Corporate Finance: Newsletter – April 7, 2012

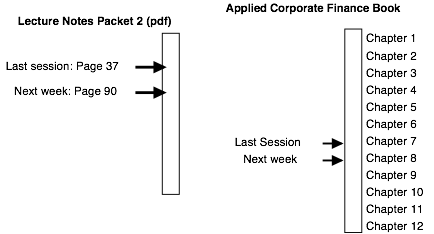

Where we

are in classÉ

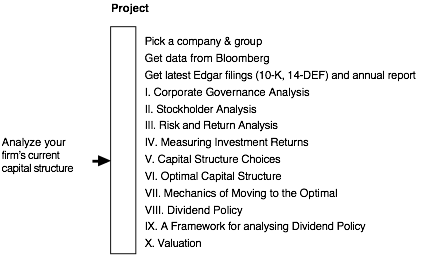

Where you

should be in the projectÉ

Data NotesÉ

The Nike case has been graded and returned the cases to you. Some of you have wondered how I assigned the grades for this case. It was subjective but it was based upon some real factors. One of the most critical was whether you reinvested to generate the growth rate forever in perpetuity.

As you start asking the questions about your firm's trade off on debt, you can see how firms in your sector measure up on proxies for each - the tax rate for tax advantages, closely held shares as a measure of added discipline.

http://www.stern.nyu.edu/~adamodar/New_Home_Page/data.html

In the next session, we will begin with a quantitative analysis of your firm's optimal capital structure. You should have your firm's current cost of capital estimated by then.

Miscellaneous FAQs

Can

I change my company now?

You can change your company anytime you want, as long as you can catch up. This is perhaps your very last chance to be able to do that.

My

company has done an acquisition or become the target of an acquisition. Am I in

trouble?

Not really. Just keep on goingÉ The acquisition will not affect your analysis, for the moment.