|

Synthetic ABS Prof. Ian H. Giddy, New York University |

Synthetic Asset-Backed Securities The most straightforward way to create asset-backed securities is the cash sale of assets to a special-purpose entity. In some cases, however, the legal transfer of the assets themselves may be restricted, cumbersome or costly. In such cases the risk of the assets might be better transferred synthetically. Synthetic ABS of this kind, also called credit-linked notes, are structured vehicles that use credit derivatives to achieve the same credit-risk transfer as conventional ABS, without physically transferring the assets. Instead, the risk is typically transferred to the investors by the entity holding the physical assets. The investors are the sellers of credit protection, since they take the risk of loss should the asset default. The institution holding the assets is the credit-protection buyer, since the risk of the loss was transferred to the investors.

Synthetic ABS may hold a combination of derivative and physical assets, and may be fully funded, partially funded, or unfunded. An example is shown in the diagram below.

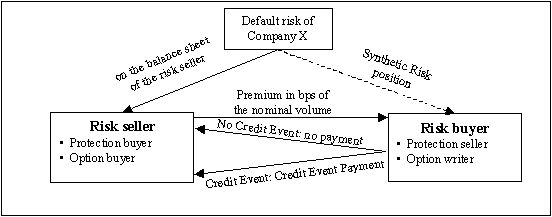

Purposes Synthetic ABS are often divided into "balance sheet" and "arbitrage" collateralized debt obligations (CDOs), depending on purpose. Balance sheet CDOs are initiated by banks which aim to sell assets or transfer the risk of assets. The motivation is to shrink the balance sheet and/or to reduce regulatory or economic capital requirements. The risk is typically that of corporate or other credit exposure Aribitrage CDOs, in contrast, are driven by potential profits from the spread between the assets' return and the funding. Equity tranche investors hope to achieve a leveraged return on the gap between the after-default yield on assets and the financing cost of the asset-backed securities. Asset managers reap a management fee from monitoring and trading the CDO's assets. They often invest in a portion of the equity tranche or subordinate a significant portion of their fee to debt and equity tranches. Credit Default Swaps A credit default swap is a bilateral contract in which the credit protection buyer pays a periodic premium on a predetermined amount (notional amount) in exchange for a contingent payment from the credit protection seller to cover losses following a specified "credit event" on a reference asset (see the diagram). Credit events are typically defined by the ISDA standards (International Swaps and Derivatives Association). Market convention, to date, has defined a credit event as failure to pay, bankruptcy, restructuring, repudiation or moratorium, and acceleration. The premium, notional amount, reference assets, credit instrument, and credit events, as well as other terms of the contract, are negotiated between the protection buyer and seller (counterparties) at inception.

See also:

|