The Levi Strauss IPO

Background

Not all companies that go public are money-losing machines, tech companies in search of a business model. Levi Strauss is a clear counter example. At the time of its public offering, Levi Strauss had already established itself as an American business and cultural icon, with one of thr most recognizable brand names in the world and a working business model. In the trailing 12 months, leading into the IPO, Levi reported a healthy operating margin of close to 10% on revenues of $5.5 billion. The company’s prospectus can be found here:

https://www.sec.gov/Archives/edgar/data/94845/000119312519037135/d632158ds1.htm

The prospectus has the standard (useless) risk disclosure requirements but it contains everything you need to value the company for its IPO.

My Story & Valuation

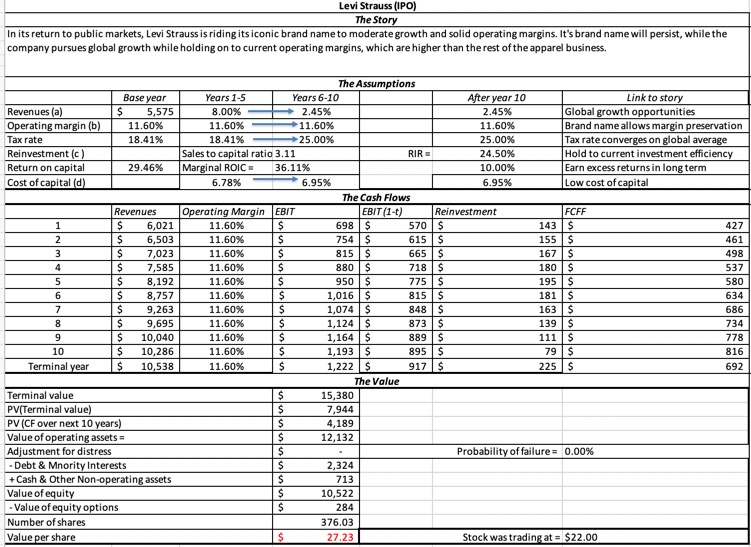

My story is a simple one and it is built on the presumption that the core of the company is its brand name, one that has endured for almost 150 years and is likely to have more staying power than the brand names of recent decades. I see a company with modest ambitions for growth, with much of its coming either geographically from its main products (jeans) or from apparel additions to its line and the capacity to sustain its operating margins, which are slightly higher than industry averages.

My value per share of $27 is based upon all outstanding shares (in both classes) as well as options and RSUs outstanding.

My concerns

In additional to all the standard concerns that brand names across the world are under assault and that they may not travel well geographically, the biggest concern I have is that Levi Strauss seems to be following the route that other newly listed tech companies have followed, with two classes of shares. The Class A shares that are being offered in the IPO have only one voting right apiece, whereas the Class B shares held by the incumbent investors/owners have ten voting rights. Without the veneer of founder worship that many tech companies can offer, the only rationale for Levi Strauss going with this two-class offering, in my view, is that they can get away with it. It worries me, as a potential investor, that if the existing management decides to take a willfully destructive path, I will have little recourse other than selling my shares.