Mature companies: Value Drivers

Operating Slack

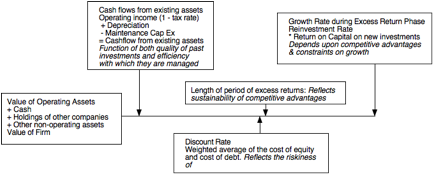

When valuing a company, our forecasts of earnings and cash flows are built on assumptions about how the company will be run. If these numbers are based upon existing financial statements, we are, in effect, assuming that the firm will continue to be run the way it is now. The value of a firm is a function of five key inputs and changes in three of them can increase operating asset value. The first is the cash flow from assets in place or investments already made, the second is the expected growth rate in the cash flows during what we can term a period of both high growth and excess returns (where the firm earns more than its cost of capital on its investments) and the third is the length of time before the firm becomes a stable growth firm. Figure 11.2 captures these elements:

Determinants of Value

A firm can increase its value by increasing cash flows from current operations, increasing expected growth and the period of high growth, by reducing its composite cost of financing and managing its non-operating assets better.

Financial Slack

There are two aspects of financing that affect the cost of capital, and through it, the value that we derive for a firm. First, we will look at how best to reflect changes the mix of debt and equity used to fund operations in the cost of capital. Second, we will look at how the choices of financing (in terms of seniority, maturity, currency and other add-on features) may affect the cost of funding and value.

The question of whether changing the mix of debt and equity can alter the value of a business has long been debated in finance. While the answer to some may seem obvious – debt after all is always less expensive than equity – the choice is not that simple. Debt has two key benefits, relative to equity, as a mode of financing. First, the interest paid on debt financing is tax deductible, whereas cash flows to equity (such as dividends) are generally not.[1] Therefore, the higher the tax rate, the greater the tax benefit of using debt. This is absolutely true in the United States and partially true in most parts of the world. The second benefit of debt financing is more subtle. The use of debt, it can be argued, induces managers to be more disciplined in project selection. That is, the managers of a company funded entirely by equity, and with strong cash flows, have a tendency to become lazy. For example, if a project turns sour, the managers can hide evidence of their failure under large operating cash flows, and few investors notice the effect in the aggregate. But if those same managers had to use debt to fund projects, then bad projects are less likely to go unnoticed. Since debt requires the company to make interest payments, investing in too many bad projects can lead to financial distress or even bankruptcy, and managers may lose their jobs. Relative to equity, the use of debt has three disadvantages—an expected bankruptcy cost, an agency cost, and the loss of future financing flexibility.

Š The expected bankruptcy cost has two components. One is simply that as debt increases, so does the probability of bankruptcy. The other component is the cost of bankruptcy, which can be separated into two parts. One is the direct cost of going bankrupt, such as legal fees and court costs, which can eat up to a significant portion of the value of the assets of a bankrupt firm. The other (and more devastating) cost is the effect on operations of being perceived as being in financial trouble.. Thus, when customers learn that a company is in financial trouble, they tend to stop buying the company’s products. Suppliers stop extending credit, and employees start looking for more reliable employment elsewhere. Borrowing too much money can create a downward spiral that ends in bankruptcy.

Š Agency costs arise from the different and competing interests of equity investors and lenders in a firm. Equity investors see more upside from risky investments than lenders to. Consequently, left to their own devices, equity investors will tend to take more risk in investments than lenders would want them to and to alter financing and dividend policies to serve their interests as well. As lenders become aware of this potential, they alter the terms of loan agreements to protect themselves in two ways. One is by adding covenants to these agreements, restricting investing, financing and dividend policies in the future; these covenants create legal and monitoring costs. The other is by assuming that there will be some game playing by equity investors and by charging higher interest rates to compensate for expected future losses. In both instances, the borrower bears the agency costs.

Š As firms borrow more money today, they lose the capacity to tap this borrowing capacity in the future. The loss of future financing flexibility implies that the firm may be unable to make investments that it otherwise would have liked to make, simply because it will be unable to line up financing for these investments.

The

fundamental principle in designing the financing of a firm is to ensure that

the cash flows on the debt match as closely as possible the cash flows on the

asset. Firms that mismatch cash flows on debt and cash flows on assets (by

using short term debt to finance long term assets, debt in one currency to

finance assets in a different currency or floating rate debt to finance assets

whose cash flows tend to be adversely impacted by higher inflation) will end up

with higher default risk, higher costs of capital and lower firm values. To the

extent that firms can use derivatives and swaps to reduce these mismatches,

firm value can be increased.

Probability of management change

There is a strong bias towards preserving incumbent management at firms, even when there is widespread agreement that the management is incompetent or does not have the interests of stockholders at heart. Some of the difficulties arise from the institutional tilt towards incumbency and others are put in place to make management change difficult, if not impossible. In general, there are four determinants of whether management will be changed at a firm:

1. Institutional concerns: The first group of constraints on challenging incumbent management in companies that are perceived to be badly managed and badly run is institutional. Some of these constraints can be traced to difficulties associated with raising the capital needed to fund the challenge, some to state restrictions on takeovers and some to inertia.

2. Firm-specific constraints: There are some firms where incumbent managers, no matter how incompetent, are protected from stockholder pressure by actions taken by these firms. This protection can take the form of anti-takeover amendments to the corporate charter, elaborate cross holding structures and the creation of shares with different voting rights. In some cases, the incumbent managers may own large enough stakes in the firm to stifle any challenge to their leadership.

3. Corporate Holding Structures: Control can be maintained over firms with a variety of corporate structures including pyramids and cross holdings. In a pyramid structure, an investor uses control in one company to establish control in other companies. For instance, company X can own 50% of company Y and use the assets of company Y to buy 50% of company Z. In effect, the investor who controls company X will end up controlling companies Y and Z, as well. Studies indicate that pyramids are a common approach to consolidating control in family run companies in Asia and Europe. In a cross holding structure, companies own shares in each other, thus allowing the group’s controlling stockholders to run all of the companies with less than 50% of the outstanding stock. The vast majority of Japanese companies (keiretsus) and Korean companies (chaebols) in the 1990s were structured as cross holdings, immunizing management at these companies from stockholder pressure.

4. Large Shareholder/Managers: In some firms, the presence of a large stockholder as a manager is a significant impediment to a hostile acquisition or a management change. Consider, a firm like Oracle, where the founder/CEO, Larry Ellison, owns almost 30% of the outstanding stock. Even without a dispersion of voting rights, he can effectively stymie hostile acquirers. Why would such a stockholder/manager mismanage a firm when it costs him or her a significant portion of market value? The first reason can be traced to hubris and ego. Founder CEOs, with little to fear from outside investors, tend to centralize power and can make serious mistakes. The second is that what is good for the inside stockholder, who often has all of his or her wealth invested in the firm may not be good for the other investors in the firm.