|

Model Summary |

||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.647a |

.419 |

.418 |

1273.85784 |

|

a. Predictors: (Constant), 3-yr

Regression Beta, Expected Growth in EPS: next 5 years, Payout Ratio |

||||

|

Coefficientsa,b |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

(Constant) |

2.741 |

.914 |

|

2.999 |

.003 |

|

Expected Growth in EPS: next 5

years |

142.627 |

4.029 |

.669 |

35.397 |

.000 |

|

|

Payout Ratio |

5.668 |

1.199 |

.090 |

4.726 |

.000 |

|

|

3-yr Regression Beta |

.550 |

.477 |

.021 |

1.153 |

.249 |

|

|

a. Dependent Variable: Current

PE |

|

|

|

|

||

|

b. Weighted Least Squares

Regression - Weighted by Market Cap |

|

|

||||

The Multicollinearity

Problem

|

Correlations |

|||||

|

|

|

Current PE |

Payout Ratio |

Expected Growth in EPS: next 5 years |

Regression Beta |

|

Current PE |

Pearson Correlation |

1 |

-.084** |

.432** |

.078** |

|

Sig. (2-tailed) |

|

.000 |

.000 |

.000 |

|

|

N |

4062 |

4031 |

2206 |

3283 |

|

|

Payout Ratio |

Pearson Correlation |

-.084** |

1 |

-.275** |

-.115** |

|

Sig. (2-tailed) |

.000 |

|

.000 |

.000 |

|

|

N |

4031 |

4118 |

2230 |

3318 |

|

|

Expected Growth in EPS: next 5

years |

Pearson Correlation |

.432** |

-.275** |

1 |

.171** |

|

Sig. (2-tailed) |

.000 |

.000 |

|

.000 |

|

|

N |

2206 |

2230 |

2631 |

2206 |

|

|

Regression Beta |

Pearson Correlation |

.078** |

-.115** |

.171** |

1 |

|

Sig. (2-tailed) |

.000 |

.000 |

.000 |

|

|

|

N |

3283 |

3318 |

2206 |

5200 |

|

|

**. Correlation is significant at the 0.01 level (2-tailed). |

|

|

|

||

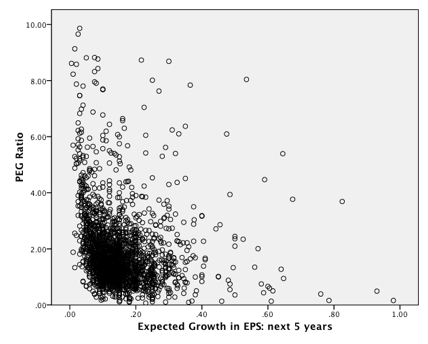

PEG Ratio Regression with intercept

|

Model Summary |

||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.483a |

.233 |

.232 |

99.60100 |

|

a. Predictors: (Constant),

Payout Ratio, Regression Beta, ln (Expcted Growth) |

||||

|

Coefficientsa,b |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

(Constant) |

-.149 |

.106 |

|

-1.395 |

.163 |

|

ln (Expcted Growth) |

-.830 |

.041 |

-.441 |

-2.016E1 |

.000 |

|

|

Regression Beta |

.162 |

.037 |

.093 |

4.351 |

.000 |

|

|

Payout Ratio |

.554 |

.095 |

.129 |

5.820 |

.000 |

|

|

a. Dependent Variable: PEG

Ratio |

|

|

|

|

||

|

b. Weighted Least Squares

Regression - Weighted by Market Cap |

|

|

||||

PEG ratio with no intercept

|

Model Summary |

||||

|

Model |

R |

R Squareb |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.909a |

.826 |

.825 |

99.62656 |

|

a. Predictors: Payout Ratio,

Regression Beta, ln (Expcted

Growth) |

||||

|

b. For regression through the

origin (the no-intercept model), R Square measures the proportion of the

variability in the dependent variable about the origin explained by

regression. This CANNOT be compared to R Square for models

which include an intercept. |

||||

|

Coefficientsa,b,c |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

ln (Expcted Growth) |

-.782 |

.023 |

-.775 |

-3.448E1 |

.000 |

|

Regression Beta |

.133 |

.031 |

.072 |

4.309 |

.000 |

|

|

Payout Ratio |

.541 |

.095 |

.093 |

5.708 |

.000 |

|

|

a. Dependent Variable: PEG

Ratio |

|

|

|

|

||

|

b. Linear Regression through

the Origin |

|

|

|

|||

|

c. Weighted Least Squares

Regression - Weighted by Market Cap |

|

|

||||

EV/EBITDA Multiple Regressions

|

Model Summary |

||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.671a |

.450 |

.448 |

722.68533 |

|

a. Predictors: (Constant),

Reinvestment Rate, Expected Growth in Revenues: next 5 years, Eff Tax Rate, ROC |

||||

|

Coefficientsa,b |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

(Constant) |

4.490 |

.676 |

|

6.644 |

.000 |

|

Expected Growth in Revenues:

next 5 years |

96.970 |

3.320 |

.640 |

29.212 |

.000 |

|

|

Effective Tax Rate |

-9.284 |

1.761 |

-.114 |

-5.271 |

.000 |

|

|

ROC |

1.745 |

1.346 |

.028 |

1.296 |

.195 |

|

|

Reinvestment Rate |

-1.837 |

.544 |

-.073 |

-3.380 |

.001 |

|

|

a. Dependent Variable:

EV/EBITDA |

|

|

|

|

||

|

b. Weighted Least Squares

Regression - Weighted by Market Cap |

|

|

||||

|

Model Summary |

||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.613a |

.376 |

.374 |

945.25361 |

|

a. Predictors: (Constant),

Reinvestment Rate, Expected Growth in Revenues: next 5 years, Eff Tax Rate, ROC |

||||

|

Coefficientsa,b |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

(Constant) |

8.641 |

.884 |

|

9.776 |

.000 |

|

Expected Growth in Revenues:

next 5 years |

109.581 |

4.342 |

.589 |

25.238 |

.000 |

|

|

Eff Tax Rate |

-14.465 |

2.304 |

-.145 |

-6.279 |

.000 |

|

|

ROC |

-2.835 |

1.761 |

-.038 |

-1.610 |

.108 |

|

|

Reinvestment Rate |

-2.252 |

.711 |

-.073 |

-3.167 |

.002 |

|

|

a. Dependent Variable: EV/EBIT |

|

|

|

|

||

|

b. Weighted Least Squares

Regression - Weighted by Market Cap |

|

|

||||

Regression with intercept

|

Model Summary |

||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.636a |

.404 |

.403 |

421.28395 |

|

a. Predictors: (Constant),

Dividend Payout, ROE, Regression Beta, Expected Growth in EPS: next 5 years |

||||

|

Coefficientsa,b |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

(Constant) |

-4.523 |

.339 |

|

-1.335E1 |

.000 |

|

ROE |

23.034 |

.812 |

.502 |

28.369 |

.000 |

|

|

Expected Growth in EPS: next 5

years |

26.253 |

1.266 |

.391 |

20.745 |

.000 |

|

|

Regression Beta |

.842 |

.156 |

.100 |

5.396 |

.000 |

|

|

Dividend Payout |

.569 |

.347 |

.031 |

1.638 |

.102 |

|

|

a. Dependent Variable: PBV

Ratio |

|

|

|

|

||

|

b. Weighted Least Squares

Regression - Weighted by Market Cap |

|

|

||||

Without intercept

|

Model Summary |

||||

|

Model |

R |

R Squareb |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.801a |

.641 |

.640 |

440.76056 |

|

a. Predictors: ROE, Payout

Ratio, Expected Growth in EPS: next 5 years, Regression Beta |

||||

|

b. For regression through the

origin (the no-intercept model), R Square measures the proportion of the

variability in the dependent variable about the origin explained by

regression. This CANNOT be compared to R Square for models

which include an intercept. |

||||

|

Coefficientsa,b,c |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

Payout Ratio |

-2.344 |

.333 |

-.131 |

-7.042 |

.000 |

|

Regression Beta |

-.110 |

.146 |

-.019 |

-.759 |

.448 |

|

|

Expected Growth in EPS: next 5

years |

18.019 |

1.168 |

.370 |

15.429 |

.000 |

|

|

ROE |

17.294 |

.717 |

.589 |

24.114 |

.000 |

|

|

a. Dependent Variable: PBV

Ratio |

|

|

|

|

||

|

b. Linear Regression through

the Origin |

|

|

|

|

||

|

c. Weighted Least Squares

Regression - Weighted by Market Cap |

|

|

||||

With intercept

|

Model Summary |

||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.745a |

.555 |

.554 |

458.86341 |

|

a. Predictors: (Constant),

Market Debt to Capital, Expected Growth in Revenues: next 5 years, ROC |

||||

|

|

||||

|

|

||||

|

Coefficientsa,b |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

(Constant) |

-3.921 |

.356 |

|

-1.101E1 |

.000 |

|

ROC |

18.057 |

.875 |

.424 |

20.633 |

.000 |

|

|

Expected Growth in Revenues:

next 5 years |

52.156 |

1.974 |

.498 |

26.415 |

.000 |

|

|

Market Debt to Capital |

-2.590 |

.808 |

-.066 |

-3.205 |

.001 |

|

|

a. Dependent Variable: EV/

Invested Capital |

|

|

|

|||

|

b. Weighted Least Squares

Regression - Weighted by Market Cap |

|

|

||||

Without intercept

|

Model Summary |

||||

|

Model |

R |

R Squareb |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.837a |

.701 |

.700 |

478.94395 |

|

a. Predictors: Market Debt to

Capital, ROC, Expected Growth in Revenues: next 5 years |

||||

|

b. For regression through the

origin (the no-intercept model), R Square measures the proportion of the

variability in the dependent variable about the origin explained by

regression. This CANNOT be compared to R Square for models

which include an intercept. |

||||

|

Coefficientsa,b,c |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

ROC |

11.342 |

.655 |

.413 |

17.322 |

.000 |

|

Expected Growth in Revenues:

next 5 years |

41.329 |

1.787 |

.570 |

23.130 |

.000 |

|

|

Market Debt to Capital |

-8.670 |

.616 |

-.241 |

-1.408E1 |

.000 |

|

|

a. Dependent Variable: EV/

Invested Capital |

|

|

|

|||

|

b. Linear Regression through

the Origin |

|

|

|

|

||

|

c. Weighted Least Squares

Regression - Weighted by Market Cap |

|

|

||||

With intercept

|

Model Summary |

||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.761a |

.578 |

.577 |

248.68771 |

|

a. Predictors: (Constant), Net

Margin, Dividend Payout, Regression Beta, Expected Growth in EPS: next 5

years |

||||

|

Coefficientsa,b |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

(Constant) |

-2.594 |

.186 |

|

-1.396E1 |

.000 |

|

Expected Growth in EPS: next 5

years |

20.064 |

.760 |

.447 |

26.396 |

.000 |

|

|

Regression Beta |

-.049 |

.094 |

-.009 |

-.521 |

.602 |

|

|

Dividend Payout |

.063 |

.213 |

.005 |

.297 |

.767 |

|

|

Net Margin |

25.355 |

.708 |

.579 |

35.827 |

.000 |

|

|

a. Dependent Variable: PS Ratio |

|

|

|

|

||

|

b. Weighted Least Squares

Regression - Weighted by Market Cap |

|

|

||||

Without intercept

|

Model Summary |

||||

|

Model |

R |

R Squareb |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.862a |

.743 |

.743 |

262.38542 |

|

a. Predictors: Expected Growth

in EPS: next 5 years, Payout Ratio, Net Margin, Regression Beta |

||||

|

b. For regression through the

origin (the no-intercept model), R Square measures the proportion of the

variability in the dependent variable about the origin explained by

regression. This CANNOT be compared to R Square for models

which include an intercept. |

||||

|

Coefficientsa,b,c |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

Net Margin |

21.827 |

.696 |

.688 |

31.340 |

.000 |

|

Payout Ratio |

-1.892 |

.202 |

-.150 |

-9.382 |

.000 |

|

|

Regression Beta |

-.632 |

.089 |

-.161 |

-7.062 |

.000 |

|

|

Expected Growth in EPS: next 5

years |

14.934 |

.706 |

.459 |

21.149 |

.000 |

|

|

a. Dependent Variable: PS

Ratio |

|

|

|

|

||

|

b. Linear Regression through

the Origin |

|

|

|

|

||

|

c. Weighted Least Squares

Regression - Weighted by Market Cap |

|

|

||||

With intercept

|

Model Summary |

||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.732a |

.536 |

.535 |

288.57291 |

|

a. Predictors: (Constant),

Pre-tax Operating Margin, Expected Growth in Revenues: next 5 years, Market

Debt to Capital |

||||

|

Coefficientsa,b |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

(Constant) |

-1.542 |

.177 |

|

-8.687 |

.000 |

|

Expected Growth in Revenues:

next 5 years |

32.909 |

1.207 |

.536 |

27.274 |

.000 |

|

|

Market Debt to Capital |

-2.985 |

.469 |

-.126 |

-6.369 |

.000 |

|

|

Pre-tax Operating Margin |

9.334 |

.467 |

.383 |

20.000 |

.000 |

|

|

a. Dependent Variable: EV/Sales |

|

|

|

|

||

|

b. Weighted Least Squares

Regression - Weighted by Market Cap |

|

|

||||

Without intercept

|

Model Summary |

||||

|

Model |

R |

R Squareb |

Adjusted R Square |

Std. Error of the Estimate |

|

1 |

.865a |

.747 |

.747 |

296.20201 |

|

a. Predictors: Pre-tax

Operating Margin, Market Debt to Capital, Expected Growth in Revenues: next

5 years |

||||

|

b. For regression through the

origin (the no-intercept model), R Square measures the proportion of the

variability in the dependent variable about the origin explained by

regression. This CANNOT be compared to R Square for models

which include an intercept. |

||||

|

Coefficientsa,b,c |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

1 |

Expected Growth in Revenues:

next 5 years |

26.494 |

.980 |

.577 |

27.048 |

.000 |

|

Market Debt to Capital |

-4.670 |

.438 |

-.191 |

-1.066E1 |

.000 |

|

|

Pre-tax Operating Margin |

7.556 |

.431 |

.442 |

17.551 |

.000 |

|

|

a. Dependent Variable:

EV/Sales |

|

|

|

|

||

|

b. Linear Regression through

the Origin |

|

|

|

|

||

|

c. Weighted Least Squares

Regression - Weighted by Market Cap |

|

|

||||