Weekly Puzzle #5: The Magic of Beta

The Set up

In most finance text books, you are told that all you need to do to estimate the beta for a stock is to run a regression of returns on the stock against returns on the market index. The slope of the line is, of course, the beta. This avoids many key questions including:

- Over what period should the regression be run, and with what return intervals?

- What market index should you use for the regression?

- What exactly is the regresssion telling you about the beta for the stock?

- What is the beta telling you about the risk in your stock?

In this weekly puzzle, I have taken one company, Volkswagen, and estimated its beta against four different indices and you will have to make your judgment, based on these betas.

Volkswagen's Betas

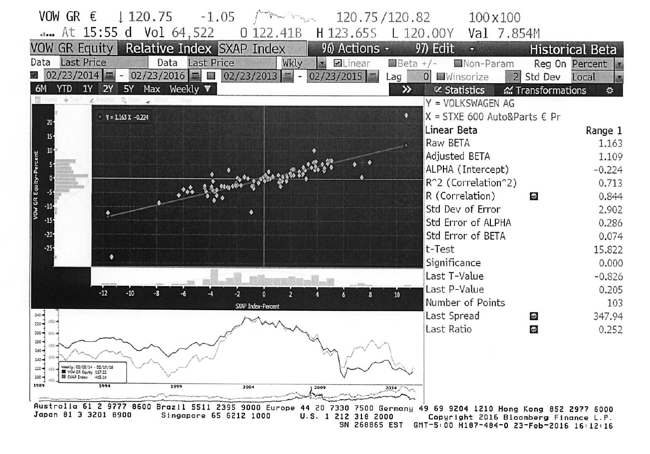

1. Against STXE Auto and Auto Parts Index

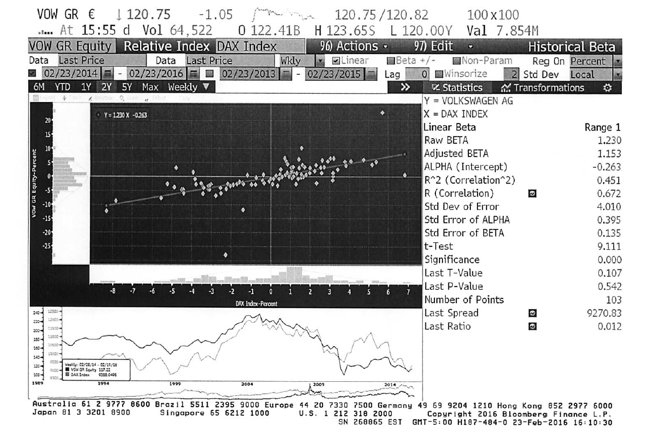

2. Against the DAX

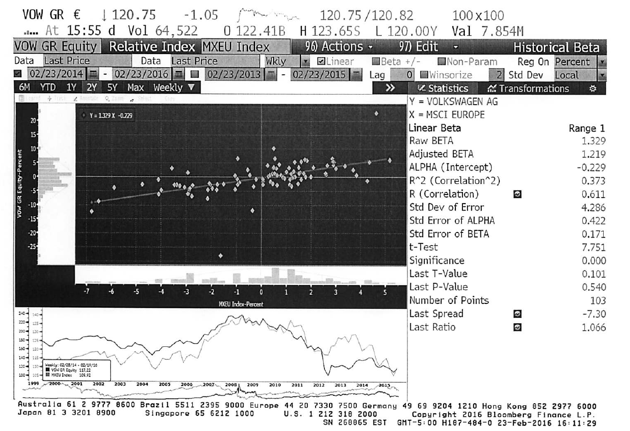

3. Against the MSCI European Index

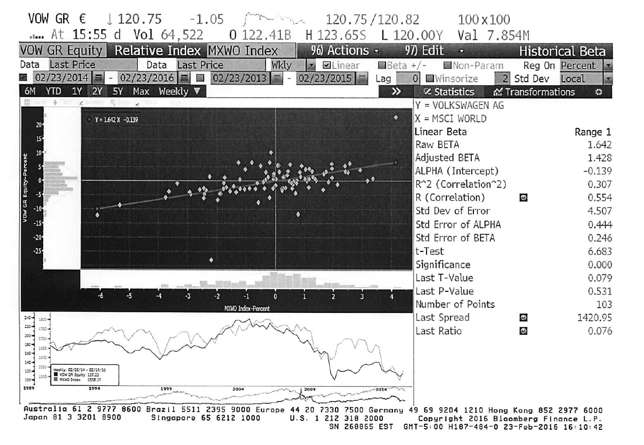

4. Against the MSCI Global Index

Questions/

discussion issues

- List out the key regression statistics (alpha, beta and R squared) in the four regressions. Do you notice any patterns? Can you explain them?

- If you are analyzing Volkswagen and were required to use one of these regression betas, which one would you use and why?

- With the beta that you decided to us, estimate the range on the beta and what it means for your estimate of cost of equity.

- Volkswagen was also involved in a major scandal for much of the last eight months of the regression, where it admitted to cheating in emissions tests, lost almost half of its value, saw the resignation of its CEO and faces billions of dollars in fines and legal charges. What effect, if any, do you think this crisis has had on your estimated regression betas (increased them, decreased them, left them unchanged)? Explain why.

- In class, we talked about how corporate governance is closely related to whether you will use this number as your cost of equity. If companies with weak corporate governance are more likely to treat equity as cheap or even free capital, what are the consequences for the investments that they will make? How would you test this hypothesis?