Valuing a large

money-center bank: JP Morgan Chase in February 2023

The Big Picture: Valuing a money-center bank can be the easiest and most terrifying of tasks at the same time. It is often the easiest of valuations, because you fall back on dividends, having tried and given up on estimating free cash flows to equity, and since it is large money-center bank, you have a long history of dividends to draw on. You also use the average levered beta for all money-center banks, on the presumption that bank regulatory authorities have overseen its activities, and made sure that the money center bank in question has not stepped over the line, and entered riskier ventures than they should have. It is terrifying at the same time, because you are trusting (a) the bank to pay out what it can afford to in dividends and (b) the regulatory framework to do its job of restraining banks, if they overreach on risk. As you well know, both assumptions broke down in 2008, and valuing banks became one of the most difficult and opaque tasks in the world for a while.

The Bank being valued: I have chosen to value JP Morgan Chase, the largest money-center bank in the United States, and one steeped in tradition. As anyone who has wandered down Wall Street knows, JP Morgan’s corner office, right across from the New York stock exchange, was where some of the most momentous decisions in US financial history were made. That original bank has gone on quite a journey in the hundred plus years since, acquiring other banks along the way and with its acquisition of Chase Manhattan Bank, another US institution, in the 1990s, becoming one of the largest players in retail banking in the US. It is also headed by perhaps the most visible and forceful of bank CEOS, Jamie Dimon, a man who honed his political and financial skills in a variety of positions before becoming JPM’s CEO.

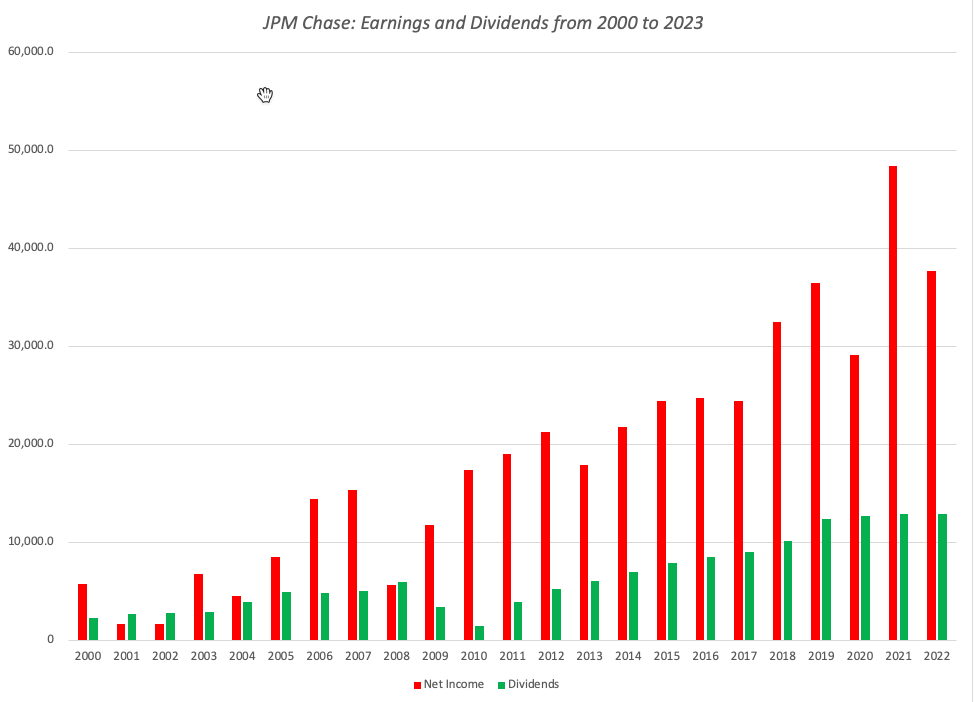

The Background: Like almost every other large bank in the world, JP Morgan Chase overreached in the early part of this century (2000-2008) and suffered grievous damage in the 2008 crisis. After years of wandering in the wilderness, fixing its wounds, it returned to reasonable health by 2012 and has seemed to put the worst behind it. In 2022, the bank reported net income of $37,676 million, well below the record profits of $48,334 million that it showed in 2021, but still higher than 2019 income. The bank also paid dividends of $12,858 million, working to quarterly dividends per share of $1.00 (annual dividends per share of $4.00) in 2022, matching its dividends in 2021:

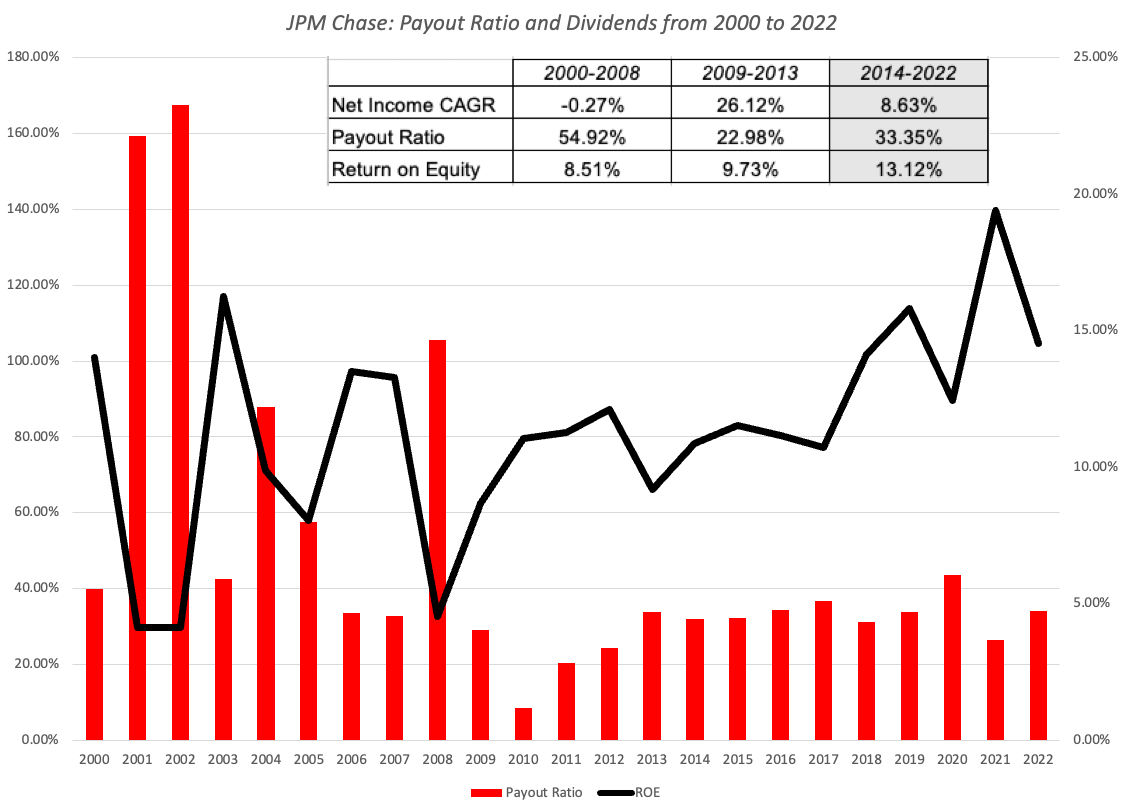

Value Drivers: While looking at dollar net income and dividends is a useful first step, to get a better measure of bank quality, you need to estimate two follow up measures. The first is the payout ratio, the percentage of net income paid out in dividends, and the other is the return on equity, which becomes an aggregate measure of the quality of earnings and growth. The latter will be driven by the bank’s competitive advantages, and if it is overreaching on risk, the consequences of that overreaching (bad debts, trading losses etc.). In the graph below, I measure both for JPM Chase from 2000 to 2022:

Value Questions: There are clearly questions that need to be addressed in the valuation, including

(a) Was the drop in 2022 a return to normalcy from abnormally high profits in 2021?

a. If yes, can the bank maintain its return on equity and payout ratio from 2022 into the future?

b. If no, what are the best estimates of normalized net income, payout ratio and return on equity for the near future (next 5 years)

(b) Given that the average levered beta for all banks is 1.08, and that it reflects the risk of all banks, is it reasonable to assume that JPM Chase is an average risk bank?

a. It size and multiple business mix push towards making the argument that its beta might be lower than a typical bank.

b. At the same time, its exposure to investment banking, trading and the riskier sides of banking may make the argument that it is riskier than a typical bank.

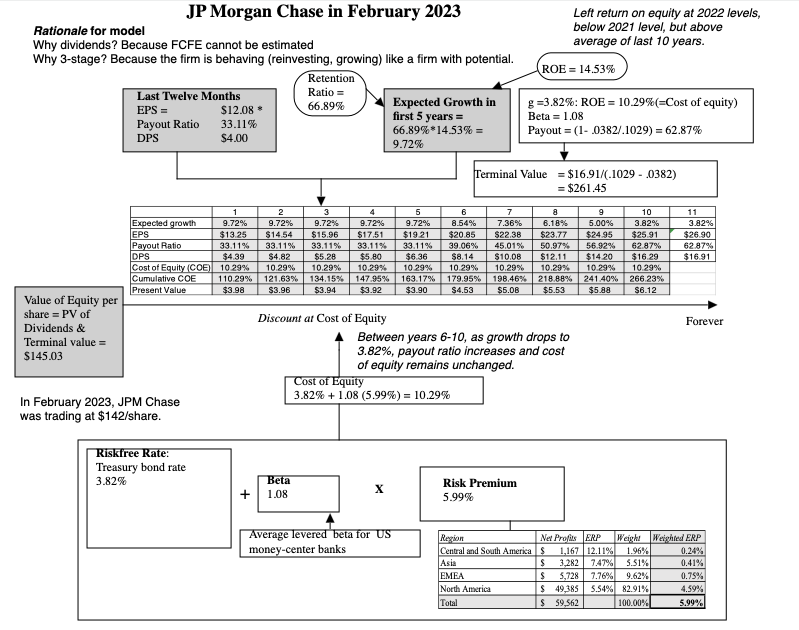

Valuation: In my valuation, I assumed that JP Morgan’s 2022 income was more a return to normalcy and is reflective of the very different interest rate environment that all companies, but especially banks, face as treasury rates have risen and default spreads have widened. I did assume that the bank will be able to maintain its return on equity (14.53%) and payout ratio (33.11%) from 2022 for the next five years, before seeing its return on equity drift down to being equal to its cost of equity in 2032. Implicitly, I am assuming that the competitive advantages of banking, comprised of regulatory barriers, will be chipped away by fintech and other disruptors over time.

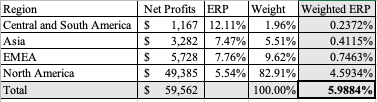

On the risk front, I have chosen to give JPM Chase the average (levered) beta (1.08) of money-center banks in the US, at the start of 2023, after checking that its tier 1 capital ratios are well above regulatory minimums and close to industry averages. At the current treasury bond rate of 3.82% and an equity risk premium of 5.99%, updated to February 2023 numbers and reflecting JPM’s mix of countries (using net profits to weight them):

(I used net profits, rather than revenues, since I am not sure what revenues even mean for a bank, with a mix of loans, deal making fees and trading profits).

Valuation Picture: The picture below provides my estimate of value per share for JPM Chase in February 2023:

In my estimate, JP Morgan Chase was trading at close to fair value on February 2023, good news for me, since I happen to have a large holding of it my portfolio that I was lucky to acquire in February 2009, just after the crisis.

Key inputs to ponder:

1. Return on equity in the future

2. Payout ratio in the future

3. Beta (Cost of equity) to use in valuation