Valuation of the Week #7: Valuing SABMiller - Control and Synergy

In this week's valuation, we look at the target of last week's big acquisition: SABMiller. The acquirer was ABInBev, the largest beer manufacturer in the world, and the deal was consummated with a premium of 50% over SABMiller's market price on September 15, 2015, the day before the ABInBev first announced its intent. While the ecosystem of big deals kicks into high gear, with bankers, consultants and strategists falling over each other in trying to explain why the deal makes sense, I thought it would be interesting to ask some questions from a value perspective.

Value Motives for an Acquistion

When you acquire a company, there are three (and only three possible) motives that are consistent with intrinsic value.

- Undervaluation: You buy a target company because you believe that the market is mispricing the company and that you can buy it for less than its "fair" value. In effect, you are behaving like any value investor would in the market and there is no need for you to either change the way the target company is run or look for synergy benefits.

- Control: You buy a company that you believe is badly managed, with the intent of changing the way it is run. If you are right on the first count and can make the necessary changes, the value of the firm should increase under your management. If you can pay less than the "changed" value, you can claim the difference for yourself (and your stockholders).

- Synergy: You buy a company that you believe, when combined with a business (or resource) that you already own, will be able to do things that you could not have done as separate entities. Broadly speaking, you can break synergy down into "offensive synergies" (where you are able to grow faster in existing or new markets than you would have as standalone businesses and/or charge higher prices for your products), "defensive synergies" (where you are able to reduce costs or slow down/prevent decline in your businesees) and "tax synergies" (where you directly take advantage of tax clauses or indirectly by being able to borrow more money).

The key distinction between synergy and control is that control does not require another entity or even a change in managers. It can be accomplished by the target company's management, if they put their minds to it and perhaps hire some help. Synergy requires two entities coming together and stems from the combined entity's capacity to do something that the individual entities would not have been able to deliver. Note that these motives can all co-exist in the same acquisition and are not mutually exclusive. To assess whether these motives apply (or make sense), there are four numbers that you need to track:

- Acquisition Price: This is the price at which you can acquire the target company. If it is a private business, it will be negotiated and probably based on what others are paying for similar businesses. If it is a public company, it will be at a premium over the market price, with the premium a function of the state of the M&A market and whether you have other potential bidders.

- Status Quo Value: This is the value of the target company, run by existing management and based on existing investing, financing and dividend policies.

- Restructured Value: This is the value of the target company, with changes to investing, financing and dividend policies.

- Synergy value: This can be estimated by valuing the combined company (with the synergy benefits built in) and subtracting out the value of the acquiring company, as a stand alone entity, and the restructured value of the target company.

Connecting these numbers to the motives, here are the conditions you would need for each motive to make sense (by itself).

- Undervaluation: Price for target company < Status Quo Value

- Control: Price for target company < Restructured Value

- Synergy: Price for target company < Restructured Value + Value of Synergy

The AB InBev / SABMiller Deal

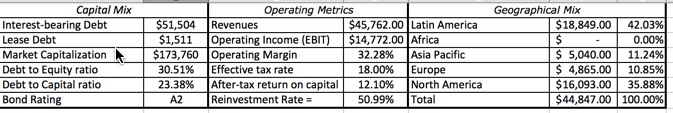

The acquirer, AB InBev, is the largest beer manufacturer in the world (in both revenues and market capitalization). On September 15, 2015, the day before the deal was first announced, the company looked as follows:

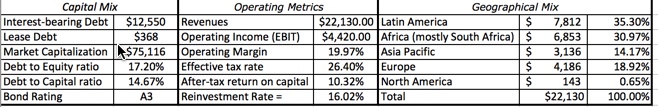

The target, SABMiller, is the second largest beer manufacturer in the world. On Septembr 15, 2015, the company looked as follows:

AB InBev is not only bigger than SABMIller, it has more debt, a higher bond rating, much higher operating margins and a more aggressive reinvestment policy than SABMiller. The companies share a large footprint in Latin America but AB has a large US presence whereas SAB's largest market is South Africa.

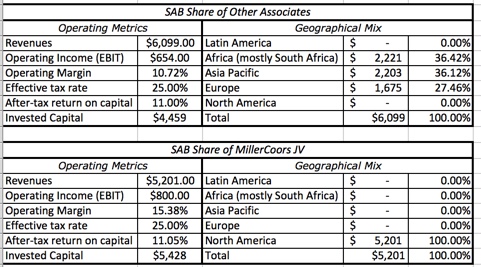

There is one aspect of SAB Miller that this picture misses, which is its 58% holding in the Coor's joint venture (with 50% of the voting rights) with Molson Coors and minority holdings in other associates in the rest of the world. These holdings are not consolidated and thus have to be valued separately. The Coors joint venture gets almost all of its sales in the United States but the other associates have holdings in Africa, Asia and Europe. The table below summarizes the information that is available on these cross holdings:

It is worth noting that if this acquisition goes through, AB InBev will probably be required to divest its joint venture investment in MillerCoors, due to anti trust concerns.

Status Quo Value

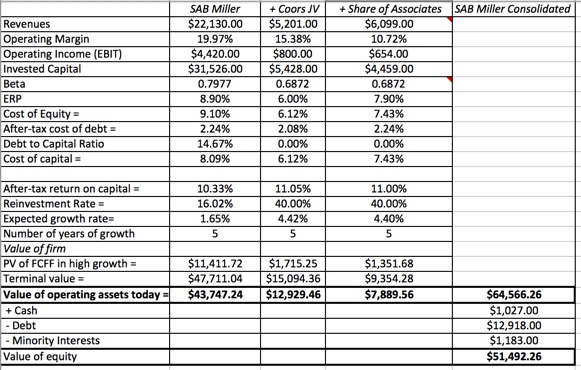

To estimate the status quo value for SABMiller, I valued the operating asset of SABMiller, assuming that they continue with their existing investing, financing and dividend policies and arrived at a value of $43.7 billion for the operating assets of the company. I also valued (with limited information) the Coors JV and the other (unconsolidated) holdings of SAB.

Adding SABMiller's cash holdings, subtracting out debt and minority interest (which I left at book value, since I was not sure what was being consolidated), I arrrived at a value for the equity of $51.49 billion. Based on my estimated value, it seems unlikely that under valuation is the motive for this deal, since the market capitalization on September 15, when the deal was announced, was $75 billion and the premium-laden final price was close to $100 billion. (This may be cynical of me, but if I used an ERP of 6% for SABMiller, based on SABMiller's country of incorporation (UK) and ignoring the risk in its operations which are in Africa and Latin America, I get a value of equity of $78 billion, which would justify the pre-deal market capitalization).

Value of Control

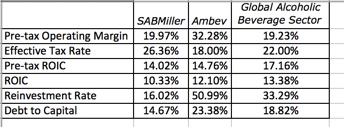

Is SABMiller ripe for a restructuring? It is tough to tell from the outside but one way to measure room for improvement is to compare the company on key corporate finance measures against both the acquirer (InBev) and the rest of the alcholic beverage sector:

This comparison may be simplistic, but it looks like SABMiller lags the sector is in its reinvestment rate and return on capital, and that it earns a profit margin that match up to the sector. It also has a debt ratio that is not far off from the sector average. ABInBev has a much higher profit margin than the rest of the sector and pays a lower tax rate. I revalued SABMiller with the return on capital, debt ratio and reinvestment rate set equal to the industry average. (I considered using ABInBev's operating margin but much of that comes from Brazil and it is unlikely that SABMiller can match it in South Africa or the rest of Latin America.

Changing the way SABMiller is run adds about $4.7 billion to the value, but even with that addition, the equity value of $56.2 billion is still far below what ABInBev paid on October 15. That suggests that control was not the primary rationale either.

Value of Synergy

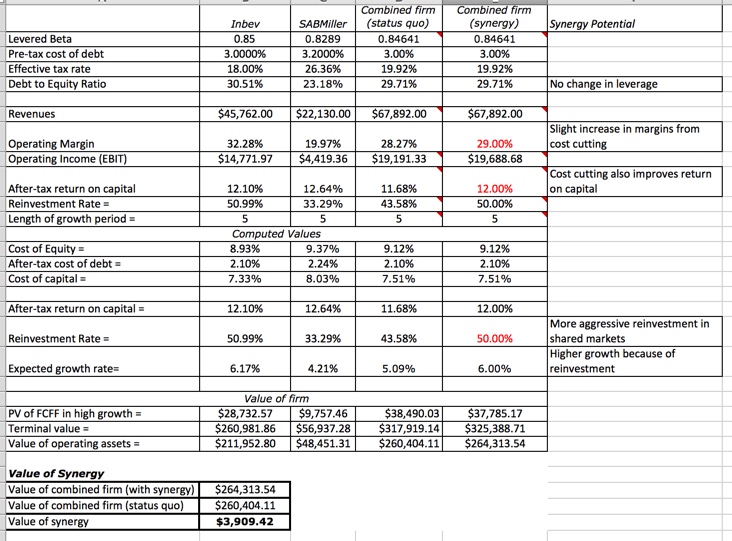

This leaves us with only one option, synergy, and to value synergy, I valued ABInBev as a standalone company and put it together with the restructured value of SABMiller:

To value synergy, I took some of the loose talk that came from the companies about the form of the synergy. In effect, there are two potential sources of synergy. One is that the companies, which complement each other geographically may be able to get more revenues by pushing their products across regions (selling more ANInBev products in Africa and more Miller in Latin America). The other is that as a combined company, they may be able to cut some costs, though the fact that their geographic complementarity will keep these cost cuts small. Allowing for a slightly higher growth (from more reinvestment and an augmented return on capital) and a small improvement in operating margin yields a value of $3.9 billion for synergy. Adding this on to the restructured value of $56.9 billion yields $60.8 billion as the maximum that you can pay on this acquisition, leaving ABInBev with a deficit of more than $40 billion.

There is one cost that will cut into this synergy. For this acquisition to get regulatory approval, the combined company will probably have to divest itself of some of its holdings. In particular, the 50% joint venture in Coors will have to be sold, with Molson Coors being the likely beneficiary, since it owns the other 50% and has first bidding rights and the rights to match the best bid. Since this divestiture will have to happen quickly (and ABInBev faces a cost of $3 billion, if the deal falls apart), it seems likely that this divestiture will be at less than "fair" value.

Bottom line

It is possible that I have missed a key synergy that can augment value. Perhaps, ABInBev has found a magical formula for higher margins and can transmit this to SABMiller's assets. If it is able to increase the collective company's margin to what it earned as a standalone company, the synergy value climbs to $33.8 billion, which pushes the deal closer to break even. As an ABInBev stockholder, that depresses me, since the best case scenario to me yields a break even.

Data Attachments

Spreadsheets