Winning Stock Picker's Losing Fund

Value Line Research Service

Has Beaten Market Handily,

But Its Own Fund Suffered

By JEFF D. OPDYKE and JANE J. KIM

Staff Reporters of THE WALL STREET JOURNAL

September 16, 2004; Page D1

Value Line Investment Survey is one of the top independent stock-research

services, touted for its remarkable record of identifying winners. Warren Buffett

and Peter Lynch, among other professional investors, laud its system.

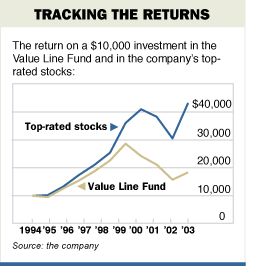

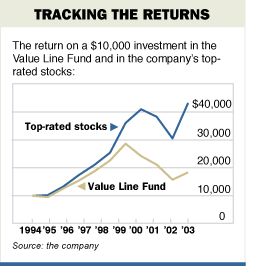

But the company also runs a mutual fund, and in one of Wall Street's odder

paradoxes, it has performed terribly. Investors following the Value Line approach

to buying and selling stocks would have racked up cumulative gains of nearly

76% over the five years ended in December, according to the investment-research

firm. That period includes the worst bear market in a generation

By contrast, the mutual fund -- one of the nation's oldest, having started

in 1950 -- lost a cumulative 19% over the same five years. The discrepancy

has a lot to do with the fact that the Value Line fund, despite its name, hasn't

rigorously followed the weekly investment advice printed by its parent Value

Line Publishing Inc. It also highlights the penalty investors often face when

their mutual fund churns its management team and plays around with its investing

style. In fact, late last night the person running the fund, Jack Dempsey,

said that as of yesterday he had been reassigned and no longer had responsibility

for managing the assets. Value Line couldn't be reached to comment.

By contrast, the mutual fund -- one of the nation's oldest, having started

in 1950 -- lost a cumulative 19% over the same five years. The discrepancy

has a lot to do with the fact that the Value Line fund, despite its name, hasn't

rigorously followed the weekly investment advice printed by its parent Value

Line Publishing Inc. It also highlights the penalty investors often face when

their mutual fund churns its management team and plays around with its investing

style. In fact, late last night the person running the fund, Jack Dempsey,

said that as of yesterday he had been reassigned and no longer had responsibility

for managing the assets. Value Line couldn't be reached to comment.

Most of all, the discrepancy between the performance of the fund and the stocks

it touts shows that investors don't always get what they think they're buying

in a mutual fund. For even though Value Line's success is built around stocks

ranked No. 1 by the company's research arm, the fund's managers have in recent

years dipped into stocks rated as low as No. 3.

Ironically, even while Value Line's own fund struggles to match the Value

Line Investment Survey's success, an independent fund company that licenses

the Value Line name is doing much better with Value Line's investment approach.

The First Trust Value Line 100 closed-end fund, run by Lisle, Ill.,-based

First Trust Portfolios, adheres far more rigorously to Value Line's investment

principles, owning only the top-rated stocks.

Each Friday, First Trust managers log on to the Value Line site to download

the week's list of Value Line's 100 most-timely stocks. During the next week,

they sell the stocks that have fallen off the list and buy those that have

been added. The result: Since its inception in June 2003, the First Trust Value

Line fund's net-asset value is up 12.4%, slightly better than the 11.6% gain

the Standard & Poor's 500-stock index posted in the same period.

Value Line's own fund, meanwhile, gained 3.1% in that same time. Because the

fund has been such a laggard in recent years, investors have been walking away.

Assets in the fund -- in the $500 million range as recently as 1999 -- are

now less than $200 million, though some of that stems from market losses.

Part of the underperformance stems from previous fund managers who didn't

rely entirely on Value Line's proven model, opting instead to venture into

lower-rated stocks, betting that active fund managers could unearth overlooked

gems that one day would shine as top-rated stocks. Thus, investors who thought

they were buying into Value Line's winning investment strategy instead were

buying into fund managers who thought they could outperform by second-guessing

the company's research -- a tactic that didn't work well.

Because the fund wasn't performing well, the company changed managers frequently,

searching for one who could post winning returns.

Value Line appeared to be moving back toward its roots in March, when it put

Mr. Dempsey in charge of the fund. He isn't the traditional mutual-fund manager;

he's a computer programmer who for a decade helped refine Value Line's investment

models. Value Line, which uses a team-managed approach, has had at least five

lead fund managers since 1998, including Mr. Dempsey, according to Morningstar.

In an interview prior to his reassignment, Mr. Dempsey said he had been restructuring

the fund to follow the ranking system "in a much more stringent fashion." Today,

about 95% of the stocks in the fund are rated No. 1. Mr. Dempsey said his goal

was to liquidate within a week stocks that fell below Value Line's No. 1 ranking.

The Value Line survey produces independent research on Wall Street stocks.

The weekly view of 1,700 stocks, which costs $538 a year online (www.valueline.com)

and nearly $600 in print form, is particularly popular with do-it-yourself

investors and the abundance of investment clubs in the U.S. Value Line rates

stocks in a variety of ways, but is especially known for its so-called timeliness

rank. Stocks ranked No. 1 are timely and expected to outperform the market;

those ranked No. 5 are expected to lag.

Instead of running an actively managed fund in which a manager cherry-picks

the stocks the fund owns, Value Line could operate what amounts to an index

fund that simply owns the highest-ranked stocks in the survey. However, active

managers believe they can improve the performance of a fund.

"As a fund manager, you want to add value," Mr. Dempsey said. Still,

he acknowledged that "it's hard to beat our quantitative system." In

the short time that Mr. Dempsey was in charge -- a nearly six-month period

in which he transformed the portfolio -- he accumulated losses of about 2%,

compared with losses of 0.2% at the S&P 500. However, he topped the First

Trust fund, which is down about 2.5% in the same period. Under Mr. Dempsey,

the fund accumulated significant positions in stocks such as Research In Motion

Ltd. and added new positions in Yahoo Inc. and Arrow Electronics Inc., among

other companies, according to Morningstar.

Value Line, based in New York, doesn't detail the inner workings of its proprietary

stock-picking model. By and large, though, the strategy is built around stocks

displaying price and earnings momentum and posting earnings surprises, says

John James, chairman of the Oak Group, a Chicago company that runs hedge funds,

some of which try to anticipate changes in Value Line's stock rankings and

then invest based on which stocks will rise to No. 1 from No. 2.

However Value Line's model works, there's no question the company's research

produces winning choices. Value Line's list of stocks ranked No. 1 produced

cumulative gains of nearly 1,300% from Dec. 31, 1988 through June, 30, 2004,

according to Value Line. The S&P 500, by comparison, posted cumulative

gains of 311%.

Write to Jeff D. Opdyke at jeff.opdyke@wsj.com and Jane J. Kim at jane.kim@dowjones.com

By contrast, the mutual fund -- one of the nation's oldest, having started

in 1950 -- lost a cumulative 19% over the same five years. The discrepancy

has a lot to do with the fact that the Value Line fund, despite its name, hasn't

rigorously followed the weekly investment advice printed by its parent Value

Line Publishing Inc. It also highlights the penalty investors often face when

their mutual fund churns its management team and plays around with its investing

style. In fact, late last night the person running the fund, Jack Dempsey,

said that as of yesterday he had been reassigned and no longer had responsibility

for managing the assets. Value Line couldn't be reached to comment.

By contrast, the mutual fund -- one of the nation's oldest, having started

in 1950 -- lost a cumulative 19% over the same five years. The discrepancy

has a lot to do with the fact that the Value Line fund, despite its name, hasn't

rigorously followed the weekly investment advice printed by its parent Value

Line Publishing Inc. It also highlights the penalty investors often face when

their mutual fund churns its management team and plays around with its investing

style. In fact, late last night the person running the fund, Jack Dempsey,

said that as of yesterday he had been reassigned and no longer had responsibility

for managing the assets. Value Line couldn't be reached to comment.