Corporate Finance: Newsletter – March 3, 2012

Where we

are in classÉ

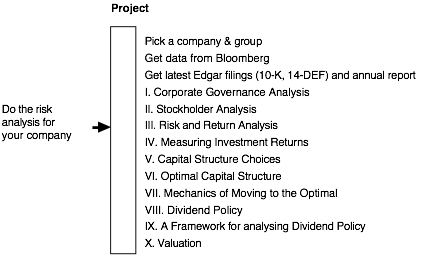

Where you

should be in the projectÉ

Data NotesÉ

To get a quick estimate of the bottom-up beta for your firm, you can visit the Yahoo! Finance site, find your company and compare it to its peer group. Once you type the symbol for your firm, and get the information on your firm, click on ratio comparisons. You will get a beta for the 50 companies that are classified as comparable to your firm. You will also get a book debt to equity ratio for these companies. To estimate the bottom up beta, first convert the book debt to equity ratio by dividing by the price to book ratio average for the sector:

Market debt to equity = Book debt to equity/Price to book ratio

Then unlever the average beta using this market debt to equity ratio (you can use a 35% tax rate)

You can also get the bottom-up betas that I estimated by sector from my web site:

http://www.stern.nyu.edu/~adamodar/New_Home_Page/data.html

Miscellaneous FAQs

These

questions relate to the quiz. Wait until you take the quiz.

I

do not agree with the grading on the quiz. What do I do?

Talk to me.

I

screwed up big time on the quiz. What do I do?

Talk to me. First, we need to figure out what went wrong and then fix it so that it does not happen on the remaining quizzes. I will treat this quiz as an outlier, if you can do much better on the remaining quizzes. I do not throw out quizzes, but I will weight them less.

What

is this case and when will I get it?

The case is an investment analysis exercise and you will get it on Monday. The case is due on March 28.