Fall from Grace:

Deutsche Bank, a Greek Tragedy?

This may be a stereotype, but the Germans are a precise people and while that precision often gets in the way of more creative pursuits (like cooking and valuation), it lends itself well to engineering and banking. For decades until the introduction of the Euro and the creation of the European Central Bank, there was no central bank in the world that matched the Bundesbank for solidity and reliability. Thus, investors and regulators around the world, I am sure, are looking at the travails of Deutsche Bank in the last few months and wondering how the world got turned upside down, that a bank that represented stability and order could melt down like a US investment bank or a lightly capitalized Italian entity.

The Journey to Hell: Retracing the steps

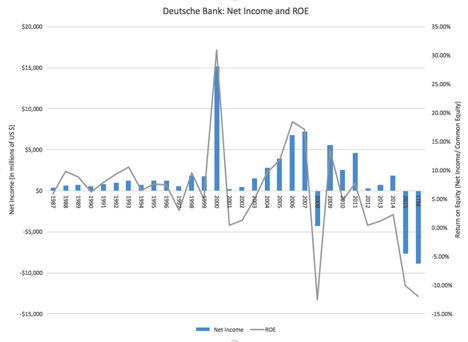

There are others who have told the story about how Deutsche Bank got into the troubles it is in, much more creatively and fully than I will be able to do so. Consequently, I will stick with the numbers and start by tracing Deutsche Bank"s net income over the last 28 years, in conjunction with the return on equity generated each year.

Like almost every bank on earth, the crisis in 2008 had a devastating impact on earnings at Deutsche but it seemed to be on a recovery path in 2009, before it relapsed. Some of its problems reflect Deutsche"s well chronicled pain in investment banking, some come from its exposure to the EU problem zone (Greece, Spain, Portugal) and some from slow growth in the European economy. Whatever the reasons, in 2014 and 2015, Deutsche reported cumulative losses of close to $16 billion, leading to a management change, with a promise that things would turn around under new management.

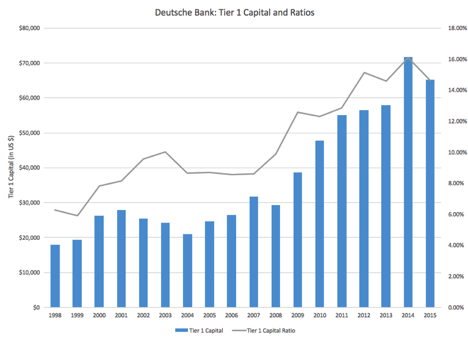

The other area where this crisis unfolded was in Deutsche"s regulatory capital, as it plummeted from a bank that was viewed as safer than most to riskier than most. This picture is best seen in the graph below of regulatory capital (Tier 1 Capital) from 1998 to 2015, with the ratio of the Tier 1 capital to risk adjusted assets each year super imposed on the graph.

The ratio of regulatory capital to risk adjusted assets at the end of 2015 was 14.65%, lower than it was in 2014, but not reaching crisis proportions and much higher than capital ratios in the pre-2008 time period. The tipping point for the crisis came from the decision by the US Department of Justice to demand that Deutsche Bank pay a fine of $14 billion for transgressions related to the pricing of mortgage backed securities in the housing crisis.

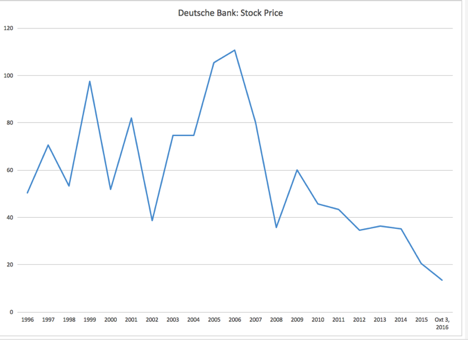

As the stories spiraled in the last few weeks, Deutsche Bank found itself in crisis, since the perception that a bank is in trouble often precipitates more trouble, as rumors replace facts and regulators panic. The market has, not surprisingly, reacted to these stories by marking the stock down, as seen in this graph:

At close of trading on October 4, 2016, the stock was trading at $13.33 as share, yielding a market capitalization of $17.99 billion, down more than 80% from its pre-2008 levels and 50% from 2012 levels.

Too hot for contrarian investors?

When a stock is down more than 50% over a year, as Deutsche is this year, it is often too hot to resist for many contrarian investors, but knee jerk contrarian investing, i.e., investing in a stock just because it has dropped a lot, is a dangerous strategy. While it is true that Deutsche Banks has lost more than $20 billion of its market capitalization in the last five years, it is also true that the fundamentals for the company have also deteriorated, in the form of lower earnings and regulatory capital shortfalls. To make an assessment of whether Deutsche is now “cheap”, I have no choice but to revalue the company with the new realities built in, to see if the market has over reacted, under reacted or reacted correctly to the news.

a.

Profitability

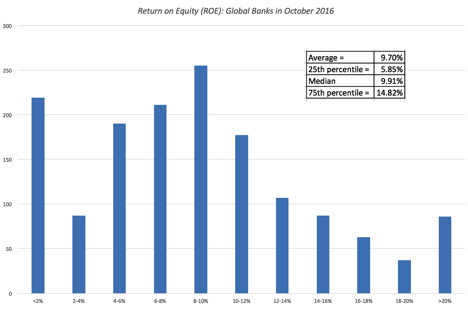

As you can see from the graph of Deutsche"s profits and return on equity, the last twelve months have delivered blow after blow to the company, but that drop has been a long time coming. The bank has been having trouble finding a pathway to make sustainable profits, as it is torn between the desire of some at the bank to return to its commercial banking roots and the push by others to explore the more profitable aspects of trading and investment banking. The questions in valuation are not only about whether profits will bounce back but also what they will bounce back to. To make this judgment, I computed the returns on equity of all publicly traded banks globally and the distribution is below:

I will assume that given the headwinds that Deutsche faces, it will not be able to improve its returns on equity to the industry median or even its own cost of equity in the near term. I will target a return on equity of 5.85%, at the 25th percentile of all banks, as Deutsche"s return on equity in year 5, and assume that the bank will be able to claw back to earning its cost of equity of 9.44% (see risk section below) in year 10. The estimated return on equity, with my estimates of common equity each year (see section of regulatory capital) deliver the following projected net income numbers.

|

Year |

Common Equity |

ROE |

Expected Net Income |

|

Base |

$74,609 |

-11.86% |

$(8,851) |

|

1 |

$81,161 |

-8.32% |

$(6,753) |

|

2 |

$82,754 |

-4.78% |

$(3,954) |

|

3 |

$84,372 |

-1.24% |

$(1,042) |

|

4 |

$86,017 |

2.31% |

$1,985 |

|

5 |

$87,688 |

5.85% |

$5,130 |

|

6 |

$89,386 |

6.57% |

$5,871 |

|

7 |

$91,111 |

7.29% |

$6,638 |

|

8 |

$92,864 |

8.00% |

$7,433 |

|

9 |

$94,644 |

8.72% |

$8,255 |

|

10 |

$96,453 |

9.44% |

$9,105 |

|

Terminal

Year |

$97,427 |

9.44% |

$9,197 |

b. Regulatory Capital

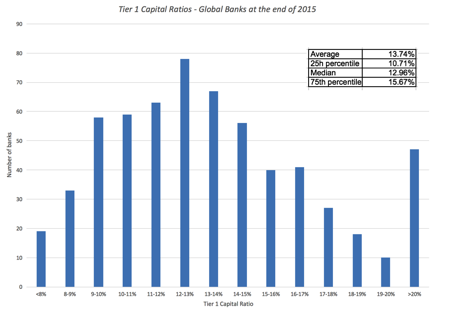

Deutsche Bank"s has seen a drop in it Tier 1 capital ratios over time but the Tier 1 capital of 14.65% ($65.28 billion) now faces the possibility of being further reduced as Deutsche Bank will have to draw on it to pay the US DOJ government fine. While the DOJ has asserted a fine of $14 billion, Deutsche (like other banks that have been similarly) will negotiate to reduce it to a lower number and there seems to be some substance to the rumor that it could counter with a value as low as $6 billion. In making my assessment of current regulatory capital, I have assumed a total capital drop of $ 10 billion, leaving me with and adjusted regulatory capital of $55.28 billion and a Tier 1 capital ratio of 12.41%. Over the next few years, the bank will come under pressure from both regulators and investor to increase its capitalization, but to what level. To make that judgment, I look at Tier 1 capital ratios across all publicly traded banks globally:

I will assume that Deutsche Bank will try to increase its regulatory capital ratio to the average (13.74%) by next year and then push on towards the 75th percentile value of 15.67%. As the capital ratio grows, the firm will have to increase regulatory capital over the next few years and that can be seen in the table below:

|

Regulatory Capital |

||||||

|

Year |

Net

Income |

Risk-Adjusted

Assets |

Tier

1 Capital/ Risk Adjusted Assets |

Tier

1 Capital |

Change

in Tier 1 Capital |

FCFE |

|

Base |

$(8,851) |

$445,570 |

12.41% |

$55,282 |

|

|

|

1 |

$(6,753) |

$450,026 |

13.74% |

$61,834 |

$6,552 |

$(13,305) |

|

2 |

$(3,954) |

$454,526 |

13.95% |

$63,427 |

$1,593 |

$(5,547) |

|

3 |

$(1,042) |

$459,071 |

14.17% |

$65,045 |

$1,619 |

$(2,661) |

|

4 |

$1,985 |

$463,662 |

14.38% |

$66,690 |

$1,645 |

$340 |

|

5 |

$5,130 |

$468,299 |

14.60% |

$68,361 |

$1,671 |

$3,459 |

|

6 |

$5,871 |

$472,982 |

14.81% |

$70,059 |

$1,698 |

$4,173 |

|

7 |

$6,638 |

$477,711 |

15.03% |

$71,784 |

$1,725 |

$4,913 |

|

8 |

$7,433 |

$482,488 |

15.24% |

$73,537 |

$1,753 |

$5,680 |

|

9 |

$8,255 |

$487,313 |

15.46% |

$75,317 |

$1,780 |

$6,474 |

|

10 |

$9,105 |

$492,186 |

15.67% |

$77,126 |

$1,809 |

$7,296 |

|

Terminal Year |

$9,197 |

$497,108 |

15.67% |

$77,897 |

$771 |

$8,426 |

By using these negative free cash flows to equity in my valuation, I am in effect reducing my value per share today for future dilution, a point that I made in a different context when talking about cash burn.

Risk

Rather than follow the well-trodden path of using risk free rates, betas and risk premiums, I am going to adopt a short cut that you can think of as a model-agnostic way of computing the cost of equity for a sector. To illustrate the process, consider the median bank in October 2016, trading at a price to book ratio of 1.06 and generating a return on equity of 9.91%. Since the median bank is likely to be mature, I will use a stable growth model to derive its price to book ratio:

PBV = ![]()

Implied Cost of

Equity = ![]()

Plugging in the median bank"s numbers into this equation and using a nominal growth rate set equal to the risk free rate (in US dollars), I estimate a cost of equity for the median bank to be 9.44% in 2016.

Implied Cost of

Equity for median bank = ![]()

Using the same approach, I arrive at estimates of 7.76% for the banks that are at the 25th percentile of risk and 10.20% for banks at the 75th percentile.

In valuing Deutsche Bank, I will start the valuation by assuming that the bank is at the 75th percentile of all banks in terms of risk and give it a cost of equity of 10.20%. As the bank finds its legs on profitability and improves its regulatory capital levels, I will assume that the cost of equity moves to the median of 9.44%.

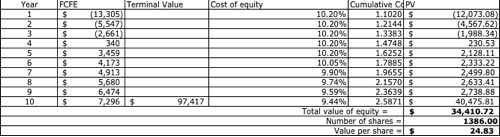

The Valuation

Starting with net income from part a, adjusting for reinvestment in the form of regulatory capital in part b and adjusting for risk in part c, we obtain the following table of numbers for Deutsche Bank.

Note that the big number as the terminal value in year 10 reflects the expectation that Deutsche will grow at the inflation rate (1% in US dollar terms) in perpetuity while earning its cost of equity. Neither is a daring assumption and the terminal value, while big, should be a conservative estimate. The discounted present value of the cash flows is $34.41 billion, which when divided by the number of shares (1,386 million) yields a value of $24.83 per share. There is one final adjustment that I will make and it reflects the special peril that banks face, when in crisis mode. There is the possibility that the perception that the bank is in trouble could make it impossible to function normally and that the government will have to step in to bail it out (since the option of letting it default is not on the table). I may be over optimistic but I attach only a 10% chance to this occurring and assume that my equity will be completely wiped out, if it occurs. My adjusted value is therefore:

Expected Value per share = $24.83(.9) + $0.00 (.1) = $22.34

That required a whole pile of assumptions, but piled on top of one another, the value per share that I get for Deutsche Bank is $22.34. To illustrate how much the regulatory capital shortfall (and the resulting equity issues/dilution) and overhang of a catastrophic loss affect this value, I have deconstructed the value per share into its constituent effects:

|

Unadjusted Equity Value = |

$38.27 |

|

- Dilution Effect from new equity

issues |

$(13.44) |

|

- Expected cost of equity wipeout |

$(2.48) |

|

Value of equity per share today = |

$22.34 |

Note that the dilution effect, captured by taking the present value of the negative FCFE in the first three years, reduces the value of equity by 35.12% and the possibility of a bailout lowers the value another 6.5%.

Action

I have always contended that valuation accompanied by inaction is pointless, and to stay true to my contention, I will have to make a decision here. At the current stock price of $13.33 (at close of trading on October 4), the stock looks undervalued by about 40%, given my estimated value. Am I uncertain? You bet, but waiting for the uncertainty to resolve itself is not a winning strategy because one of two things will happen. Either the uncertainty will resolve itself and everyone (including the market) will have clarity on what Deutsche is worth, and the price will adjust, or the uncertainty will not resolve itself in the near future and I will sit on the side lines. For those of you who have been reading my blog over time, you know that I have played this game before, with mixed results. My bets on JP Morgan (after the London Whale) and Volkswagen (after the emissions scandal) paid off well but my bet on Valeant (after its multiple scandals) has lost me 15% so far, but I am still holding. While I hope that my Deutsche Bank investment does better, there is a very real chance of more bad news, since banks in crisis seem to attract negative attention!