Weekly Puzzle #1: The Corporate Life Cycle

The Set up

In class, I introduced the notion of a corporate life cycle and how it offers a simple path to making corporate finance judgments. In particular, as a firm ages, its focus in corporate finance shifts from investing to financing to dividends. I also talked about the danger of firms that are in denial, i.e., refuse to act their age and was particularly harsh in my assessment of Microsoft. Since I am not the most unbiased source on Microsoft, I thought it would be useful to make them the center of this week's puzzle and put you into the position of CEO and ask you what the best path forward for the company is.

The Corporate Life Cycle

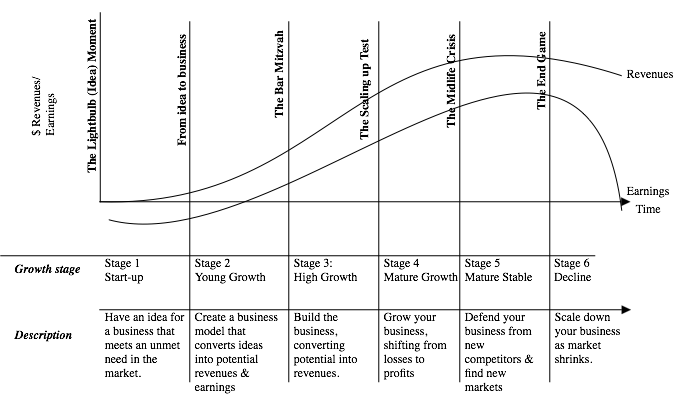

Businesses go through life cycles, just as people do, from start ups with little or no assets to growth companies to maturity and then finally, into decline. Along the way, there are plenty of barriers to overcome and threats to their survival, and the challenges that investors and managers face change as they age. The life cycle framework, while simple and intuitive, is a powerful way to think about how the challenges in management and investing change as a company moves through that its life cycle.

Notice not only the different stages of the life cycle but the transition points from one stage to another. They are difficult for managers (and investors) to deal with since they change the rules of the game.

While all companies go through this life cycle, tech companies seem to move through the life cycle at hyperspeed, or as I like to put it, they age in dog years. I present my argument for why in this blog post on tech company aging:

http://aswathdamodaran.blogspot.com/2015/12/aging-in-dog-years-short-glorious-life.html

Once you have this post under your belt, try the follow up post that I wrote on the challenges and choices faced by tech companies (and especially aging ones):

http://aswathdamodaran.blogspot.com/2015/12/the-compressed-tech-life-cycle.html

The Microsoft Challenge

Microsoft has been an incredible success story, from its IPO in the mid-eighties, to a brief rein as the most valuable company in the world, to a still-valuable company, it has ridden its two cash cows, Windows and Office. It's failure to add to its product repertoire has surprised people (and investors) and the changing of the guard from Bill Gates to Steve Ballmer did nothing to change that track record. However, Microsoft's new CEO, Satya Nadella, seems to have made people feel more optimistic about the company again. An article on the company recently in Bloomberg suggested that the company may have found a way to break out. If it does work, Satya Nadella will be a hero, but if it does not, will we be surprised? I don't think so!

However, you can make your judgments on how the company has changed by taking a look at its history from 1990 to 2015, and you can find the historical financial statements for the company at this link.

Questions/

discussion issues

In the second post on tech company aging that I linked to above, I suggest that there are three healthy choices for a tech company with a short life cycle and that each comes with a potential unhealthy side (that can be destructive)

- Accept the reality that you have a short life and enjoy it / Go into denial and act like a growth company well after growth is done

- Reseed and grow/ Spend immense amounts to keep growth going, while destroying value.

- Reinvent your business / Step over the line and become a legal target because of monopolistic or unfair practices

Assume that you have now replaced Satya Nadella as CEO of Microsoft.

- Which of these three strategies would you be most likely to follow?

- What were the factors that led you to this choice? (Good for stockholders? Corporate sustainability? Personal glory as a CEO?)

- What would you track to see if your choice was the right one? (What are the financial or non-financial variables that you would track to make sure that you have not wandered over to the dark side)