|

|||

|

|||

As companies and investors are globalize, there is no place for either to hide from country risk. There is more risk in some countries than others and that has to be taken into account, when we set required returns for investments in those countries. In this puzzle, we look at what causes country risk to vary across countries, and in any given country, across time, using five Latin American countries - Argentina, Brazil, Colombia, Peru and Venezuela and how it will affect corporate finance and investing decisions.

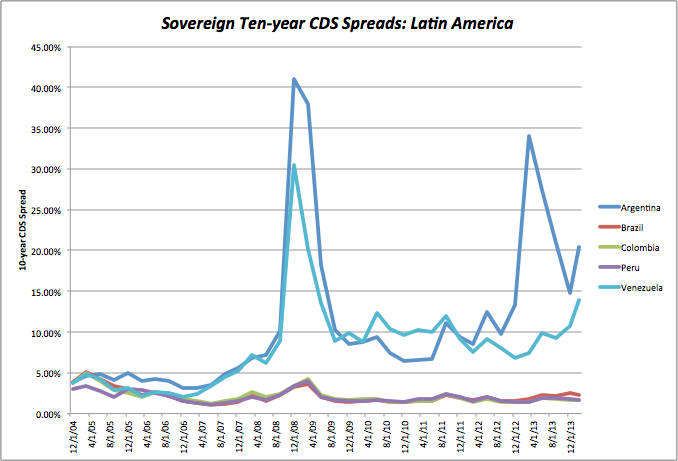

The starting point for this discussion is some historical data. In the graph below, I report the sovereign CDS spreads (for ten-year CDS) for the five Latin American countries:

Note that while the five countries started with fairly similar CDS spreads, the numbers have diverged with the spreads for Argentina and Venezuela exploding relative the spreads for the other countries. You can download the raw data by clicking on this link.

You can follow up with my estimates of country risk premiums at the start of each year from 2005 to 2014. The primary measure that I use to compute these premiums is sovereign ratings for these countries from Moody's. You may want to compare how these premiums have shifted over time, relative to the CDS spreads and form your own judgments about the two measures of default risk (sovereign ratings versus CDS spreads).

You can close by reading two blog posts from the middle of last summer, when the globe was in the throes of an emerging market sell off. The first one was occassioned by my mid-year update for country risk premiums in 2013 but is more an exploration of how country risk evolves over time. The second follows up by looking at how this risk plays out in equity markets.

Key Questions