Valuation of the Week #3: Apple

Background

This week, we start on our first company valuation and I picked a company that is both a favorite of mine and an obsession. It is Apple, a company that I have valued once every three months since 2010. As you look at the valuation, you should be able to follow along with many different themes that we have already started talking about in this class, as well as specific details (like how to estimate equity risk premiums and betas). I have also attached my latest valuation of Apple. Feel free to download the spreadsheet and make it yours.

Story and Numbers

One of the first themes that I introduced for this class was that every valuation is enriched by a story that becomes numbers. For Apple, the story that I have been telling about thec company for the last seven years has been remarkably consistent. In my September 2010 valuation, where I looked at Apple just after it had become the largest market cap company in the world and had come off perhaps the greatest decade of disruption of any company in history (iTunes with music, iPhone and phones, iPad and computers), I had come to conclude that Apple was one of the great cash machines of all time, but that its days of disruption were behind it, partly because Steve Jobs was no longer at the helm but more because of its size. It is so much more difficult for a $600 billion company to create a significant enough disruption to change its earnings, cash flows and value. So, in my story, I see Apple continuing to produce massive cash flows, with little revenue growth and gradually lower margins in the future, as the smartphone business became more competitive. I won't make you read all of the posts that I have on Apple, but let me start with a post that I had in August 2015, when I updated that story (and looked at Facebook and Twitter at the same time.

Narrative Resets: Revisiting a Tech Trio (August 2015)

Once you have read that post, you can move on to a post from February 2016, where I revisited the story after an earnings report from Apple and compared it to Alphabet:

Race to the top: The Duel between Apple and Alphabet (February 2016)

In May 2016, Carl Icahn, a long time bull on Apple sold his shares, and Warren Buffett, a long time avoider of tech companies, bought shares in the company. I looked at how actions by these big name investors changed (or did not change) my story:

Icahn exits, Buffet enters: Whither Apple? (May 2016)

Last week, Apple released its latest 10Q and in conjunction with its latest 10K (Apple's fiscal year end is in September), I now have updated numbers for Apple. Using those numbers, I took at look at my Apple story and guess what? It looks like it did last year, a great cash machine, with flat revenues and declining margins.

Valuation Details

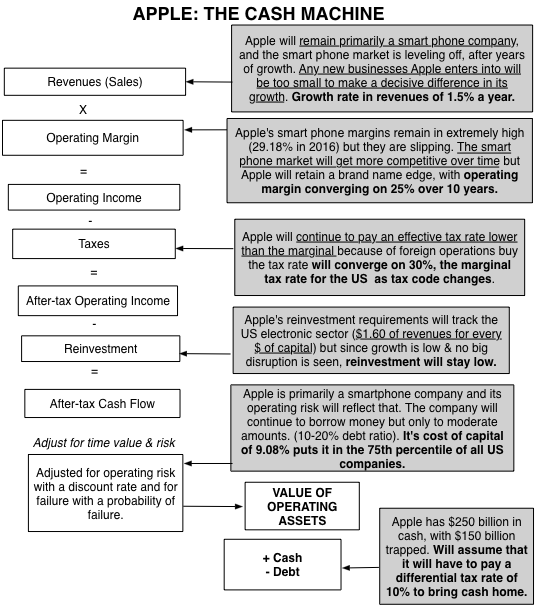

Since the Apple story is a simple one, my valuation reflects the story. The picture below takes my story and converts it into valuation inputs:

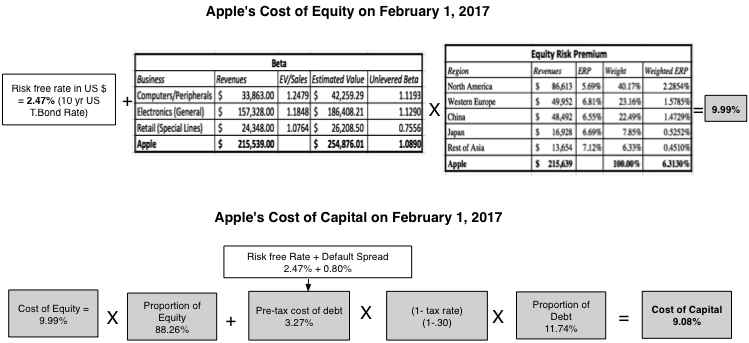

Those valuation inputs are what drive my most recent valuation of Apple, which you can download here. As you browse through the valuation, you may want to pay attention to how the cost of capital is computed for Apple, since I draw on many of the lessons we talked about in class about risk free rates, equity risk premiums and betas (ahead of tomorrow's class.

Value and Price

The bottom line is that my estimate of value for Apple right now is $129.04, just a hair below its current price of $130.27; a year ago, it was 25% below value and the difference has narrowed. My investment from last year has paid off, but lest it looks easy, my journey with Apple over the last seven years summarizes why making money on valuation takes patience and luck.

Your turn

Now, its your turn. Your story for Apple may be different from mine and if it is, here is what I want you to do. Take my spreadsheet and use it to reflect your story. So, if you think that Apple can find a disruptive product (electric car, fintech) that can put it back on a growth path, you might use higher revenue growth than I do, though these may be more capital intensive and lower margin businesses. See what you get as a value. When you are ready, the shared google spreadsheet awaits you:

https://docs.google.com/spreadsheets/d/1T8Sj37Y2uBwjT6REYMsVtlneO-Q416dKlBB13rhLijM/edit?usp=sharing

Good luck!