A Valuation of

easyJet

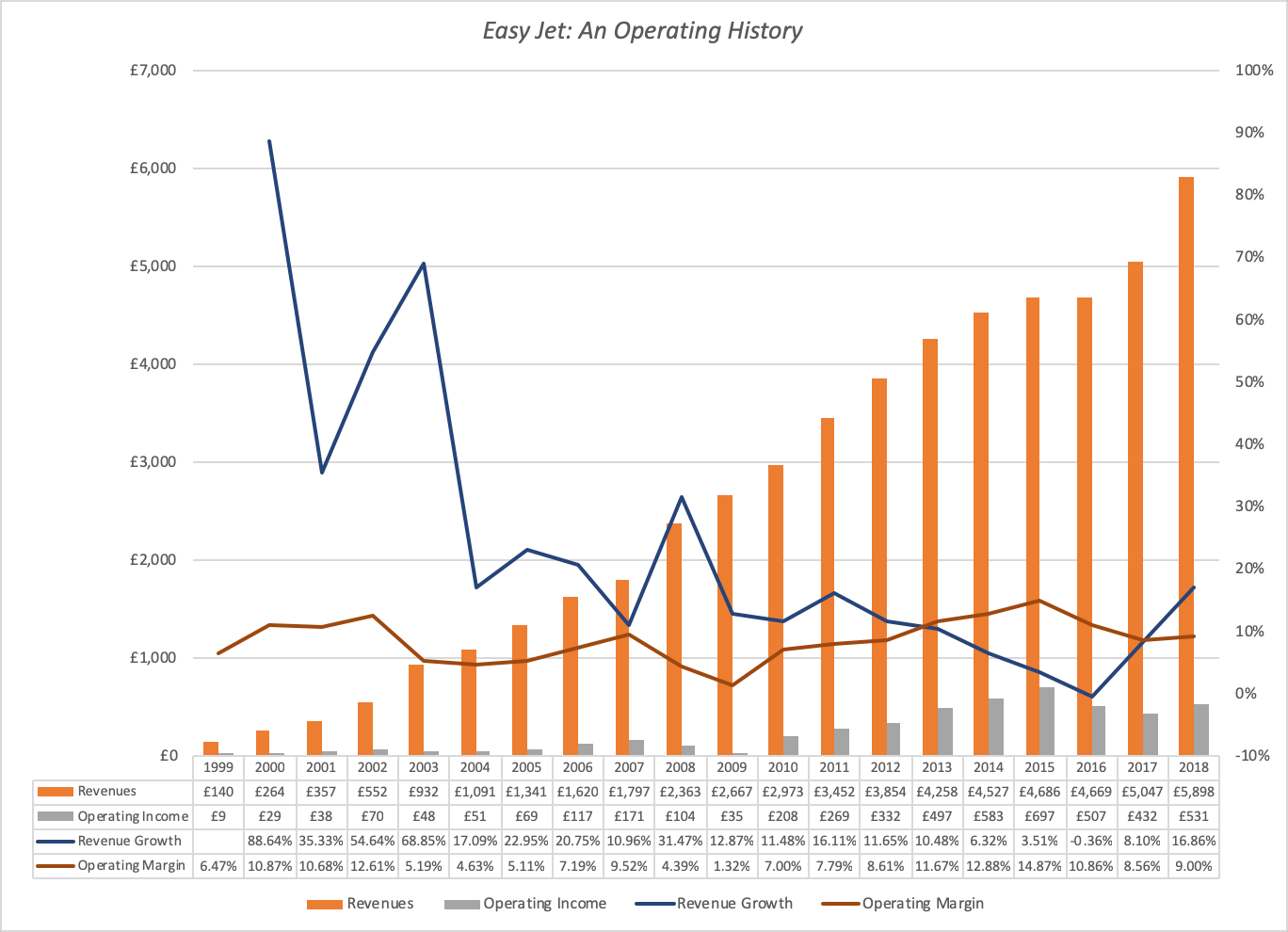

The Back Story: easyJet is a UK based discount

airline. In the last two decades, the airline has managed to grow while being

profitable, an uncommon combination in this sector.

While easyJet continues to grow, its growth has declined in recent years, though 2018 represented a throwback in time.

The Front Story: easyJet has made a transition from high growth, low margin airline to a moderate growth, solid margin airline. With or without Brexit, revenue growth will continue to slow as easyJet's European market gets saturated, and competition will continue to eat away at margins. With a much lower leverage than its peer group, easyJet will continue to benefit from a low cost of capital and will not be exposed to distress, while reinvesting in new capacity as efficiently as it has been doing for the last decade.

The Suspense: While easyJet has planned for Brexit by creating a Austrian base that is can use for its EU operations and keeping EU shareholderd at 50%+, a hard Brexit can have consequences for the company, creating up front restructuring costs, followed by lower revenue growth and margins. There are three scenarios that I consider:

|

|

No Deal Brexit |

Bad Deal Brexit |

Soft or No Brexit |

|

Restructuring cost (up front) |

£500 million |

£300 million |

$0 |

|

Revenue growth |

3.00% |

5.00% |

5.00% |

|

Operating Margin |

6.00% |

7.00% |

8.00% |

|

Sales to Capital Ratio |

1.73 |

1.73 |

1.73 |

The Valuations

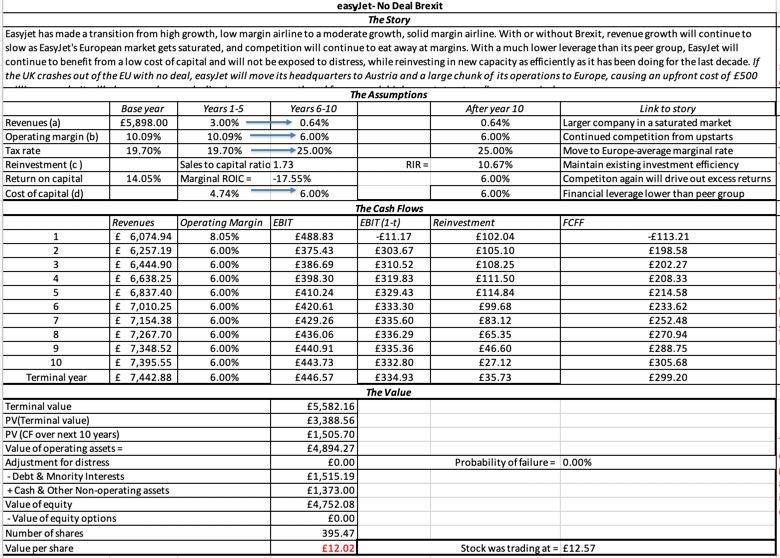

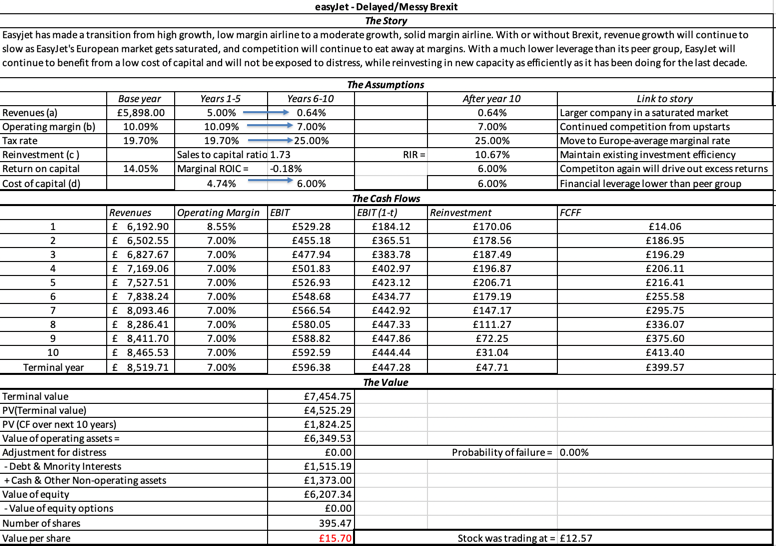

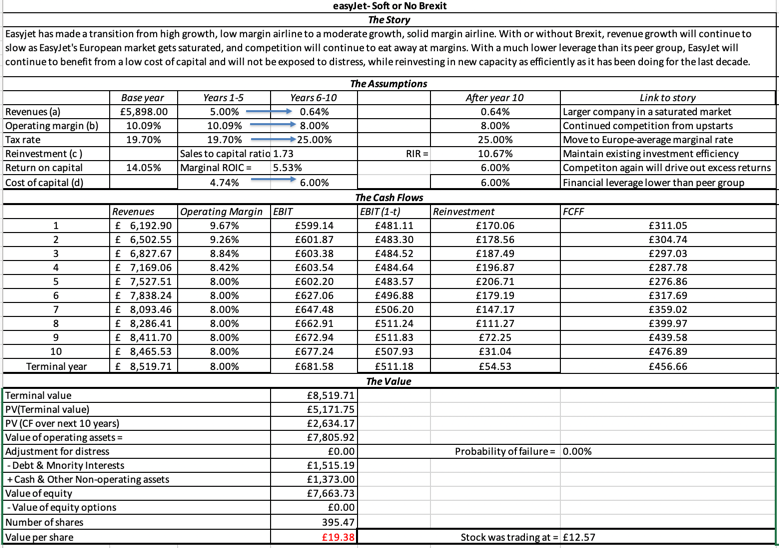

I valued easyJet under three scenarios, a no deal Brexit where the UK crashes out of the EU with no deal, a delayed and messy Brexit where the uncertainty and the exit occurs over a longer period (2 years?) and a soft Brexit (where the UK finds a smooth exit) or no Brexit.

|

|

No Deal Brexit |

Delayed & Messy Brexit |

Soft or No Brexit |

|

Probability |

25% |

50% |

25% |

|

Value Per Share |

£12.02 |

£15.70 |

£19.38 |

Expected Value per share = .25 (£12.02) + .50 (£15.70) + .25 (£19.38) = £15.70

Current Price per share (3/25/19) = £12.57

Stock is under valued by 19.9%.