Valuation of the Week #5: Netflix and the Weight of Commitments

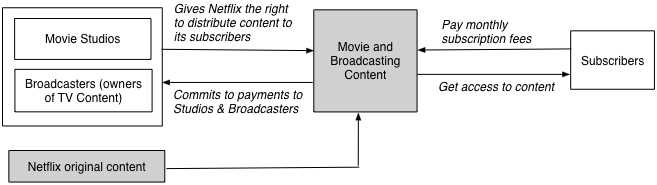

Netflix has been a star performer on the market in the last few years and its market capitalization today of $47 billion reflects that success. It is not difficult to see why investors are enamored with the company. As technology has made streaming both viable and convenient, Netflix has become one of the primary distribution mechanisms for movies and TV shows to get to consumers. Its basic business model is captured below:

The model initially rested entirely on acquiring the content from movie studios and TV show producers, with long term contractual commitments assocated with these agreements. In recent years, though, Netflix has started producing its own content, partly to get some freedom from having to enter into expensive commitments, and partly to get subscribers to be get attached to the content (and keep paying monthly fees). While much of the content is delivered in streaming form now, a portion of the subscription base still gets DVDs mailed to them with their content.

The narrative that drives its value is a simple one. As streaming online becomes the central mechanism for delivering entertainment content, the market is assuming that Netflix will continue to grow, and as it grows, it will be able to generate higher margins. Whether this comes from economies of scale (since the cost of acquiring the content is fixed) or from higher prices for consumers, those higher margins, in conjunction, with higher revenues will make Netflix a more valuable company. The competitive advantages Netflix has solidifies, if it acquires proprietary access to the content, and shuts competition out.

Rather than make this an assessment of whether Netflix is cheap or expensive, I will try to isolate the effect of one characteristic of Netflix's business model, the large contractual commitments that stem from their agreements with movie and TV broadcasting companies, to carry their content. That cost, right now, is considered an operating expense, but the company has billions of dollars of future commitments, as evidenced in this table from their 2014 annual report:

| Year | Operating Lease Commitments |

Broadcasting Commitments |

| 1 | $35.50 |

$3,968.04 |

| 2 | $37.08 |

$2,382.34 |

| 3 | $27.70 |

$2,382.34 |

| 4 | $19.80 |

$585.48 |

| 5 | $14.92 |

$585.48 |

| Beyond year 5 | $76.10 |

$44.30 |

The current accounting for these commitments is hazy and reflects the typical accounting choice of splitting the loaf. Some of the costs are capitalized and some are expensed. Netflix reflects the capitalized portion both as a content asset and a content liability, but it seems to be of the magnitude of about $3 billion; these choices, in turn, drive the expensing of content, which in the most recent twelve months worked out to about $4 billion. Rather than take the accounting judgment as the right one, I decided to capitalize the broadcasting commitments, just as I would lease commitments, and come up with my own estimates. At Netflix's current rating (B1 with Moody's and B+ with S&P), the pre-tax cost of debt is 6%, and using this pre-tax cost of debt results in a present value of lease/broadcasting commitments of $8.97 billion. The lease conversion also changes the operating income and invested capital computations for the company.

At this stage, you are right to be skeptical. What if the market is taking the accounting numbers as given, and valuing the company accordingly? What effect, if any, would be the effect of converting commitments to debt have on value? The questions can be answered in two steps:

- Value Netflix without treating the broadcasting (or lease) commitments as debt commitments. Estimate the revenue growth rate that Netflix would need to deliver to sustain its current market capitalization. (To make this computation, you have to hold all else constant, including cost of capital and a target pre-tax operating margin, which I set at 20% in year 10, roughly the average for the US entertainment business. I also assumed that the company would maintain its existing sales to invested capital of 3.74, though the invested capital does not include capitalized content). The breakeven revenues that I would need to get to the current market value is 34.23%.

- Value Netflix, with the broadcasting (and the very small lease) commitments as debt. The changes it introduces in the key inputs into the valuation are substantial and are summarized in the table below. The value of Netflix shares, with the commitments treated as debt, drops precipitously to about $20 per share, if the company's investment in content continues to rise with its subscriber base, i.e., it maintains its new recalculated sales to invested capital ratio of 0.58. If the company is able to capture economies of scale and add subscribers, without having to add substantially to content, the game changes and the value per share rises. In fact, if you assume that Netflix will be able to have the same sales to invested capital as the typical company in the entertainment sector, the value per share hits about $101/share.The reasons are simple and can be captured in key inputs and how they change as a result of the commitment conversion to debt:

| Commitments not treated as Debt | Commitments treated as Debt | Comment | |

| Value of Operating Assets (Intrinsic Enterprise value) | $48,447 million | $53,516 million |

Firm has more value in operating assets |

| Debt Outstanding | $2400 million | $11,367 million |

Firm owes more than balance sheet indicates |

| Operating Income (Pre-tax) | $348 million | $2,541 million |

Firm is much more profitable than it looks |

| Invested Capital | $1,635 million | $10,602 million |

But has had to invest more to get to these profits |

| Pre-tax operating margin in the most recent year = | 5.69% | 41.57% |

NFXL keeps more of its revenues as profits |

| Sales to Invested Capital | 3.74 | 0.58 |

But Invests far more to get these revenues |

| Return on invested capital in most recent year= | 14.06% | 15.85% |

Generating a lower return on invested capital |

Bottom line: You get a different picture of Netflix as a company, when you capitalize broadcasting lease commitments. The bad news is that it has cost Netflix more to grow than has been hitherto believed. The good news is that Netflix is very profitable on its marginal dollar of revenue. Thus, if it is able to grow its subscriber base without making significant additions to content, it will see its operating income rise quickly and its sales to invested capital rise; that is partly why I chose to use the industry average sales to invested capital ratio in the second valuation. The danger to investors is if the cost of acquiring content rises with the subscriber base, i.e., the sales to invested captial ratio stays at 0.58. If that happens, the market is over valuing Netflix.

Action: I like Netflix as a company and Reed Hastings as its CEO, but at its current price, it is too richly priced for me. Not only does it have to grow revenues as a significant pace (increasing them nine-fold over the next decade), but it has to do so while improving profit margins and keeping its content acquisition costs low. That is possible and even plausble, but on the probability count, this is asking for a lot.

Data Attachments

Spreadsheets