Henkel: A Solid (Stolid) German Corporate

Background

Henkel is a German company, founded in 1876, and now operating in three businesses: industrial adhesives, cosmetics/toiletries and household products. It has a global presence and owns several well-known brand names, including Persil, the very first self-activated laundry detergent.

The Financial Setting

The word that repeatedly comes to mind when valuing Henkel is stolid, as in boring. The company takes investments that make it solid profits, rather than invest in projects with more optionality, but does not overreach by going into new markets (either as businesses or in new geographies. The company has generated profits for much of the last decade but its revenues have stagnated for the last year. In keeping with its conservative investment policy, the company also borrows very little (with its cash balance exceeding its normal debt.

The Valuation

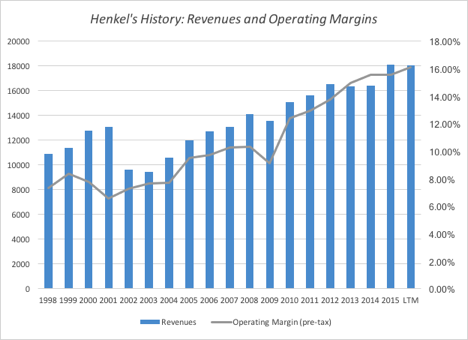

As in most valuations, the bulk of the value in this valuation comes from the terminal value; to be precise, in the Henkel valuation, about 56% of the value comes from the terminal value. In fact, this statistic (% of value from terminal value) is less an indicator or terminal value reliability and more of where the company is in its life cycle. To provide a sense of how Henkel has grown over the last two decades, I show revenues and operating margins over time, in the graph below:

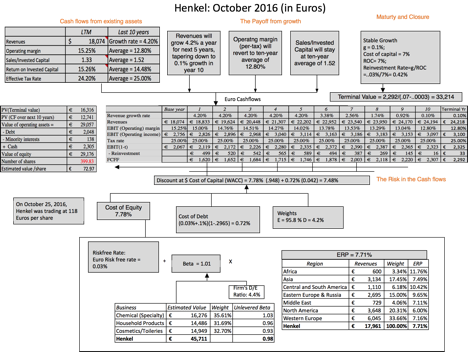

In valuing Henkel, I made the

following assumptions:

1. The revenues will grow 4.2% a year, matching the compounded average growth

rate in revenues over the last decade.

2. The operating margins will stay high initially, but will drop from LTM levels of 15.25% to the average value of 12.80% (from the last 10 years).

3. To estimate the reinvestment, I will assume that Henkel will generate $1.52 in revenues for every dollar of new investment, and use this statistic in conjunction with revenue growth to estimate the reinvestment each year.

With these assumptions, I arrive at a value per share of $72,97, well below the stock price of 118 Euros, on October 25, 2016 (the data of my Henkel valuation).

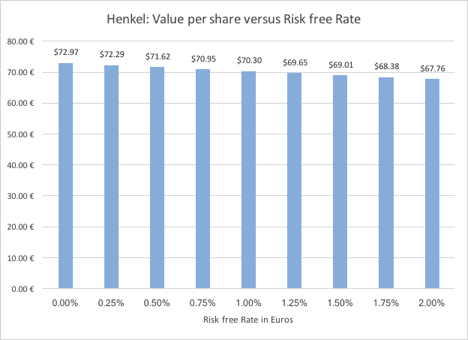

The Risk free Rate Effect

In valuing Henkel, I used the German Euro bond rate of 0.03% as my risk free rate in Euros. If you are wondering how much this near-zero risk free rate is affecting value, the answer is not much since as the risk free rate changes, I also change the growth rate in perpetuity. The value per share for Henkel changes little as I change the risk free rate from 0.03% to 2%: