Corporate Finance: Newsletter – March 10, 2012

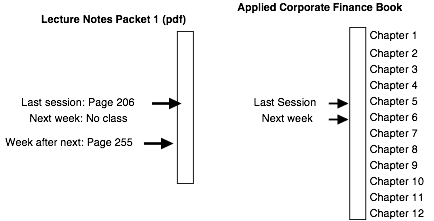

Where we

are in class…

Where you

should be in the project…

Data Notes…

To compute the cost of debt and the dollar debt that your firm has outstanding, start by looking for a rating for your firm. Bloomberg should provide this information and it also available online at many service – try both S&P and Moody’s, though they both require you to register before you pull up any information. If your company is rated, you can use the rating in conjunction with the default spreads provided on my site under updated data to get the pre-tax cost of debt. The tax rates for different countries are also available under updated data. If you don’t have a rating, use the ratings spreadsheet that I emailed you (it is also under spreadsheets) to assess a synthetic rating.

For the dollar debt, start with your balance sheet and find the interest bearing debt. In addition, look up the lease and rental commitments that are provided in a footnote to the balance sheet. You may not be able to find this information for European companies….

Miscellaneous FAQs

What is

this case and what do we do with it?

The case is an investment analysis case that you have to do as a group. It is due on March 28. You can download the case online when you do get a chance.

I

do not agree with the grading on the quiz. What do I do?

Talk to me.

I

screwed up big time on the quiz. What do I do?

Talk to me. First, we need to figure out what went wrong and then fix it so that it does not happen on the remaining quizzes. I will treat this quiz as an outlier, if you can do much better on the remaining quizzes. I do not throw out quizzes, but I will weight them less.