Equity Instruments: Newsletter – November 24,

2012

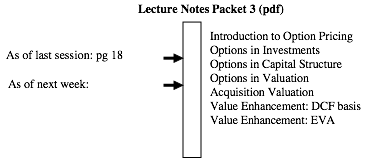

Where we

are in class…

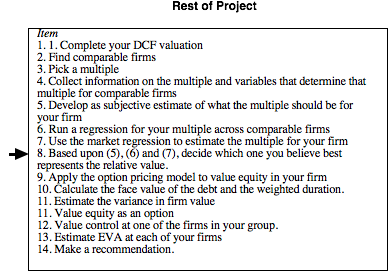

Where you

should be in the project…

Data Notes…

Now that we

are done with multiples, you can check out your mastery of the topic by picking

up equity research reports and browsing through them. As you read the reports,

play devil’s advocate and ask the key questions. To the extent that the report

seems to have anticipated these questions and tried to

answer them, it is a good analysis. If not, it tells you little about whether the

stock in question is cheap or expensive.

If

you are interested in getting a taste of private

company valuation, I would recommend that you visit the following websites:

http://www.ipocentral.com (a central site

for prospective IPOs; you can check out the prospectuses and value them)

http://www.bvresources.com (a site that

provides data and hosts discussions on topics near and dear to private business

appraisers)

Miscellaneous FAQs

Do

we all have to use the same multiple in a group?

No. In fact, you will find that the same multiple will not work for all firms. Therefore, use the best multiple for your firm and focus on the estimate of value that you obtain using that multiple

Can I use more than one multiple to value my

firm?

Sure. As long as you keep your eyes on the final recommendation, you can use as many multiples as you want in your analysis.

What if my value from relative valuation is

different from my DCF valuation?

I would be surprised if this were not the case. The whole point of doing a relative valuation is to get a different perspective on value.