Book |

Description |

Website |

| Investment Valuation (2nd Edition) |

This is the book that is most suited for a classroom text book.

It has almost all of the material of the class (barring the more

recent updates) and has problems at the end of every chapter. It

follows the standard script of valuation, looking at different valuation

models with twists. |

|

| Damodaran on Valuation (2nd edition) |

This book provides a quicker review of the basic valuation but

the second half of the book is built around dealing with what I call

the loose ends of valuation – control, synergy, intangible

assets etc. It has no problem sets and is really meant for practitioners

who deal with the loose ends on a constant basis. |

|

| Dark Side of Valuation (2nd edition) |

This book covers companies that are difficult to value – young

companies, money losing companies, financial service companies, emerging

market companies. While it covers the basics of valuation, it is

meant more for those who get the basics but want to explore the far

corners.

|

|

| The Little Book of Valuation |

If you truly, truly hate to read and are budget constrained, think of this as the Cliff notes version of my longer books. |

|

.

Information Central

Website for the class: Everything associated with the class (and I mean everything) will be available at the website for the class

Social media website for the class: You can also get access to much of the same stuff at this site, but it also has a social media component that will allow you to partake in discussions on valuation topics.

Google calendar for class: The Google calendar for the class is available here:

My blog: My not-so-brilliant and not-at-all-insightful thoughts on valuation, corporate finance and portfolio management will be posted on my blog, Musings on Markets.

Twitter feed: Just in case you don't get enough of me in clas, online and on my blog, please help me approach Lady Gaga status by joining my Twitter follower list.

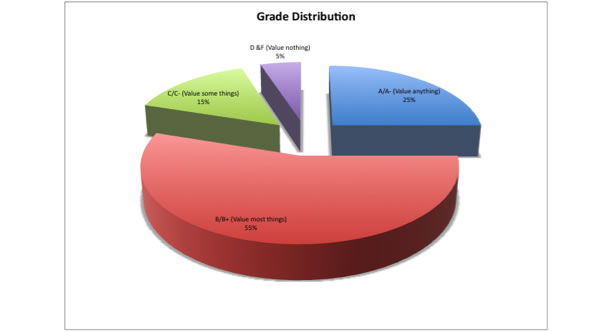

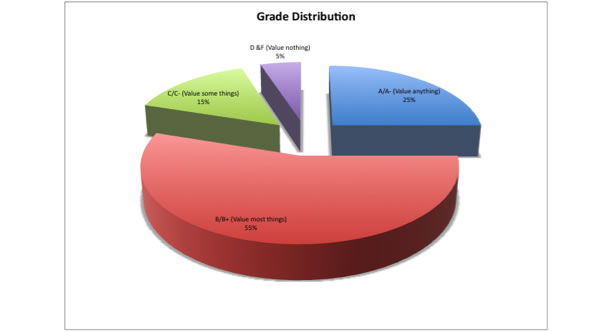

Grade Distribution

Grading Basis

- Group Work: Students should work in groups of five. Each group will

be required to work on a group project.

- Valuation Project Due in two parts 30%

- Part 1: DCF Valuation due by October 18

- Part 2: Entire project due by December 9 at 5 pm.

- Mystery Project: Will be specified later. -

Worth 10%

- Individual Work:

- Quizzes: There will be three quizzes worth 10% apiece.

- Quiz 1: Discounted Cash Flow Valuation: Session 9 (October 2)

- Quiz 2: Relative Valuation: Session 16 (October 28)

- Quiz 3: Private Company Valuation: Session 22 (November 18)

- Final Exam: This will

also be an open-book and open-notes cumulative exam worth 30% on December 13 from 1-3.

Rules of Engagement

- Rules of group work:

- Pick your own groups. (If you have trouble getting picked, I will help)

- All group work will be self policed, except in extreme circumstances.

- There will be one grade per group, no matter how the work load is distributed

among the group members

- Rules on individual work

- All exams and quizzes are strictly individual work.

- There will be no make-up quizzes. If you miss a quiz due to ill health,

the grade will be redistributed over the remaining part of the course.

- I will be the grader, and I do make mistakes. If I screw up, bring it to

my attention and I will fix it.

- Rules on Participation

- All participation is welcome.