The Back Story

For those of you who are not familiar with the

company, GoPro makes cameras that you can attach to yourself and record video

of your activities. While that might not seem exceptional, it is designed for

high-energy physical activities, including running, rock climbing or hunting.

You can get a measure of the company's current offerings on its website.

The current offerings include three models of the camera (the Hero, the Hero 3

and the Hero 4), numerous accessories and two free software products (a GoPro

App and GoPro Studio) to convert the recorded videos into watchable ones.

The company believes that the creators of videos

will share them, not only with their friends, but also with the general public.

In its most recent earnings report, it noted that

GoPro videos published on YouTube had increased 200% over the previous year,

launched a GoPro channel on Pinterest to attract more attention to the videos

and one for the Microsoft Xbox.

The company's cameras have found a ready market, with revenues hitting $986 million in 2013 and increasing to $1,033 million in the twelve months ending in June 2014. In spite of large investments in R&D ($108 million in the trailing twelve months), the company still managed to be profitable, with operating income of $70 million in that period. Capitalizing R&D increases their pre-tax operating margin to 13.25%, impressive for a young company. The figure below looks at the evolution of revenues and units sold over the history of the company.

GoPro has been a stock on fire since its initial

public offering on June 26, jumping 30% on its offering date (from $24 to

$31.44) and continuing its rise to $94 on October 7, before falling back to $78

on October 14 (the day of this post).

The stock has accumulated a large number of vocal

short-sellers, who are convinced that this is a high flyer destined for a fall

and many of them have been burnt in the price run-up, a fact alluded to in this Wall Street Journal article about the company.

An Intrinsic Valuation

In valuing GoPro, we face all of the typical

challenges associated with valuing a company, with growth possibilities, early

in its life cycle, in determining the market potential and imminent

competition.

1. Potential Market

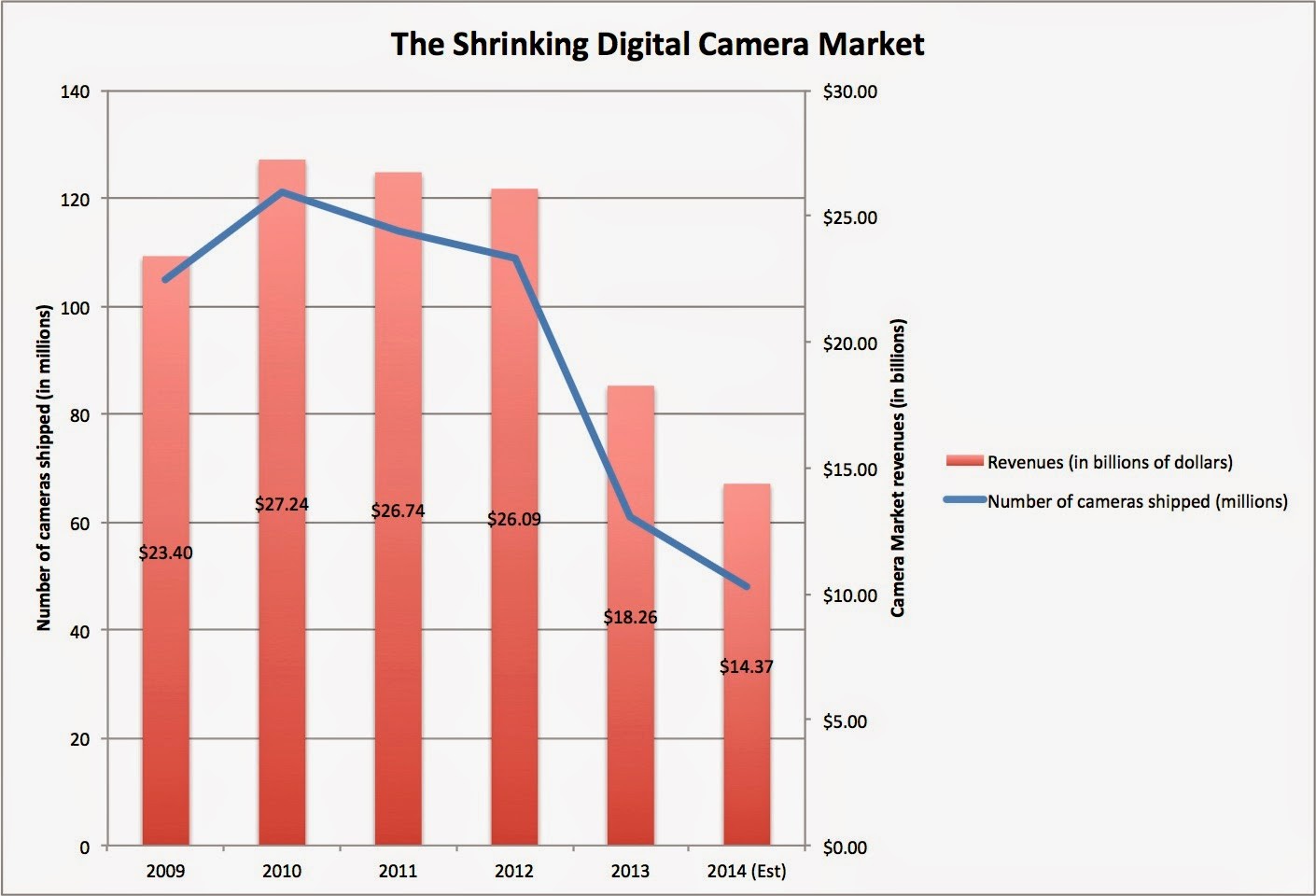

Since GoPro makes cameras, the first market to look

at is the camera market, a market that is characterized by the following

trends/facts:

a. It is a market under threat, as smart phones

increasingly take market share away from conventional camera manufacturers. The

graph below shows the decline in overall camera market revenues and units sold

over the last few years:

|

Source: CIPA |

Increasingly, customers are turning to smartphones

and tablets as their preferred "camera" devices, as is made clear in

this projection for 2016 (compared to 2012) and 2023; I am assuming that the

overall market will increase to $120 billion in ten years and that

smartphones/accessories will be 60% of that market and tablets/PCs will be

about 15%.

|

Source: IC Insights for 2016, My estimate for 2023 |

If this estimate is credible, the smartphone camera

market will be larger than the conventional camera market in a few years, with

the potential of attracting new users into the market, i.e., customers who did

not find photography appealing (with old cameras) but are willing to use

smartphone cameras (perhaps because they plan to use the photographs in a

different format).

b. The traditional camera market is dominated by

Japanese manufacturers of long standing, as evidenced by the market shares of

the leading companies in the market below, but GoPro is the largest player in

the market, outside of the conventional smartphone companies (Apple, Samsung

and HTC).

|

Market Share in 2011 |

The first key question that we face in valuing

GoPro is the size of the potential market. If we define it as a camera, and

look at the camera market, its growth will be constrained, both by the size of

the market and the established competition. If, as I think we should, we define

GoPro's market more broadly as a subset of the market that includes smart phone

accessories, the market is a much larger one. In fact, we will use the

expected market of $90 billion for smartphone cameras/video capture in 2023 as

a starting point, and assume that GoPro's challenge is getting as large a slice

of that market is possible. A significant portion of this market will be

claimed by smartphone makers, since many customers will settle for the cameras

in their phones. GoPro is a camera designed to capture physical activity

(hiking, mountain climbing, bungee jumping) with the specific intent of sharing

the videos on social media. Consequently, there are two characteristics that

you would look for in potential GoPro customers: a liking for physical activity

and a proclivity towards over sharing (on Facebook, Twitter, YouTube etc). In

2014, the CDC estimated that roughly 22.4% of adults are physically active and

if we assume that the same percentage of the smartphone camera market will be

willing to consider a GoPro, we arrive at a total market of about $20.16

billion for action cameras.

2. Market Share & Profit Margins

The market share and target profit margin that we

assess for GoPro will be a function of the potential market that we see for it

and the competition in that market. If we define the smartphone accessory

market as the primary market, GoPro's potential market is large. While it initially

had the action-camera market to itself, the competition is starting to take

form both from upstarts, established camera makers and from some smartphone manufacturers.

On the market share component, I don't see any

potential networking advantages that GoPro can bring to this process that will

allow it, even if successful, to control a dominant share of this market, as

the market gets bigger. Drawing from the established camera business market

shares, I will assign a market share of 30%, higher than the 20% market share

for Nikon, the leading camera maker, of the camera market in 2013, since GoPro

does not face as many competitors. (I am not drawing a direct parallel between

Nikon and GoPro, but I am arguing the market share breakdown of the action

camera market is likely to resemble the market share breakdown of the

conventional camera market).

On the profit margin, GoPro's first mover advantage

has given it a headstart in this market, allowing it to charge premium prices

and earn a profit margin of 12.5%. This margin is significantly higher than the

6.5%-7% margins reported by camera companies and closer to the 12%-15% margin

reported by smartphone companies. (Apple is the outlier, with its 20-25%

operating margins on smartphones) I will assume that GoPro will try to preserve

its premium pricing, even in the face of competition, but will have to cut

prices and margins to keep its products selling.

3. Investment Needs

While GoPro users may post to social media sites,

GoPro is not a social media company when it comes to investment needs. While

social media companies like Facebook, Twitter and Linkedin generate their

revenues in advertising and have little tangible investment, GoPro will need to

invest in manufacturing capacity to produce and sell more cameras. To estimate

the reinvestment needs, I made two assumption: (a) that the company will have

to invest $1 for every $2 in additional revenues generated in years 1-10

and that the return on capital will move towards about 17% in year 10.

4. Risk

While GoPro does have a social media focus for the

videos made on its cameras, the company currently generates all of its revenues

from selling cameras and accessories. There is the real possibility, though,

that the videos delivered through media may have entertainment value, which, in

turn, could lead to other revenue sources (advertising on GoPro's YouTube

channel or a dedicated media outlet for GoPro videos, for instance). That does

seem a little far fetched at the moment and we will assume that GoPro's risk

will resemble the risk of high-end electronics companies.

5. Valuation

With this spectrum of choices on the inputs (revenue growth derived from the total market/market share assumptions, operating margin, sales to capital and cost of capital), the value per share that I get is about $20, well below the market price of $77. This value is conditioned on my assumptions about the total market, market share and profit margin and it is entirely possible that I am missing GoPro's potential in the entertainment market. Given how addicted we are to reality shows, it is entirely possible that our entertainment a decade from now will take the form of watching each other hike, hunt and swim and that GoPro will be the beneficiary of this absolutely appalling development.