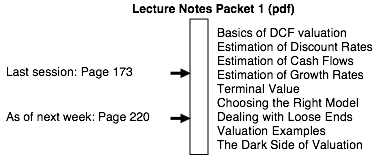

Equity Instruments: Newsletter – October 4, 2014

Where we

are in classÉ

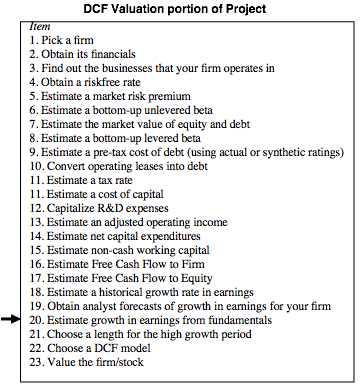

Where you

should be in the projectÉ

Data NotesÉ

Next week, we will start on the discussion of growth and how best to estimate growth for a company. You can get analyst estimates of growth in earnings for your firm by visiting the zacks web site

If you want to look at historical growth rates in revenues and earnings for your firms, check under updated data on my web site. Since we also link growth to fundamentals, you can also get a measure of the fundamentals that drive growth (retention ratio, reinvestment rates, return on equity and return on capital) for different sectors under the updated data site as well.

Miscellaneous FAQs

Which

earnings should I compute growth in? Net income? Operating Income? Earnings per

share?

At this stage in the process it is probably best to do all of the above. The differences will tell you a great deal about how this firm is growing and may affect your estimates for the future.

What

happens if my firm is not followed by analysts or I cannot get analyst

projections of growth?

Given how little information there is in these forecasts, it is not the end of the world. Work with fundamental growth rates.

I

am having trouble estimating historical growth. What should I do?

See answer to last question.