Weekly Puzzle #6: Market Risk Exposure

The Set up

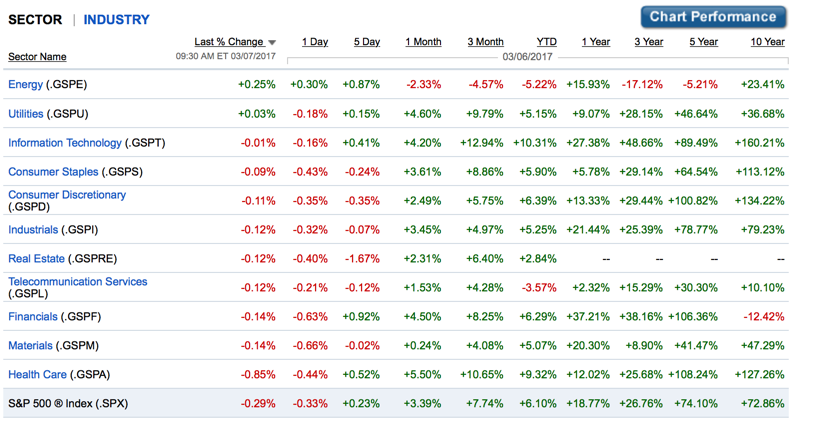

While risk and return models try to measure risk using regressions of stock returns against market indices, it is only during big market move periods that you really see the differential risk across sectors or businesses. One simple way to back out a measure of market risk exposure (an implied beta) is to take a period where markets were on the move (say from November 2016- Today, for US markets) and look at differences in returns across sectors. It is dangerous to base everything on a month but it is an interesting technique.

The Trump Effect and More...

If you are interested in a longer time period visualization of the sectors, try this link. It is a neat one, since it lets you highlight a sector and see how it shifts over time.

Questions/

discussion issues

- Look at the returns over the last three months, a good approximation of how the Trump election has shifted markets. What may explain the differences between sectors?

- Based upon just the returns in the last three months, what was the riskiest sector in the market and which one was the safest?

- Why might you want to be cautious about generalizing this finding?

- If you had this data for the worst 50 months in the market, would you be able to use it to get a measure of the relative risk of each sector and convert it into a number that looks like a beta?