Statistical Distributions

Every

statistics book provides a listing of statistical distributions, with their

properties, but browsing through these choices can be frustrating to anyone

without a statistical background, for two reasons. First, the choices seem

endless, with dozens of distributions competing for your attention, with little

or no intuitive basis for differentiating between them. Second, the descriptions

tend to be abstract and emphasize statistical properties such as the moments,

characteristic functions and cumulative distributions. In this appendix, we

will focus on the aspects of distributions that are most useful when analyzing

raw data and trying to fit the right distribution to that data.

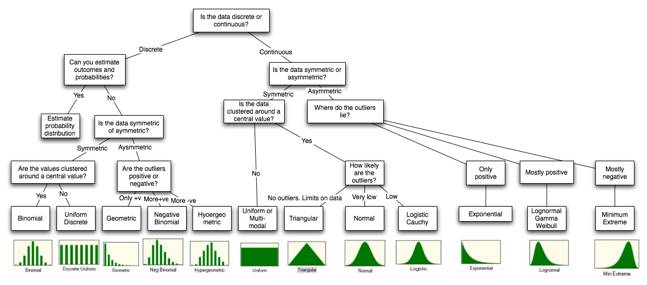

Fitting the Distribution

When

confronted with data that needs to be characterized by a distribution, it is

best to start with the raw data and answer four basic questions about the data

that can help in the characterization. The first relates to whether the data

can take on only discrete values or whether the data is continuous;

whether a new pharmaceutical drug gets FDA approval or not is a discrete value

but the revenues from the drug represent a continuous variable. The second

looks at the symmetry of the data and if there is asymmetry, which

direction it lies in; in other words, are positive and negative outliers

equally likely or is one more likely than the other. The third question is

whether there are upper or lower limits on the data;; there are some

data items like revenues that cannot be lower than zero whereas there are

others like operating margins that cannot exceed a value (100%). The final and related

question relates to the likelihood of observing extreme values in the

distribution; in some data, the extreme values occur very infrequently whereas

in others, they occur more often.

Is the data discrete or continuous?

The

first and most obvious categorization of data should be on whether the data is

restricted to taking on only discrete values or if it is continuous. Consider

the inputs into a typical project analysis at a firm. Most estimates that go

into the analysis come from distributions that are continuous; market size,

market share and profit margins, for instance, are all continuous variables.

There are some important risk factors, though, that can take on only discrete

forms, including regulatory actions and the threat of a terrorist attack; in

the first case, the regulatory authority may dispense one of two or more

decisions which are specified up front and in the latter, you are subjected to

a terrorist attack or you are not.

With

discrete data, the entire distribution can either be developed from scratch or

the data can be fitted to a pre-specified discrete distribution. With the

former, there are two steps to building the distribution. The first is

identifying the possible outcomes and the second is to estimate probabilities

to each outcome. As we noted in the text, we can draw on historical data or

experience as well as specific knowledge about the investment being analyzed to

arrive at the final distribution. This

process is relatively simple to accomplish when there are a few outcomes with a

well-established basis for estimating probabilities but becomes more tedious as

the number of outcomes increases. If it is difficult or impossible to build up

a customized distribution, it may still be possible fit the data to one of the

following discrete distributions:

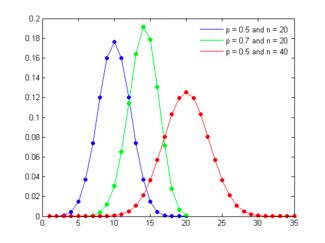

a.

Binomial distribution: The binomial distribution

measures the probabilities of the number of successes over a given number of

trials with a specified probability of success in each try. In the simplest

scenario of a coin toss (with a fair coin), where the probability of getting a

head with each toss is 0.50 and there are a hundred trials, the binomial

distribution will measure the likelihood of getting anywhere from no heads in a

hundred tosses (very unlikely) to 50 heads (the most likely) to 100 heads (also

very unlikely). The binomial distribution in this case will be symmetric,

reflecting the even odds; as the probabilities shift from even odds, the

distribution will get more skewed. Figure 6A.1 presents binomial distributions

for three scenarios – two with 50% probability of success and one with a

70% probability of success and different trial sizes.

Figure

6A.1: Binomial Distribution

As the

probability of success is varied (from 50%) the distribution will also shift

its shape, becoming positively skewed for probabilities less than 50% and

negatively skewed for probabilities greater than 50%.[1]

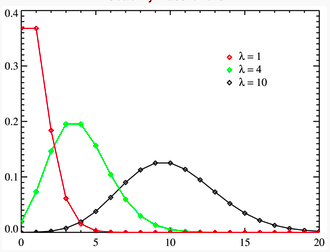

b.

Poisson distribution: The Poisson distribution measures

the likelihood of a number of events occurring within a given time interval,

where the key parameter that is required is the average number of events in the

given interval (l). The resulting

distribution looks similar to the binomial, with the skewness being positive

but decreasing with l. Figure 6A.2 presents three Poisson

distributions, with l ranging from 1 to

10.

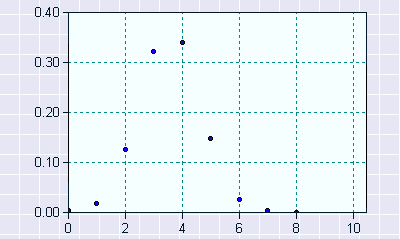

Figure

6A.2: Poisson Distribution

c.

Negative Binomial distribution: Returning again to the

coin toss example, assume that you hold the number of successes fixed at a

given number and estimate the number of tries you will have before you reach

the specified number of successes. The resulting distribution is called the

negative binomial and it very closely resembles the Poisson. In fact, the

negative binomial distribution converges on the Poisson distribution, but will

be more skewed to the right (positive values) than the Poisson distribution

with similar parameters.

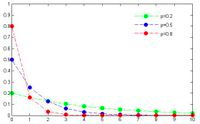

d.

Geometric distribution: Consider again the coin toss

example used to illustrate the binomial. Rather than focus on the number of

successes in n trials, assume that you were measuring the likelihood of when

the first success will occur. For instance, with a fair coin toss, there is

a 50% chance that the first success will occur at the first try, a 25% chance

that it will occur on the second try and a 12.5% chance that it will occur on

the third try. The resulting distribution is positively skewed and looks as

follows for three different probability scenarios (in figure 6A.3):

Figure

6A.3: Geometric Distribution

Note that the distribution is

steepest with high probabilities of success and flattens out as the probability

decreases. However, the distribution is always positively skewed.

e.

Hypergeometric distribution: The hypergeometric

distribution measures the probability of a specified number of successes in n

trials, without replacement, from a finite population. Since the

sampling is without replacement, the probabilities can change as a function of

previous draws. Consider, for instance, the possibility of getting four face

cards in hand of ten, over repeated draws from a pack. Since there are 16 face

cards and the total pack contains 52 cards, the probability of getting four

face cards in a hand of ten can be estimated. Figure 6A.4 provides a graph of

the hypergeometric distribution:

Figure

6A.4: Hypergeometric Distribution

Note

that the hypergeometric distribution converges on binomial distribution as the

as the population size increases.

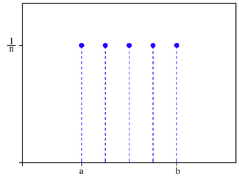

f. Discrete

uniform distribution: This is the simplest of discrete distributions and

applies when all of the outcomes have an equal probability of occurring. Figure 6A.5 presents a uniform discrete

distribution with five possible outcomes, each occurring 20% of the time:

Figure

6A.5: Discrete Uniform Distribution

The discrete uniform distribution is best reserved for

circumstances where there are multiple possible outcomes, but no information

that would allow us to expect that one outcome is more likely than the others.

With continuous data, we cannot

specify all possible outcomes, since they are too numerous to list, but we have

two choices. The first is to convert the continuous data into a discrete form

and then go through the same process that we went through for discrete

distributions of estimating probabilities. For instance, we could take a

variable such as market share and break it down into discrete blocks –

market share between 3% and 3.5%, between 3.5% and 4% and so on – and

consider the likelihood that we will fall into each block. The second is to

find a continuous distribution that best fits the data and to specify the

parameters of the distribution. The rest of the appendix will focus on how to

make these choices.

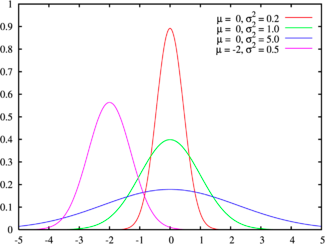

How symmetric is the data?

There are some datasets that

exhibit symmetry, i.e., the upside is mirrored by the downside. The symmetric

distribution that most practitioners have familiarity with is the normal

distribution, sown in Figure 6A.6, for a range of parameters:

Figure 6A.6: Normal Distribution

The normal distribution has several features that make it

popular. First, it can be fully characterized by just two parameters –

the mean and the standard deviation – and thus reduces estimation pain.

Second, the probability of any value occurring can be obtained simply by

knowing how many standard deviations separate the value from the mean; the probability

that a value will fall 2 standard deviations from the mean is roughly 95%. The normal distribution is best

suited for data that, at the minimum, meets the following conditions:

- There

is a strong tendency for the data to take on a central value.

- Positive

and negative deviations from this central value are equally likely

- The

frequency of the deviations falls off rapidly as we move further away from

the central value.

The last two conditions show up when we compute the

parameters of the normal distribution: the symmetry of deviations leads to zero

skewness and the low probabilities of large deviations from the central value

reveal themselves in no kurtosis.

There is a cost we pay, though,

when we use a normal distribution to characterize data that is non-normal since

the probability estimates that we obtain will be misleading and can do more

harm than good. One obvious problem is when the data is asymmetric but another potential

problem is when the probabilities of large deviations from the central value do

not drop off as precipitously as required by the normal distribution. In

statistical language, the actual distribution of the data has fatter tails than

the normal. While all of symmetric distributions in the family are like the

normal in terms of the upside mirroring the downside, they vary in terms of

shape, with some distributions having fatter tails than the normal and the others

more accentuated peaks. These

distributions are characterized as leptokurtic and you can consider two

examples. One is the logistic distribution, which has longer tails and a higher

kurtosis (1.2, as compared to 0 for the normal distribution) and the other are

Cauchy distributions, which also exhibit symmetry and higher kurtosis and are

characterized by a scale variable that determines how fat the tails are. Figure

6A.7 present a series of Cauchy distributions that exhibit the bias towards

fatter tails or more outliers than the normal distribution.

Figure 6A.7: Cauchy Distribution

Either the logistic or the Cauchy distributions can be used

if the data is symmetric but with extreme values that occur more frequently

than you would expect with a normal distribution.

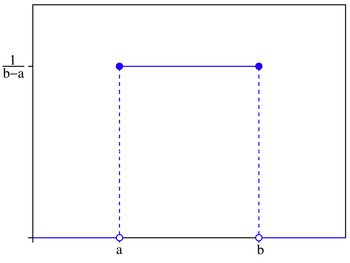

As the probabilities of extreme

values increases relative to the central value, the distribution will flatten

out. At its limit, assuming that the data stays symmetric and we put limits on

the extreme values on both sides, we end up with the uniform distribution,

shown in figure 6A.8:

Figure 6A.8: Uniform Distribution

When is it appropriate to assume a uniform distribution for

a variable? One possible scenario is when you have a measure of the highest and

lowest values that a data item can take but no real information about where

within this range the value may fall. In other words, any value within that

range is just as likely as any other value.

Most data does not exhibit symmetry

and instead skews towards either very large positive or very large negative

values. If the data is positively skewed, one common choice is the lognormal

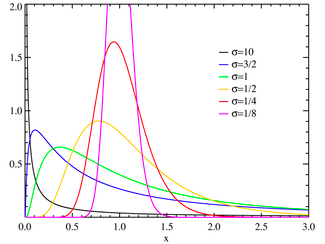

distribution, which is typically characterized by three parameters: a shape (s or sigma),

a scale (m or median) and a shift

parameter (![]() ). When m=0 and

). When m=0 and ![]() =1, you have the standard lognormal distribution and

when

=1, you have the standard lognormal distribution and

when ![]() =0, the distribution requires only scale and sigma

parameters. As the sigma rises, the peak of the distribution shifts to the left

and the skewness in the distribution increases. Figure 6A.9 graphs lognormal

distributions for a range of parameters:

=0, the distribution requires only scale and sigma

parameters. As the sigma rises, the peak of the distribution shifts to the left

and the skewness in the distribution increases. Figure 6A.9 graphs lognormal

distributions for a range of parameters:

Figure 6A.9: Lognormal distribution

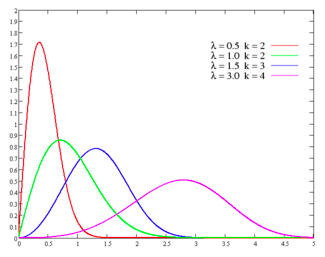

The Gamma and Weibull distributions are two distributions

that are closely related to the lognormal distribution; like the lognormal

distribution, changing the parameter levels (shape, shift and scale) can cause

the distributions to change shape and become more or less skewed. In all of

these functions, increasing the shape parameter will push the distribution

towards the left. In fact, at high values of sigma, the left tail disappears entirely

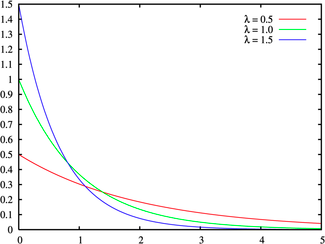

and the outliers are all positive. In this form, these distributions all

resemble the exponential, characterized by a location (m) and scale parameter

(b), as is clear from figure 6A.10.

Figure

6A.10: Weibull Distribution

The question of which of these distributions will best fit

the data will depend in large part on how severe the asymmetry in the data is. For

moderate positive skewness, where there are both positive and negative

outliers, but the former and larger and more common, the standard lognormal

distribution will usually suffice. As the skewness becomes more severe, you may

need to shift to a three-parameter lognormal distribution or a Weibull

distribution, and modify the shape parameter till it fits the data. At the

extreme, if there are no negative outliers and the only positive outliers in

the data, you should consider the exponential function, shown in Figure 6a.11:

Figure

6A.11: Exponential Distribution

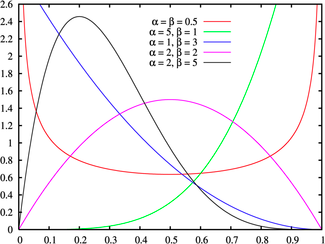

If

the data exhibits negative slewness, the choices of distributions are more

limited. One possibility is the Beta distribution, which has two shape

parameters (p and q) and upper and lower bounds on the data (a and b). Altering

these parameters can yield distributions that exhibit either positive or

negative skewness, as shown in figure 6A.12:

Figure

6A.12: Beta Distribution

Another is an extreme value distribution, which can also be

altered to generate both positive and negative skewness, depending upon whether

the extreme outcomes are the maximum (positive) or minimum (negative) values

(see Figure 6A.13)

Figure 6A.13:

Extreme Value Distributions

Are there upper or lower limits on data values?

There

are often natural limits on the values that data can take on. As we noted

earlier, the revenues and the market value of a firm cannot be negative and the

profit margin cannot exceed 100%. Using a distribution that does not constrain

the values to these limits can create problems. For instance, using a normal

distribution to describe profit margins can sometimes result in profit margins

that exceed 100%, since the distribution has no limits on either the downside

or the upside.

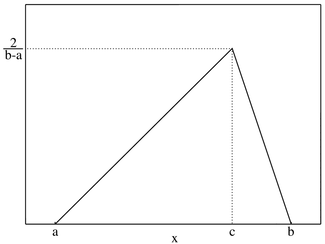

When

data is constrained, the questions that needs to be answered are whether the

constraints apply on one side of the distribution or both, and if so, what the

limits on values are. Once these questions have been answered, there are two

choices. One is to find a continuous distribution that conforms to these

constraints. For instance, the lognormal distribution can be used to model

data, such as revenues and stock prices that are constrained to be never less

than zero. For data that have both upper and lower limits, you could use the

uniform distribution, if the probabilities of the outcomes are even across

outcomes or a triangular distribution (if the data is clustered around a

central value). Figure 6A.14 presents a triangular distribution:

Figure

6A.14: Triangular Distribution

An alternative approach is to use a continuous distribution that

normally allows data to take on any value and to put upper and lower limits on

the values that the data can assume. Note that the cost of putting these

constrains is small in distributions like the normal where the probabilities of

extreme values is very small, but increases as the distribution exhibits fatter

tails.

How likely are you to see extreme values of data, relative to the middle

values?

As

we noted in the earlier section, a key consideration in what distribution to

use to describe the data is the likelihood of extreme values for the data,

relative to the middle value. In the case of the normal distribution, this

likelihood is small and it increases as you move to the logistic and Cauchy

distributions. While it may often be more realistic to use the latter to

describe real world data, the benefits of a better distribution fit have to be

weighed off against the ease with which parameters can be estimated from the

normal distribution. Consequently, it may make sense to stay with the normal

distribution for symmetric data, unless the likelihood of extreme values

increases above a threshold.

The

same considerations apply for skewed distributions, though the concern will

generally be more acute for the skewed side of the distribution. In other

words, with positively skewed distribution, the question of which distribution

to use will depend upon how much more likely large positive values are than

large negative values, with the fit ranging from the lognormal to the

exponential.

In

summary, the question of which distribution best fits data cannot be answered

without looking at whether the data is discrete or continuous, symmetric or

asymmetric and where the outliers lie. Figure 6A.15 summarizes the choices in a

chart.

Tests for Fit

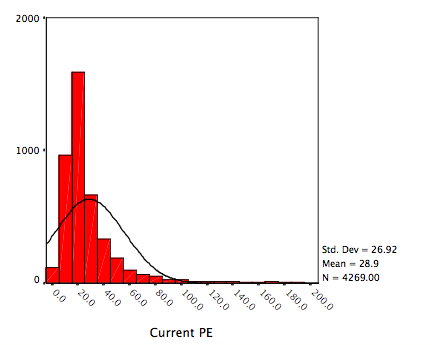

The

simplest test for distributional fit is visual with a comparison of the

histogram of the actual data to the fitted distribution. Consider figure 6A.16,

where we report the distribution of current price earnings ratios for US stocks

in early 2007, with a normal distribution superimposed on it.

Figure 6A.16:

Current PE Ratios for US Stocks – January 2007

The distributions are so clearly divergent that the normal

distribution assumption does not hold up.

A

slightly more sophisticated test is to compute the moments of the actual data

distribution – the mean, the standard deviation, skewness and kurtosis

– and to examine them for fit to the chosen distribution. With the

price-earnings data above, for instance, the moments of the distribution and

key statistics are summarized in

table 6A.1:

Table 6A.1: Current

PE Ratio for US stocks – Key Statistics

|

|

Current

PE |

Normal

Distribution |

|

|||

|

Mean |

28.947 |

|

|

|||

|

Median |

20.952 |

Median

= Mean |

|

|||

|

Standard

deviation |

26.924 |

|

|

|||

|

Skewness |

3.106 |

0 |

|

|||

|

Kurtosis |

11.936 |

0 |

|

|||

|

|

|

||||

|

|

|

||||

|

|

|

||||

|

|

|

||||

|

|

|

||||

|

|

|

||||

|

|

|

||||

|

|

|

||||

|

|

|

||||

|

|

|

||||

|

|

|

||||

|

|

|

||||

|

|

|

||||

|

|

|

||||

|

||||||

Since the normal distribution has no skewness

and zero kurtosis, we can easily reject the hypothesis that price

earnings ratios are normally distributed.

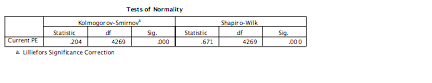

The typical tests for

goodness of fit compare the actual distribution function of the

data with the cumulative distribution function of the

distribution that is being used to characterize the data, to

either accept the hypothesis that the chosen distribution fits

the data or to reject it. Not surprisingly, given its constant

use, there are more tests for normality than for any other

distribution. The Kolmogorov-Smirnov test is one of the oldest tests

of fit for distributions[2],

dating back to 1967. Improved versions of the tests include the

Shapiro-Wilk and Anderson-Darling tests. Applying these tests to

the current PE ratio yields the unsurprising result that the

hypothesis that current PE ratios are drawn from a normal

distribution is roundly rejected:

Tests of Normality

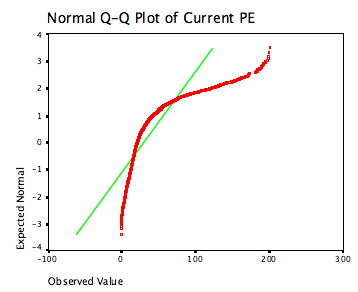

There are graphical tests of normality,

where probability plots can be used to assess the hypothesis that

the data is drawn from a normal distribution. Figure 6A.17

illustrates this, using current PE ratios as the data set.

|

|

|

|

|

Given that the normal distribution is one of

easiest to work with, it is useful to begin by testing data

for non-normality to see if you can get away with using the normal

distribution. If not, you can extend your search to other and

more complex distributions.

Conclusion

Raw

data is almost never as well behaved as we would like it to

be. Consequently, fitting a statistical distribution to data

is part art and part science, requiring compromises along the

way. The key to good data analysis is maintaining a balance

between getting a good distributional fit and preserving ease

of estimation, keeping in mind that the ultimate objective is

that the analysis should lead to better decision. In

particular, you may decide to settle for a distribution that

less completely fits the data over one that more completely

fits it, simply because estimating the parameters may be

easier to do with the former. This may explain the

overwhelming dependence on the normal distribution in

practice, notwithstanding the fact that most data do not meet

the criteria needed for the distribution to fit.

Figure 6A.15:

Distributional Choices