may want to do two things to follow up:

q Check your bond rating at the optimal debt ratio. If it is below investment grade, you may want to impose a rating constraint and check what the constrained optimal is.

q Compare your company’s debt ratio to the debt ratios of other companies in your peer group. You can get a rough measure of how your sector stacks up on a variety of fundamental measures – tax rates, volatility of earnings etc. – by looking at the industry averages on my web site.

q Follow up by devising the best path to get to the optimal by examining both the need for immediacy (Are you under threat of a takeover? Or bankruptcy?) and the project opportunities you have. You should use the Jensen’s alpha and EVA you computed in earlier sections when you make these judgments.

Miscellaneous FAQs

Do

I have to recommend that the firm move to the optimal debt ratio that comes up

from the cost of capital approach?

Not at all. You should consider it as one input into the decision process but not necessarily the dominant one. You can bring in both qualitative and quantitative concerns into your final recommendation, which may be very different from the unconstrained optimal debt ratio.

Will

my optimal debt ratio change over time?

Yes. It will change both as macro variables such as risk premiums and interest rates change and also because of changes in your company’s financial health.