Equity Instruments: Newsletter – November 16,

2012

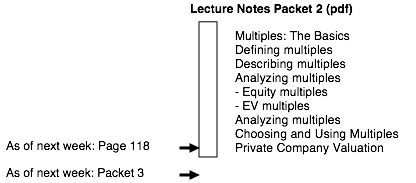

Where we

are in classÉ

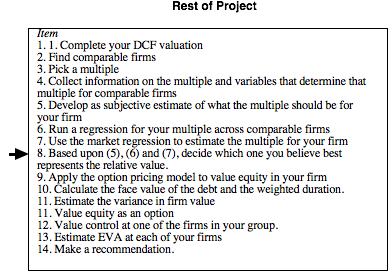

Where you

should be in the projectÉ

Data NotesÉ

As the information on firms gets more extensive, we are faced with making choices. With earnings, the choices are increasing with different measures of earnings reported by different services. Since so many multiples are based upon earnings, you may want to check out some of these alternative approaches.

To get a measure of core earnings, you can check out the S&P web site for their definition of core earnings. S&P adjusts earnings for pension fund and management option effects.

Miscellaneous FAQs

Do

we all have to use the same multiple in a group?

No. In fact, you will find that the same multiple will not work for all firms. Therefore, use the best multiple for your firm and focus on the estimate of value that you obtain using that multiple

Can I use more than one multiple to value my

firm?

Sure. As long as you keep your eyes on the final recommendation, you can use as many multiples as you want in your analysis.

What if my value from relative valuation is

different from my DCF valuation?

I would be surprised if this were not the case. The whole point of doing a relative valuation is to get a different perspective on value.