EBay: More than just

an online auction site

I just bought an office chair on EBay paid for it using funds from my Paypal account, and I am sure that I am not alone. Since it creation in 1997, the company has revolutionized online retail, by providing an outlet for individuals to sell items (ranging the spectrum from collectibles to furniture) to the online world. The news that EBay is planning to break up into two businesses, its marketplace (or merchandising) unit in one and its payment processing unit in the other, is therefore both big news and worth examining for its value and pricing implications.

EBay: History

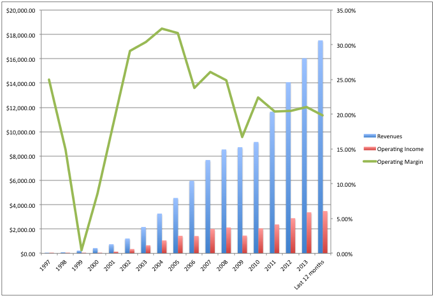

EBay was founded in 1995 in San Jose, California. It is eerie coincidence that its CEO during its early years was Meg Whitman, who is the news as the CEO of HP, the other big company announcing a break up. As online commerce picked up in the late 1990s, EBay benefited from the boom, reporting exponential growth in revenues, but it also stood out from the crowd as one of the few companies that actually had found a way to profitability. In the graph below, you can see revenues and operating income at EBay from its inception through 2014, with the operating margin for the company overlaid on the graph:

It was to facilitate transactions on EBay that Paypal was created, a payment processing system that allowed buyers and sellers in the auction market to reduce time involved in payment processing, while also reducing the risk of not getting paid. In fact, Paypal formed such a small part of EBay"s revenues in its early years that the company did not start breaking out revenues into its marketplace and payment processing units until 2006 and operating income until 2011. The table below summarizes the revenues and operating income at the two businesses, with revenue growth from 2006-14 and operating margins for each from 2011-14:

Looking at the evolution of the two businesses over time, they seem to be following different paths. The marketplace unit has seen slower revenue growth and higher operating margins that seem to be under pressure, dropping from 46% in 2006 to 35% in 2014. The payment-processing unit has higher revenue growth and while its operating margin is lower than that of the marketplace unit, it has also held up better over the last three years.

EBay: Valuing the Break up

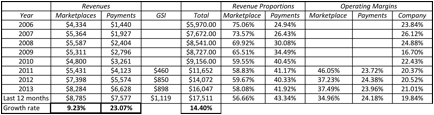

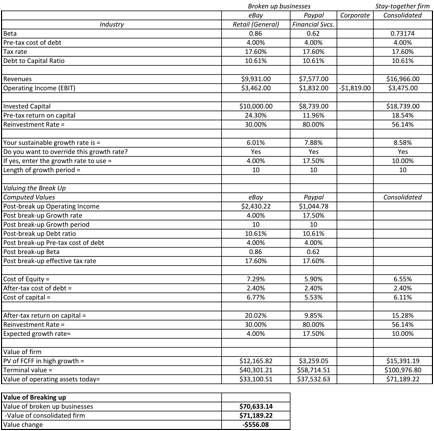

At the risk of stating the obvious, a break up can affect value, only if it affects the inputs into value, i.e., cash flows, expected growth, the cost of capital or the length of the growth period. In effect, if EBay breaks up into two units and the composite cash flows, growth rate, growth period and cost of capital for the two units remains the same as the consolidated unit, there will be no value created. In the table below, we start with this presumption, where we allocate the corporate costs across the two businesses, in proportion to revenues, and assume that the growth rates, growth period and debt ratios don't change for the broken up units.

Not surprisingly, if you assume no fundamental changes in how the units are run or financed after the deal, there is no value created from the break up.

So, what are the potential value enhancers? I can think of four possible changes:

(1) The corporate costs are bloated at the consolidated level and could be lowered, if the company is broken up. Thus, if the corporate costs, currently $1,819 million for the consolidated company could be lowered by a hundred or two hundred million dollars, there will be an immediate value effect. If costs are cut by $100 million annually, for instance, the value of the combined firm will increase by $1.73 billion.

(2) If the broken up units can have a composite growth rate in revenues and operating income that exceeds that of the consolidated unit, there will be a value increase that comes with that higher growth. Of the two units at EBay, the one that seems most likely to benefit from being cut adrift is Paypal and using a 20% growth rate for the next few years, instead of 17.5%, increases the value of the combined firm by $7.6 billion.

(3) If the broken up units can improve their competitive advantages, relative to the consolidated unit, the higher return on capital and longer growth period that result will increase the value of the broken up units.

(4) If the broken up units are able to adopt financing mixes that better reflect their standing as businesses, it is possible that the costs of capital will decline at the broken up units, relative to the consolidated unit and increase value.

The spreadsheet that I attach can be used to tweak each of these numbers, to see the impact. I remain skeptical on (1), willing to listen on (2), don't see much of a basis for (3) and (4).

The Pricing Effect

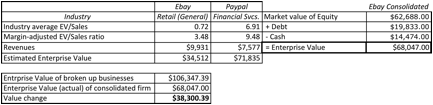

It is possible that the motives for this break up have nothing to do with management focus and value enhancement and have more to do with investor focus and price enhancement. EBay has two very different businesses in its consolidated unit that should be priced relative to different sectors and using different multiples. It is possible that investors (and analysts) are comparing EBay to the wrong set of companies, using the wrong metrics, and are thus mispricing it.

To assess the pricing impact, I tried a very simplistic analysis, where I broke the company down into two businesses, the market place business and the payment processing business and priced each relative to what I thought were more relevant comparable firms: retail firms for the former and non-bank financial service companies for the latter. It is true that the nature of EBay"s marketplace business model will keep its revenues low (since it reports only its cut of the price of items sold as revenues rather than gross revenues) and its margins high. Similarly, the payment-processing unit (Paypal) has a different business model from other financial service companies and a higher operating margin, as a consequence. I adjusted the enterprise value to sales ratio for both businesses to reflect that:

Margin adjusted EV/Sales = ![]()

If I do that, you can see some pricing magic at play in the table below:

Note that the estimated price of the two units exceeds that of the consolidated company by $38 billion. Do I believe that the price will jump this much? Not for a moment, since the market will undoubtedly adjust for other differences as well, but I would not blame EBay"s managers for trying to play this game. You can play the game too, trying different pricing metrics and sets of comparable firms to see what you come up with.