Weekly Puzzle #7: Investment Decision and Post-decision Blues

The Set up

In investment analysis, you are called upon to make judgments on where you will invest your resources. In making these judgments, there are a few simple rules that you have to follow. The "required return"or "hurdle rate" for the investment should reflect the risk of the investment, not the risk of the company making the investment. The returns on the investment should be based on cash flows, not earnings, and those cash flows should be incremental and time weighted. Even if you follow these rules, though, you are making your best estimates for the future, and notwithstanding your estimation efforts, the real world can deliver surprises that make your investment decisions look bad, at least in hindsight. There is no sector where you see this problem more than in the energy space, where the collapse of oil prices has made investments that looked like they were "can't miss" a few years ago into very iffy propositions.

This year's Carnage

While there are any number of examples of this investor regret, take this one case of Chevron's bet on becoming a leading gas supplier that looked good when it was made but is looked vulnerable just as the investment gets ready to start production:

To make a long story short, Chevron made a 50% investment in Gorgon, an Australia-based gas plant. That investment was made six years ago, when oil and gas prices were much higher than they are today, Chevron was flush with cash and could borrow money at low rates.

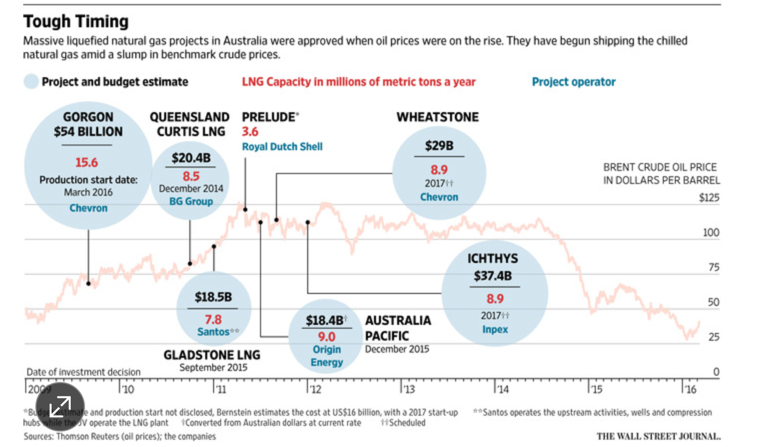

Updating to today, the plant is finally ready to produce gas, albeit at much lower prices than anticipated and Chevron recently had its bond rating cut. The evolution of the gas business over the last few years is captured in this graph:

Gorgon cost $54 billion to build, $17 billion more than originally estimated. Oil prices were $60 a barrel and rising in 2009, when the decision to build was made but they are about $38 today.

Questions/

discussion issues

- Should the analysts who looked at the plant in 2009 foreseen the oil price rout when making the investment decision? If they are not to blame for not foreseeing the oil price drop, do they bear any responsibility for the "bad" investment? (Hint: Look at the cost, relative to the original estimate).

- Asssume that at today's oil prices, the present value of expected cash flows on the plant is well below the $54 billion that it cost to build the plant? Should Chevron shut the plant down today? If yes, why? If not, why not?

- Assume that you are offered $25 billion by Exxon Mobil for the plant? Would you accept it? What would determine your decision?

- Now that you have seen the cost of this deal, what would you do differently, if anything, on any new investments that you make as an oil company?